Does Anyone Care About Nvidia’s CES Breakthroughs?

The official unveiling of Nvidia’s new chip architecture, dubbed the Vera Rubin, wasn’t expected until later this spring.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

If a tree falls in an AI forest and no one is around to hear it, does it make a sound?

Nvidia arrived guns blazing at the Consumer Electronics Show (CES) this week, announcing its next-gen line of hyper-efficient chips sooner than expected, while showing off new hardware for video game makers and a suite of new autonomous driving tools for automakers. Investors barely stifled their yawns. Consider it a sign of a market rotation in full motion.

Row, Row, Rotate Your Boat

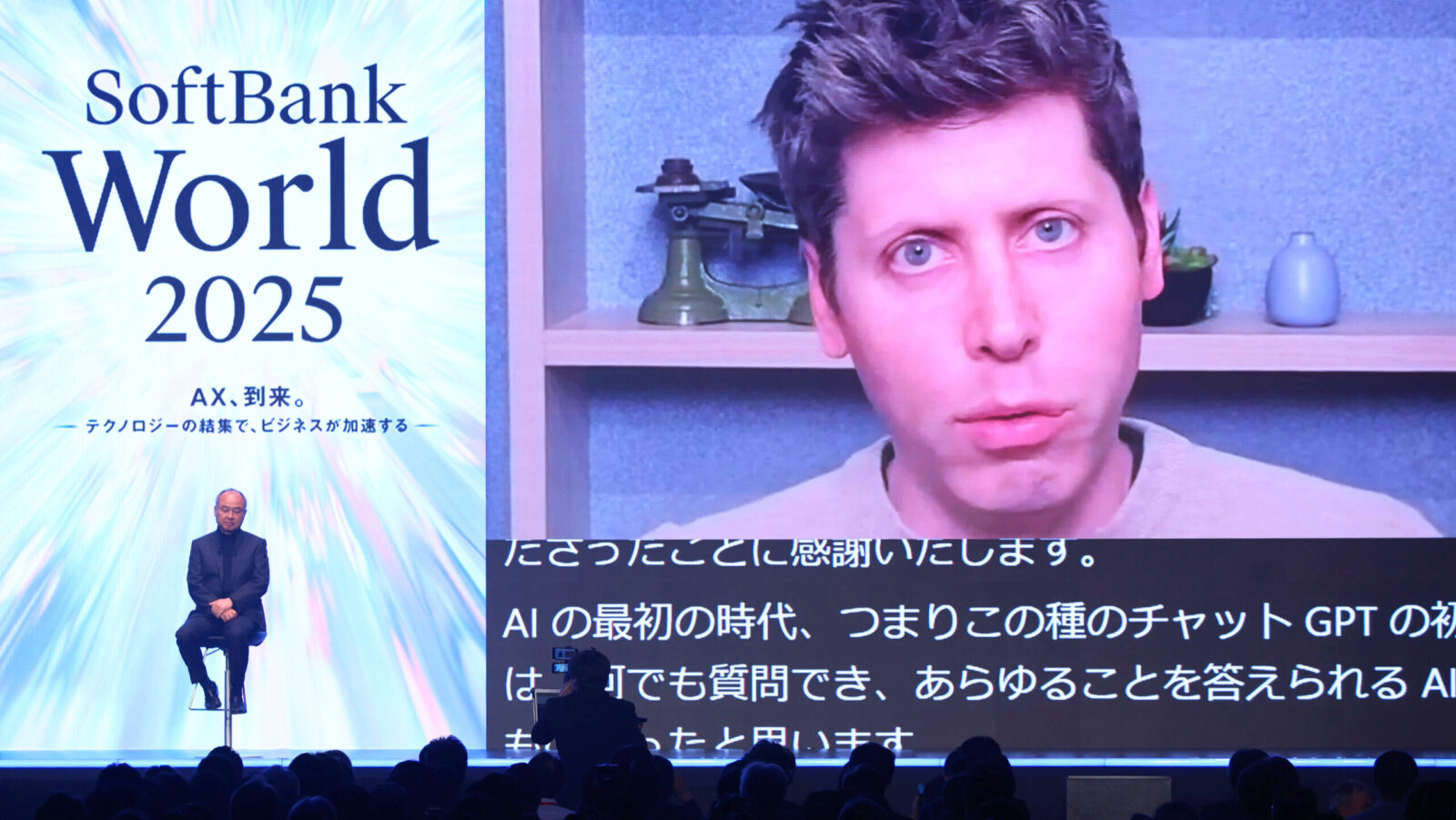

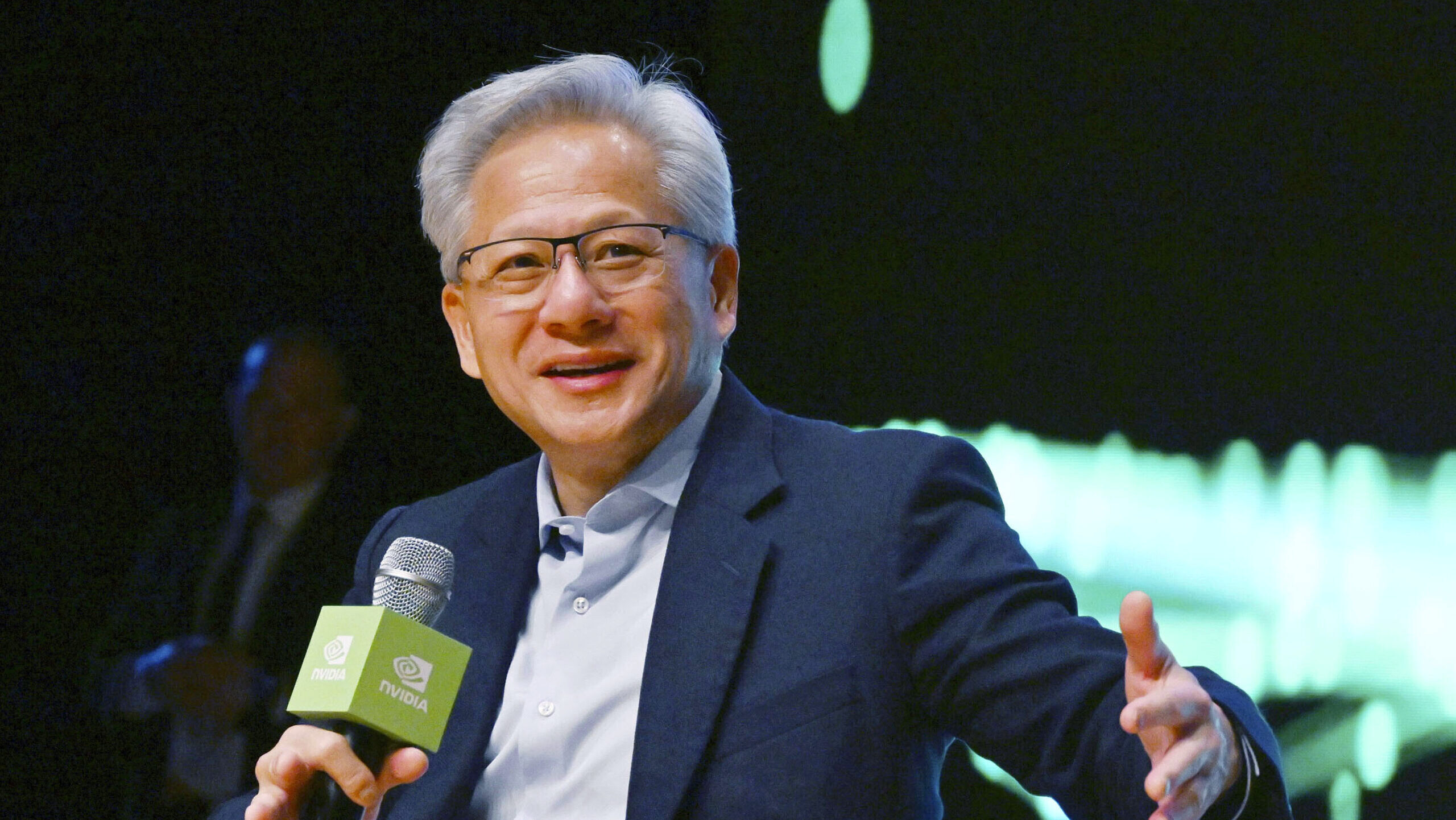

The official unveiling of the new chip architecture, dubbed the Vera Rubin, wasn’t expected until later this spring. But in his keynote presentation at CES, CEO Jensen Huang said the chips are already in production and are set to go on sale in the second half of the year. More importantly, Jensen said the new chips can train AI models using just one-quarter the amount of chips required by its current-gen Blackwell offering, while delivering a 90% cost reduction compared with Blackwell chips when used for AI inference applications. Amazon, Anthropic and OpenAI are already slated to employ the new chips.

In other words, Nvidia is on the front lines of the tech industry’s AI efficiency war. Meanwhile, CFO Colette Kress said at an event hosted by JPMorgan on Tuesday that the company’s revenue forecast “has definitely gotten larger” since it projected $500 billion in future sales back in October.

Still, shares of the company barely budged Tuesday following Huang’s keynote address, dipping 0.4% by market close. Companies downstream from the chip giant, on the other hand, saw lots of action:

- The winners? Data storage companies such as Sandisk (stock up 27% Tuesday), Western Digital (up nearly 17%), and Seagate (up 14%), which surged after Huang said the AI industry’s need for memory storage is a “completely underserved market.”

- The losers? HVAC companies. Among Vera Rubin’s nifty new tricks is that it won’t require water-chilling systems. Shares of cooling-equipment makers were slammed; among them: Modine Manufacturing (down 7%), Johnson Controls (down 6%) and Trane Technologies (down 2%).

Music To My Ears: Nvidia made headlines beyond the new toys it showed off at CES, too. The company is seeing demand for its lower-powered H200 chips in China and is now waiting on regulatory approval from DC and Beijing. Meanwhile, Universal Music Group announced Tuesday it had struck a partnership with the chip designer to “pioneer responsible AI for music discovery, creation and engagement.”