interest rates

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

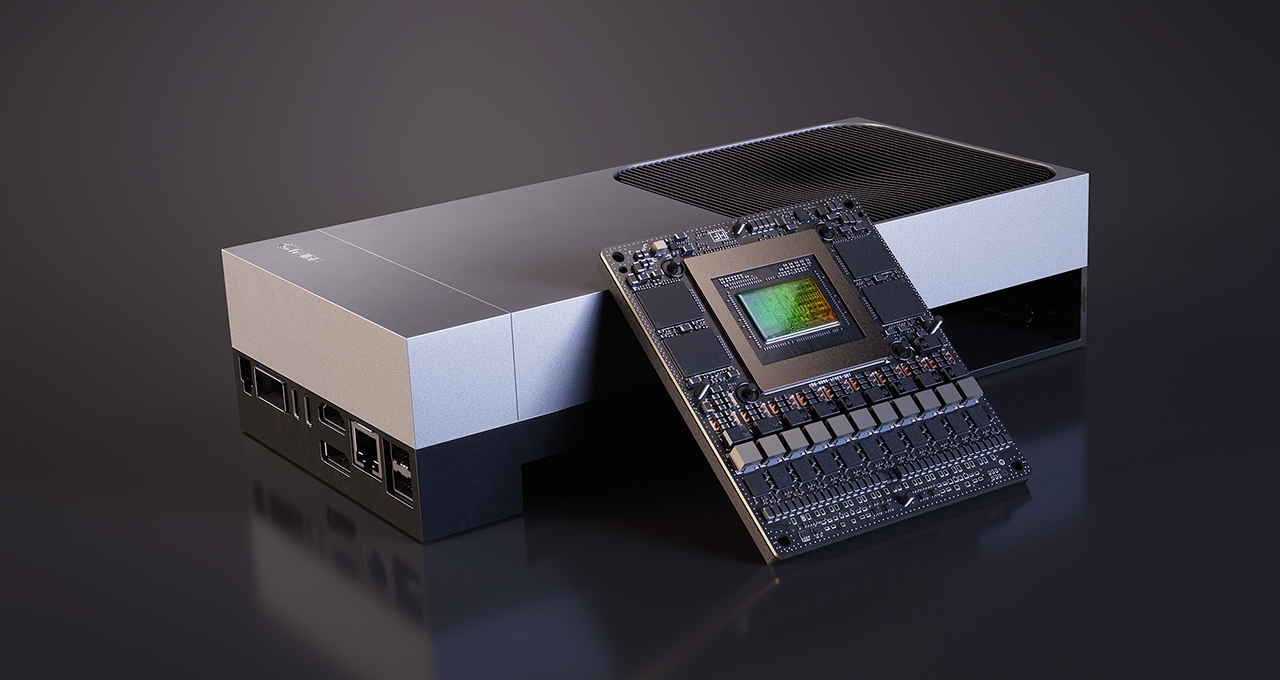

Nvidia Markets New ‘Robot Brain,’ Yours for Just $3,499

Photo via Nvidia

-

Improving S&P 500 Outlook Signals Revival of TINA Trade

Photo via John Angelillo/UPI/Newscom