Investing in the Gateway Cities to the American Dream

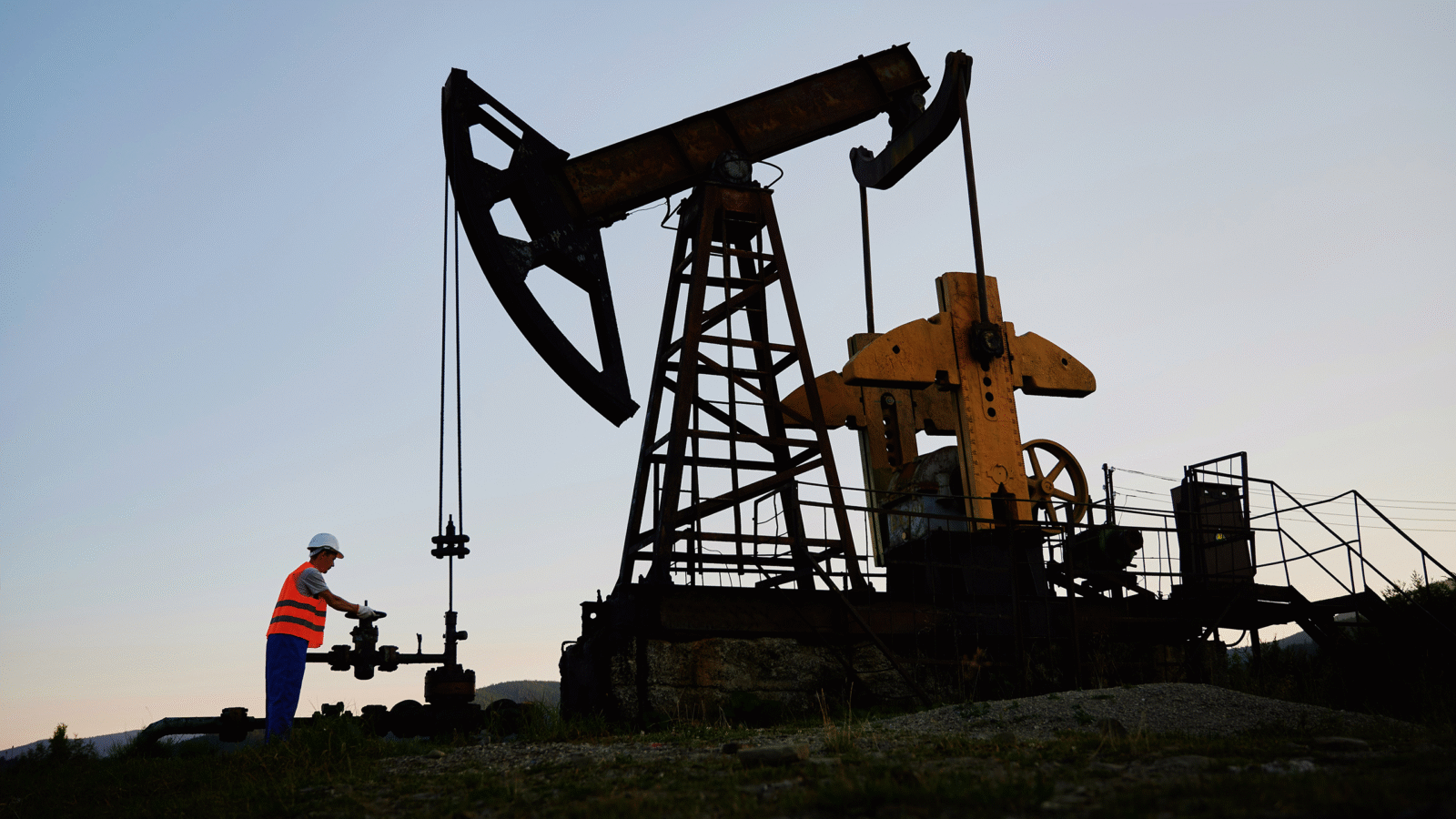

Commercial real estate has experienced a remarkably tumultuous few years. The overnight work-from-home transformation has wreaked havoc on office space across the country, with even the strongest pre-pandemic markets experiencing challenged demand environments.

In New York City, office occupancy rates are still hovering at 50%, but the city itself is as vibrant as ever. West Village residents are shelling out north of $6,000 in rent for a one bedroom, fourth floor walk up.

Demand destruction is a fallacy. Demand hasn’t evaporated, it has simply transformed.

RealtyMogul is a platform that empowers investors to navigate today’s increasingly complex real estate environment. While “location, location, location” is the common mantra in the industry, CEO Jilliene Helman believes that true success begins with “people, people, people.”

The RealtyMogul team has a combined 200+ years of real estate experience and is laser focused on doing business with “people who value integrity and reflect RealtyMogul’s core value to sleep well at night”.

And while there is no crystal ball that can forecast which markets will outperform the general market, there are two interesting core real estate sub-sectors:

- Multifamily

- Industrial

The multifamily story is simple enough. The same work-from-home trend creating pain for office landlords has created ample demand for space at home. At the same time, mortgage rates are now approaching 8% — the highest in over two decades — making the notion of home ownership a veritable pipe dream for tens of millions of Americans. In turn, demand and prices for rentals have continued to climb during the first half of 2023.

Industrial follows a similar trend. Companies like Amazon and Walmart are riding their pandemic coattails to massive expansion and solidification of next-day and same-day delivery across the country. Demand for warehouse and last-mile delivery logistics has risen in lock step.

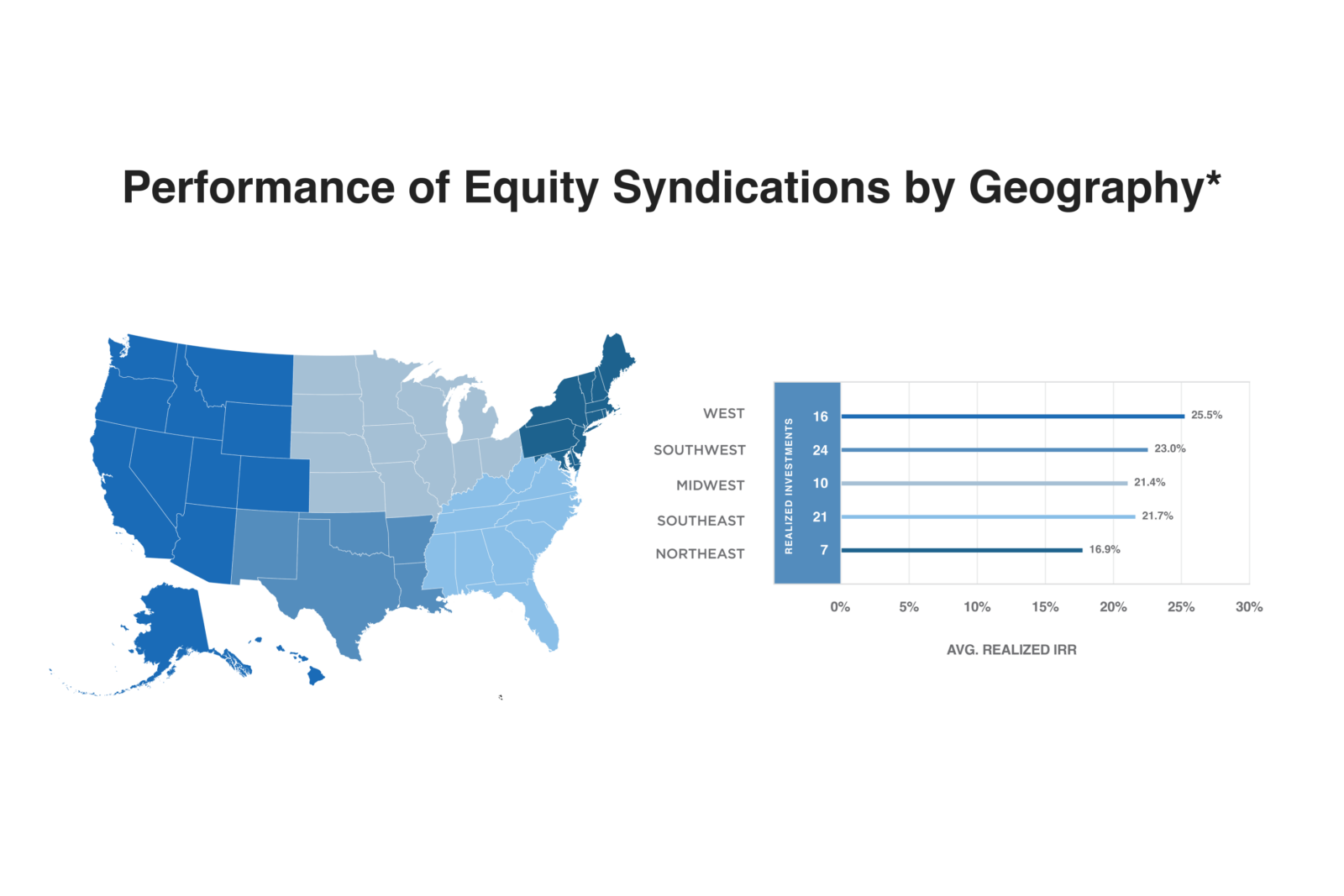

Since 2012, investors using the RealtyMogul platform have invested in over 227 Total Realized Investments which have seen an Overall Realized IRR of 20.6%*.

What Will Shape Go-Forward Returns? Demographic shifts — in large part driven by cost of living dynamics and even political trends — are likely to play a large role in returns going forward.

Sponsors using the RealtyMogul platform are focused on so-called “gateway cities” in the south like Charlotte, Atlanta, and Dallas that have seen population inflows during the pandemic years. These midsize urban centers, that for millions of Americans serve as the gateway to the American dream, offer good jobs, historical architecture, museums, hospitals, and an authentic urban fabric.

The deals offered by sponsors using the RealtyMogul platform can have the potential to offer passive income. While acquiring and operating yourself requires considerable capital and effort (like overseeing the purchase, performing inspections, finding tenants and ongoing property management and maintenance) the sponsors on RealtyMogul’s platform take care of all the diligence and maintenance.

For you, the investor, the RealtyMogul platform has the suite of tools needed to empower you to make informed decisions about whether to invest in a particular property or market.

Learn more about the RealtyMogul Platform today.

Disclosure:[1] *Past performance is not indicative of future results. Forward-looking statements, hypothetical information or calculations, financial estimates, projections and targeted returns are inherently uncertain. Any such information should not be used as a basis for an investor’s decision to invest. Investments in real estate, including those offered by sponsors using the RealtyMogul platform are speculative and involve substantial risk. You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. Nothing on this webpage should be regarded as investment advice,. either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any real estate investment. Please carefully review all Defined Terms and the additional Disclosures on the Track Record page and on the RealtyMogul website. All information and any calculations used herein is based on information from inception through August 31, 2023.