e-commerce

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

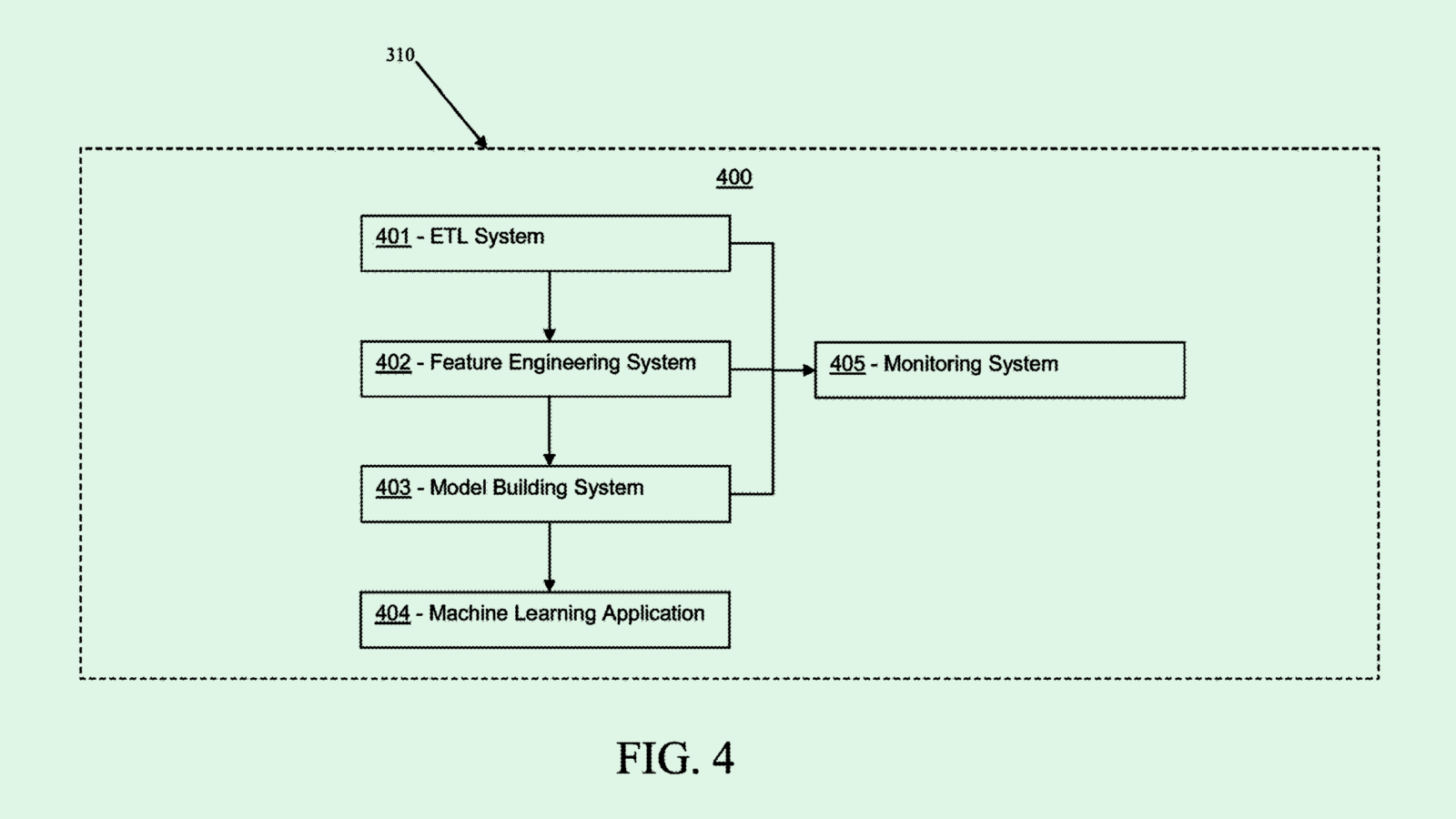

Walmart AI Patent Signals Continued Pressure to Compete with Amazon

Photo via U.S. Patent and Trademark Office