crypto

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Vanguard Warms Up to Crypto, Sort Of

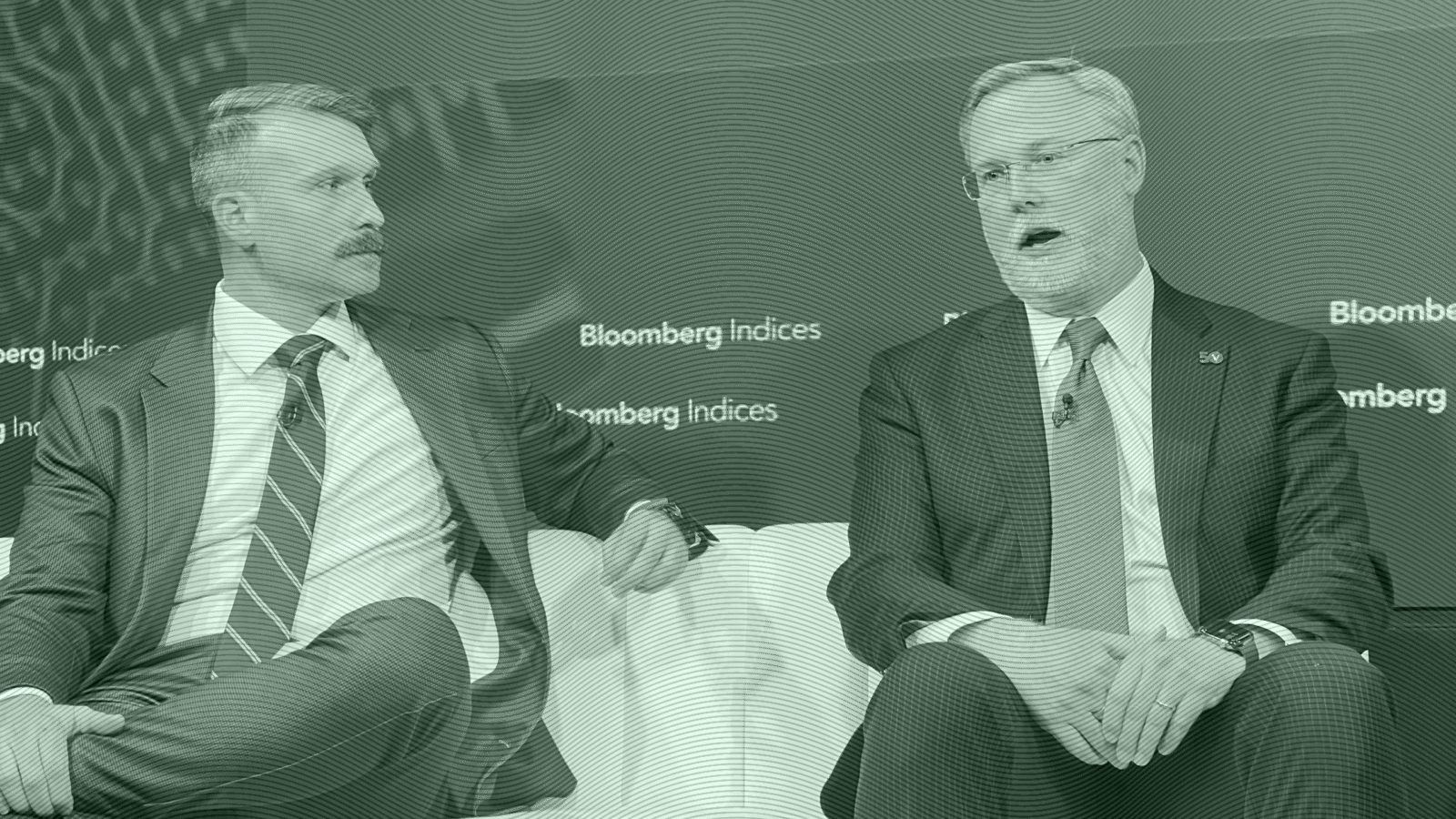

From left: Bloomberg Senior Research Analyst James Seyffart, Head of Vanguard Global Quantitative Equity Group John Ameriks. Photo by Griffin Kelly / The Daily Upside.