Is Meta the Big Winner of the AI Wars?

Meta hit its 17th straight day of share price gains, good for the longest winning streak of a current Nasdaq 100 Index component in decades.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

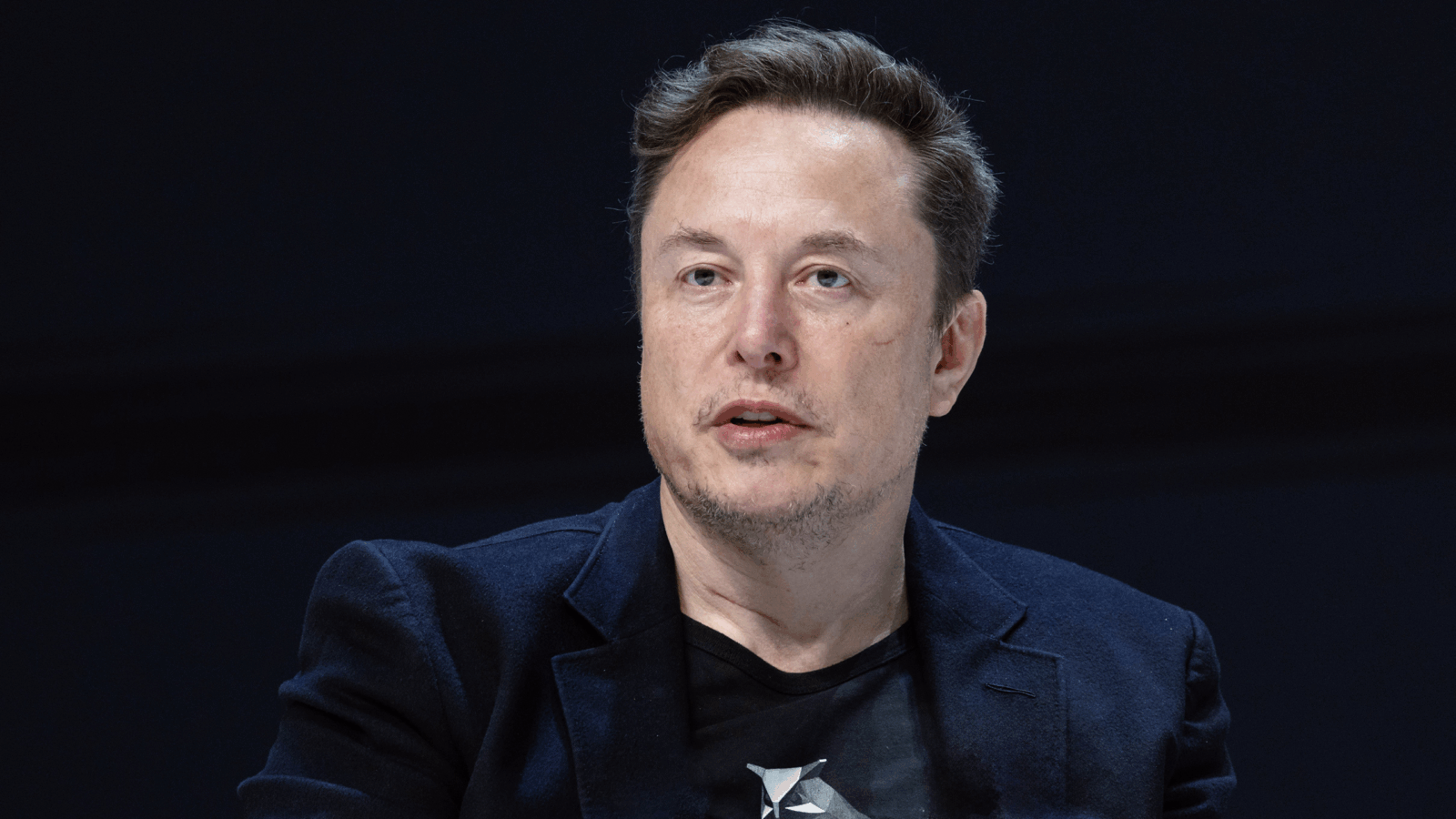

This time around, Mark Zuckerberg is happy to let someone else get in the ring with Elon Musk.

On Tuesday, Zuck’s Meta empire completed its 17th straight day of share price gains, good for the longest winning streak of any current Nasdaq 100 Index component since 1990, according to Bloomberg data. It’s a sign that Meta has emerged — perhaps surprisingly — as the big winner in the AI sweepstakes.

Insta Gratification

Meta’s metaverse pivot just a few years ago may have been a big whiff, but its pivot to massive AI investment is paying off. Why? Because it actually enhances Meta’s core business. The tech industry has poured tens of billions into developing and deploying consumer and enterprise-facing AI models, mostly in the form of chatbots. The problem, of course, is the lack of an actual, profit-generating business model. OpenAI, for instance, says it’s losing money on its $200-per-month ChatGPT Pro subscriptions. And when the open-source DeepSeek came along and proved you could get just as much juice for a lot less squeeze, well… you know the rest.

Meta, on the other hand, found its open-source approach to AI validated by DeepSeek, and the company has been integrating AI into what is already the ultimate profit-generating business model: targeted advertising. (And, sure, it has also debuted quite a few somewhat unseemly chatbots along the way). In other words, AI is helping Meta serve up even more clickable ads. So far, it’s meant a pretty quick return on investment — or at least, enough return to keep justifying copious investment:

- In its earnings report two weeks ago, Meta announced that its full-year revenue — nearly 98% of which comes from advertising — increased 22% year-over-year to $164 billion in 2024; net income increased 59% to $62 billion.

- Revenue growth may reach 15% this year, per Bloomberg data, while net earnings growth may accelerate from 6% this year to 15% in 2026. It all makes the planned $65 billion in capital expenditures this year look digestible, especially as Meta still trades around just 27 times forward earnings — roughly on par with the Nasdaq 100 and lower than any Magnificent 7 stock other than Alphabet.

Still, not everyone will be along for the ride through what Zuckerberg has dubbed a “really big year” for AI (and, we’re assuming, a big year for “masculine energy,” too). On Tuesday, Meta began a round of deep layoffs, targeting around 4,000 employees, or around 5% of the company’s total headcount.

Mr. Vance Goes to Paris: Across the pond, world leaders are meeting in Paris this week for an AI summit. As European Union leaders trumpet a plan to attract some €200 billion in investments in the bloc’s AI industry (not long after Trump 2.0 announced the $500 billion AI-focused Stargate fund), Vice President JD Vance on Tuesday delivered a big speech centered around a big theme: deregulation. Let’s keep the AI bubble safe for all mankind.