Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Hungry Eyes for AI in ETFs

Photo by Getty Images via Unsplash

-

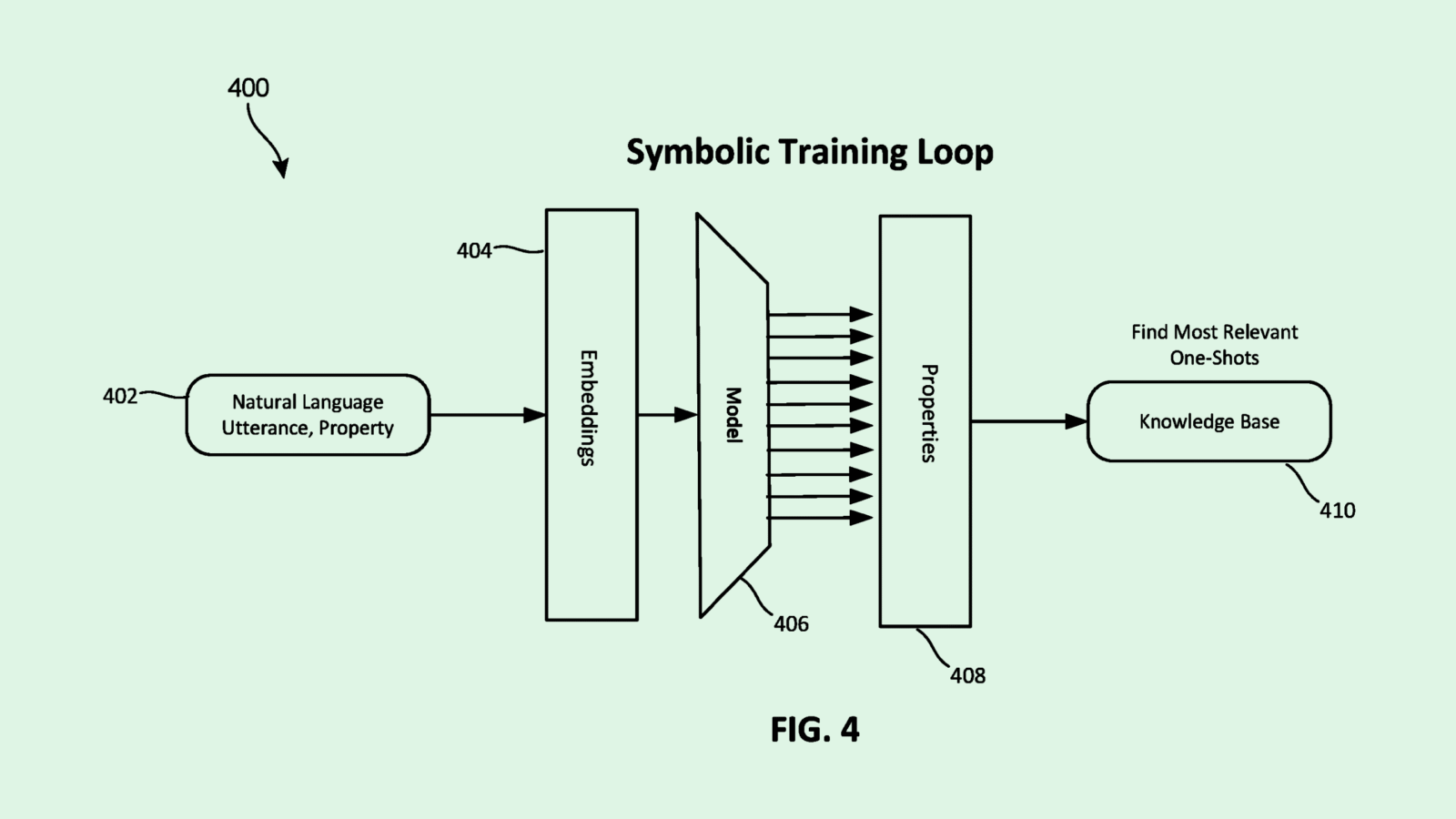

Microsoft Wants to Improve AI-Powered Code Generation

Photo via U.S. Patent and Trademark Office