CoreWeave, Once the Year’s Hottest AI Stock, Takes Extended Tumble

CoreWeave was the hottest stock on the block after its March IPO, but investors are now concerned its explosive valuation went a little far.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

For much of 2025, New Jersey’s CoreWeave was hotter than a spicy rigatoni, its shares rocketing after one of the year’s most anticipated initial public offerings.

But shares in the Livingston-based AI-cloud computing firm tumbled 9% on Friday, a day after an even steeper 10% fall, which had to make investors feel a little bit like Jersey Shore residents as the annoying Bennys arrive from North Jersey and New York for their summer holidays.

The Biggest Backer

CoreWeave was once a bit crypto player, with its founders buying up graphics processing units in the late 2010s to mine for bitcoin at high speeds. But they took what turned out to be a serendipitous pivot after a Bitcoin crash in September 2018: They raised money, bought more GPUs from then-hard-on-their-luck crypto miners and started offering their beefed-up chip capacity as a cloud service. Wisely, the company also rebranded from the extremely New Jersey name Atlantic Crypto to the high-tech sounding CoreWeave. It now runs 33 data centers in the US and Europe, with some leased to single clients and others to multiple.

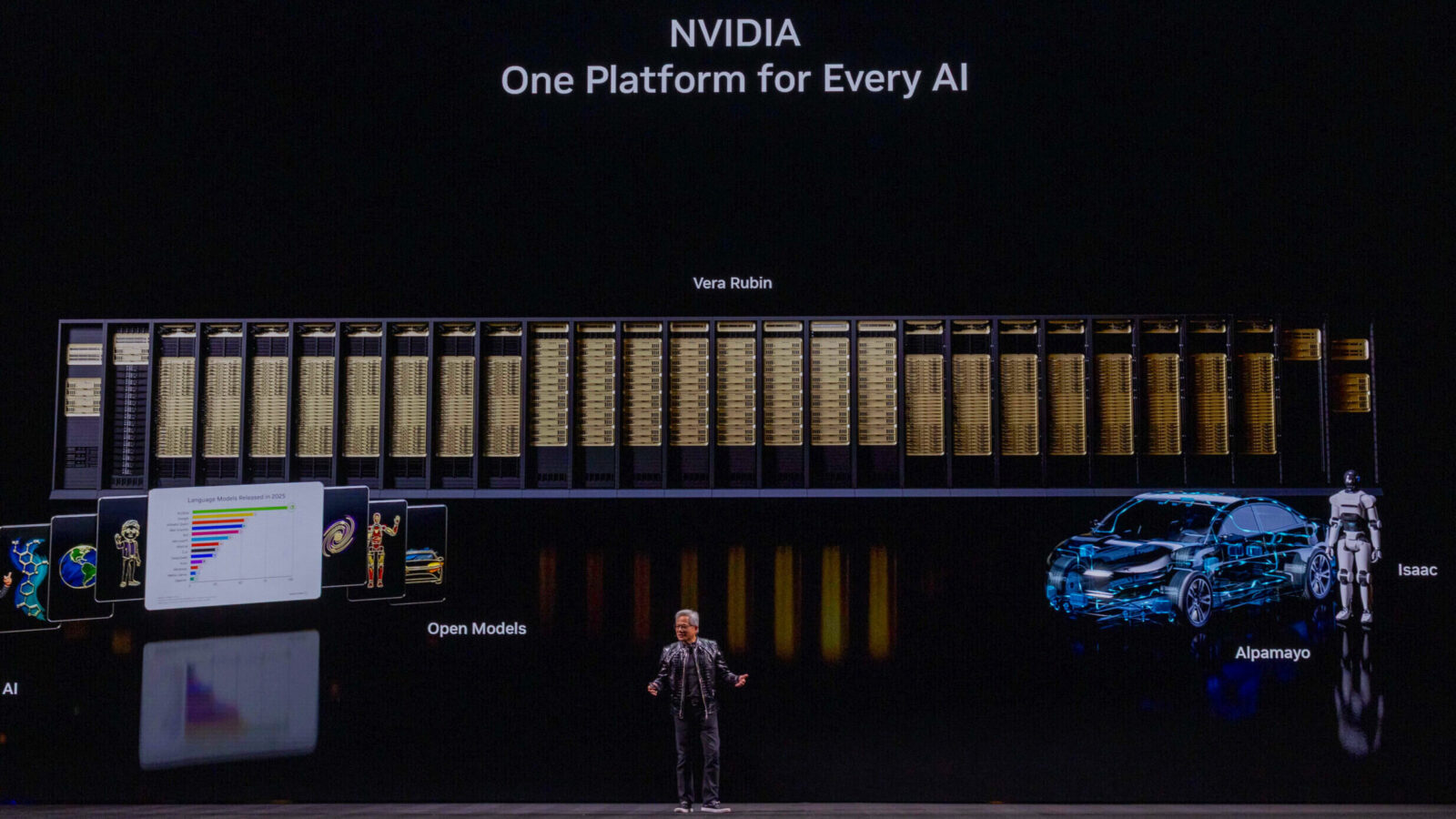

Nvidia, now the world’s largest publicly traded company with a $4 trillion market cap, became an early investor with a $100 million stake in 2023, which it upped by $250 million shortly before CoreWeave’s March initial public offering. The backing of the Jensen Huang-led GPU juggernaut signaled a winner positioned at the heart of the artificial intelligence sector to investors. Shares ballooned after the IPO and peaked at $187, a more than 350% jump from their debut on June 20. Ever since, however, things have turned as downhill as the Kittatinny Mountains. Shares fell 23% last week and have mostly trended downward since the peak, despite business advantages:

- CoreWeave’s relationship with Nvidia has resulted in the company being granted preferred access to the chip giant’s GPUs. Last week, CoreWeave said it was the first company to make the power of the state-of-the-art Nvidia RTX PRO 6000 Blackwell Server Edition generally available on its platform — it was enough to move the stock up 1% on Wednesday before selling resumed to close out the week.

- In May, CoreWeave inked a $4 billion deal with OpenAI for access to its GPU power, on top of an existing $11.9 billion deal between the two companies. Meanwhile, CoreWeave last week announced a $9 billion all-stock acquisition of another crypto-miner-turned-data center firm, Delaware-based Core Scientific.

The Downside’s in the Details: Shares in Core Scientific fell 29% last week and are trading below the value of CoreWeave’s offer, suggesting investors think CoreWeave’s share price has room to fall more. The concerns aren’t about the company itself as much as its overheated valuation. For example, analysts at Needham downgraded CoreWeave after the deal was announced: They reasoned that the benefits of 150 to 200 megawatts of capacity and $500 million in annual operating savings are already priced into the stock. The overwhelming majority of analysts tracked by MarketWatch recommend holding the stock, and their average price target of $95.50 implies a roughly 30% downside to the current $139.30. Profitability in the short term also seems out of the picture: Wall Street projects Coreweave to report a $236 million loss in the second quarter, narrower than its $315 million loss in the first quarter.