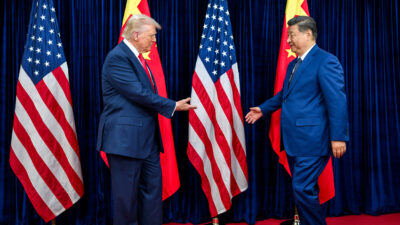

China

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

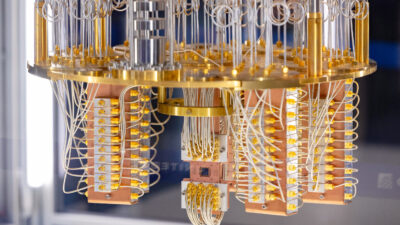

A model of inside a quantum computer on display at Terminal 1 in Chicagoâs O’Hare International Airport on Sept. 25, 2025. The exhibit is organized by members of the STAGE Center at the University of Chicagoâs Pritzker School of Molecular Engineering and IBM. (Dominic Di Palermo/Chicago Tribune/TNS) (Newscom TagID: krtphotoslive956980.jpg) [Photo via Newscom]