AI Wants to be the Future of Drug Discovery

Novo Nordisk on Wednesday announced an expanded deal with healthtech firm Valo Health to use AI to fuel drug discovery.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Call us paranoid, but it sure looks as if artificial intelligence is gunning for biotech lab technician jobs.

Our proof? A pair of deals announced Wednesday. First: Novo Nordisk announced an expanded deal with healthtech firm Valo Health to use AI to fuel drug discovery. Then, AI chipmaker AMD announced a deal to invest in drug-discovery firm Absci, with plans to integrate its AI tech to help discover new drugs.

Sizing Up

As with chess, applying AI to drug discovery is most powerful when paired with humans — or human data. At least, that’s Novo Nordisk’s philosophy. On Wednesday, the Danish pharma giant behind Ozempic and Wegovy said in a statement that it plans to employ Valo’s extensive human dataset and AI-enhanced computation in the discovery and development of treatments for cardiometabolic diseases, its bread and butter.

The deal with Valo Health marks a major expansion from an original agreement with the firm back in 2023. And while Novo has soared to incredible highs since then, it might just be starting to get antsy looking for its next major win:

- Last month, Novo shares took a tumble after the company announced disappointing results in a late-stage trial for its next-gen weight-loss drug CagriSema — knocking off some $125 billion in market value. That came after a September earnings call in which the company narrowly missed earnings growth expectations.

- Wednesday’s announced deal will drastically ramp up drug discovery operations with Valo. In 2023, the firms agreed to develop 11 drug programs primarily focused on cardiovascular disease, with $2.7 billion in milestone payment incentives given to Valo. The new deal expands that list to 20, with a heavier focus on obesity and type 2 diabetes treatments, with Valo eligible for payments up to $4.6 billion.

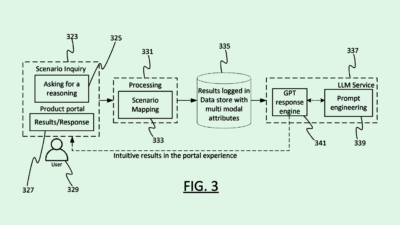

Lab Rat Race: For AMD, meanwhile, breaking into healthtech is a way to catch up to industry frontrunner Nvidia — with this latest investment in Absci cutting into Nvidia’s lead directly. For $20 million, AMD will score an equity stake (size still undisclosed) in Absci, which is focused on using generative AI to build up a drug pipeline. The firm currently employs around 470 Nvidia AI chips, but it told The Wall Street Journal on Wednesday it will start to migrate some of its workload to AMD chips. “We’re starting to see this big shift from designing drugs in the wet lab to now designing drugs on AI, and that means compute is extremely important. Our compute spend has skyrocketed,” CEO Sean McClain told the WSJ.