Can Big Tech Earnings Soothe Investors’ AI Bubble Worries?

As major tech companies tee up earnings reports this weeks, shareholders are hoping their massive AI investments start generating returns.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It’s too bad “AI” is so hard to CTRL-F, because investors will have to scan earnings reports for every mention this week — or maybe, they can just ask AI to do it.

As major tech companies tee up their earnings reports, shareholders will be looking to see whether massive investments in artificial intelligence have begun to generate returns. Companies spent hundreds of billions on AI last year, and Wall Street analysts expect that to rise further, with AI spending on track to break past $500 billion in 2026. Investors started feeling jittery about spending last fall as concerns about an AI bubble grew, and their fears haven’t dissipated so far.

Meta and Microsoft report on Wednesday (along with Tesla), and Apple follows on Thursday.

Spinning Round and Round

Heading into the big earnings week, Microsoft debuted its next generation of AI chips yesterday, which it said have 30% higher performance for the price than competing products. The new chip shows how tech companies are jockeying for position in the AI race, and increasingly, pushing into territory Nvidia has dominated. The new Maia 200 chip comes with a software tool called Triton that could rival Nvidia’s Cuda, a major selling point for Nvidia’s chips. Microsoft’s chip is also packed with SRAM, a type of memory that Cerebras Systems and Groq depend on.

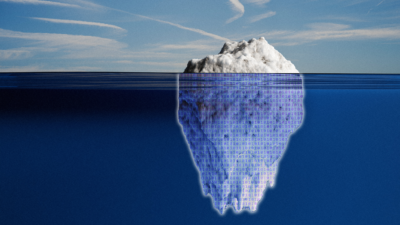

While companies like Microsoft are competing with each other to win AI biz, they’re also depending on each other for profits from the AI biz in a circular-spending vortex:

- Who’s sourcing server power from whom for whose AI is an increasingly tangled web that even Charlie Day with a chalkboard would struggle to sort out. Take Meta: Earlier this month, it announced plans to build tens of gigawatts of AI power in the next decade and, eventually, hundreds. At the same time, Meta’s said to be sourcing power from several companies. It reportedly signed a $10 billion deal to tap into Google’s cloud network and a $20 billion deal with Oracle.

- On the front end, Apple’s expected to announce an updated Siri next month that uses Google’s Gemini AI models as part of a partnership the two tech giants confirmed earlier this month. Siri currently looks to ChatGPT for an AI boost, and it’s unclear what the new Google tie-up means for OpenAI.

Double-edged: The top tech companies are increasingly intertwined, which could make them vulnerable if AI turns out to be a bubble. If one bursts, it could set off the rest (picture: the exploding naval mines in “Finding Nemo”). On the other hand, if AI’s promise to boost productivity by creating workplace efficiencies translates to major cost-savings, the tech companies could spin high into the air together. Of course, they’ll be trying to knock each other down as they do so.