Charles Schwab

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

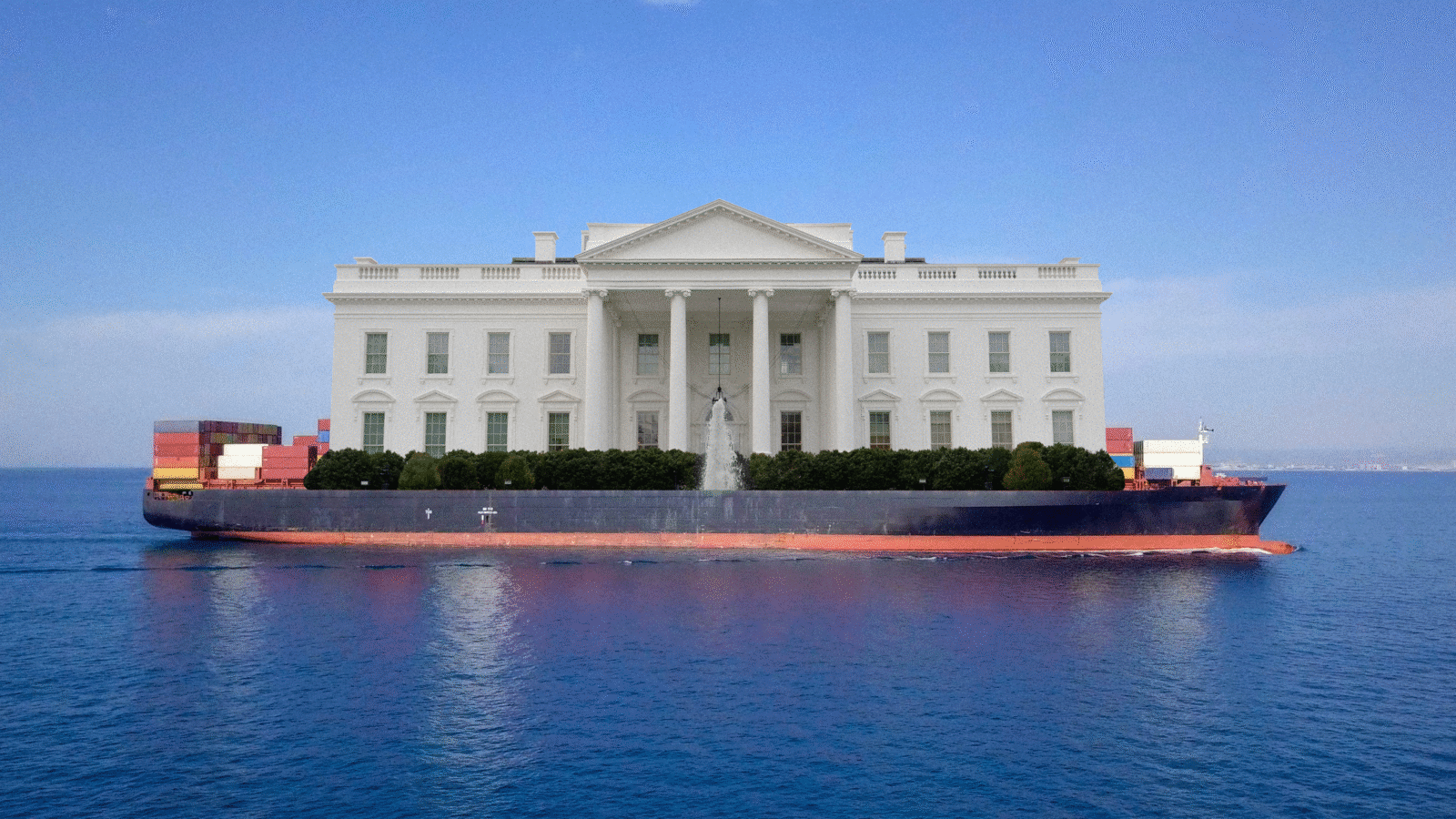

Tariff Turmoil Not ‘Rear View Mirror’ Yet: Schwab’s Liz Ann Sonders

Photo illustration by Connor Lin / The Daily Upside, Photos by Liorpt via iStock and Chris Kleponis/ZUMAPRESS/Newscom