ETFs

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

ETFs Unfazed by Market Volatility

Photo by Planet Volumes via Unsplash

-

Gold ETF Inflows Top $8.6B in March

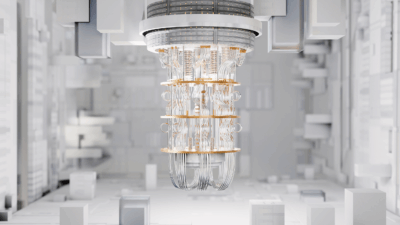

Photo by Getty Images via Unsplash