Artificial intelligence

-

How the CFP Board Is Leading the Charge on AI

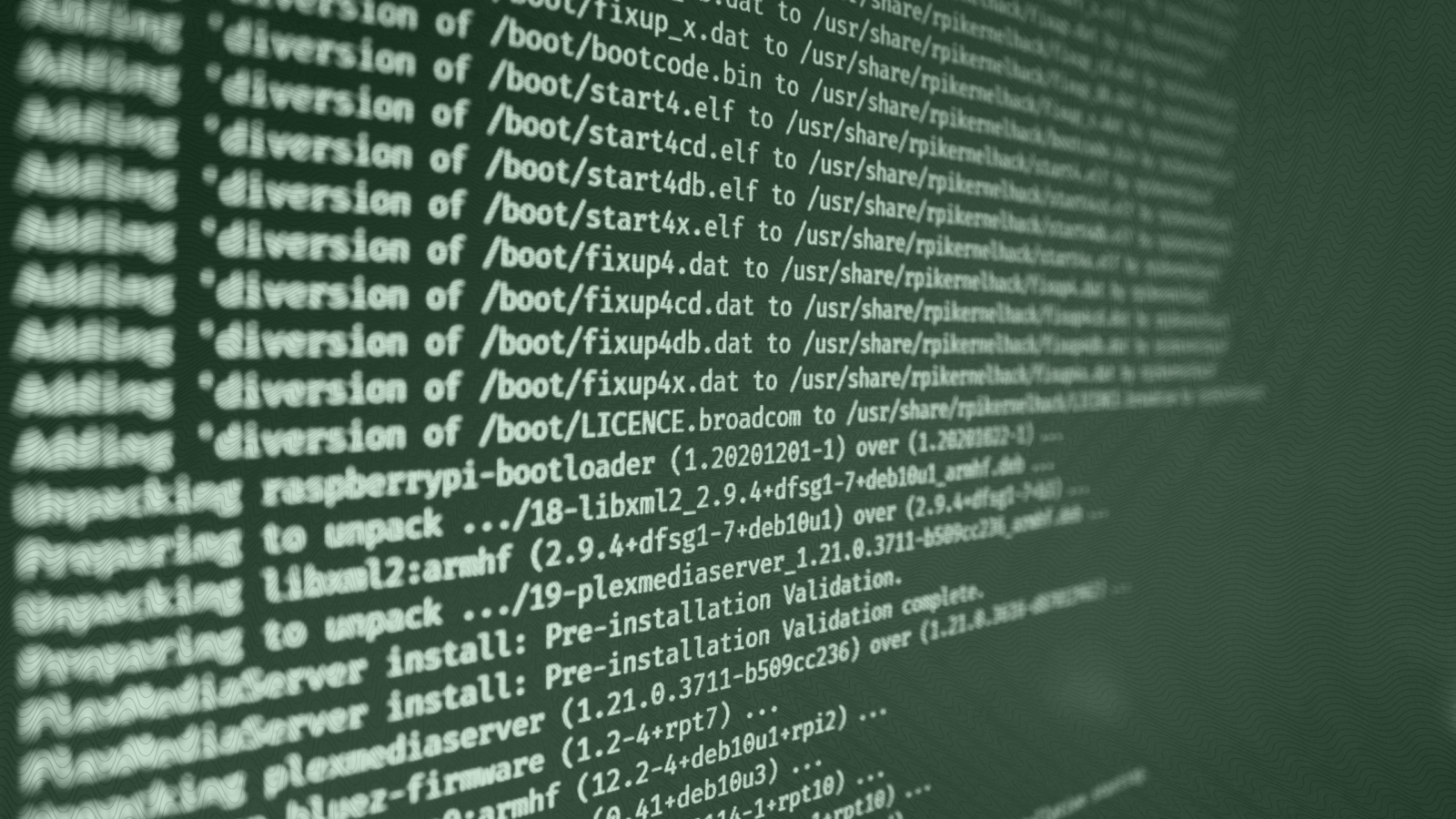

Photo via Connor Lin / The Daily Upside

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

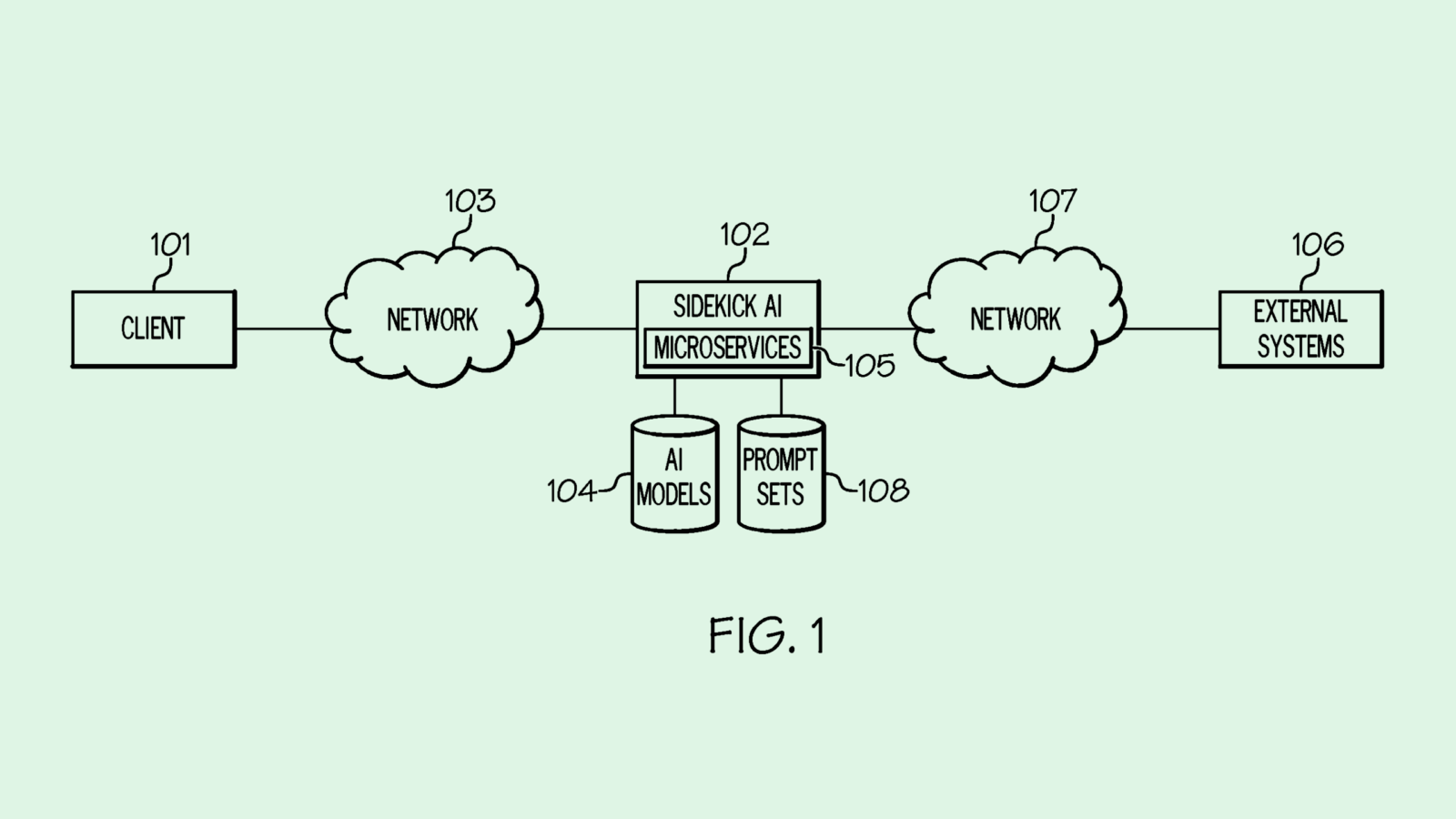

IBM Patent Introduces Context to Fix Hallucinations

Photo via U.S. Patent and Trademark Office

-

AI’s Coming for Wall Street Jobs

Photo by Jake Walker via Unsplash