tokenization

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

3 Trends Expected to Give Advisors Hangovers in 2025

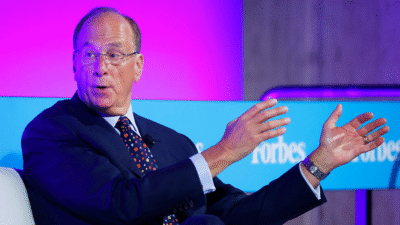

Photo via Connor Lin / The Daily Upside