Overenthusiastic or Just Right? The AI Boom’s Goldilocks Question

Between 2000 and 2002, after the dot com bubble popped, the Nasdaq lost nearly 80% of its value, wiping out trillions of dollars in wealth.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

March of this year marked the 25th anniversary of the dot-com bubble doing what bubbles do: pop. In the months since, a growing cohort of prominent market observers and participants has warned that the current AI boom could represent a repeat.

Among them are University of Michigan financial markets expert Eric Gordon, OpenAI CEO Sam Altman, Alibaba chair Joseph Tsai, Apollo chief economist Torsten Sløk and Bridgewater hedge fund leader Ray Dalio. They have a case worth taking seriously, but so does the other side.

Magnificent or Predicament

The dot-com bubble formed in the late 1990s when the internet, then a relative novelty, was pitched as if it were going to transform the world. It did, of course, but investors also piled into every IPO and opportunity with a “.com” attached to it, regardless of whether a business plan was also attached. Between 2000 and 2002, after the bubble popped, the Nasdaq lost nearly 80% of its value, wiping out trillions of dollars in wealth.

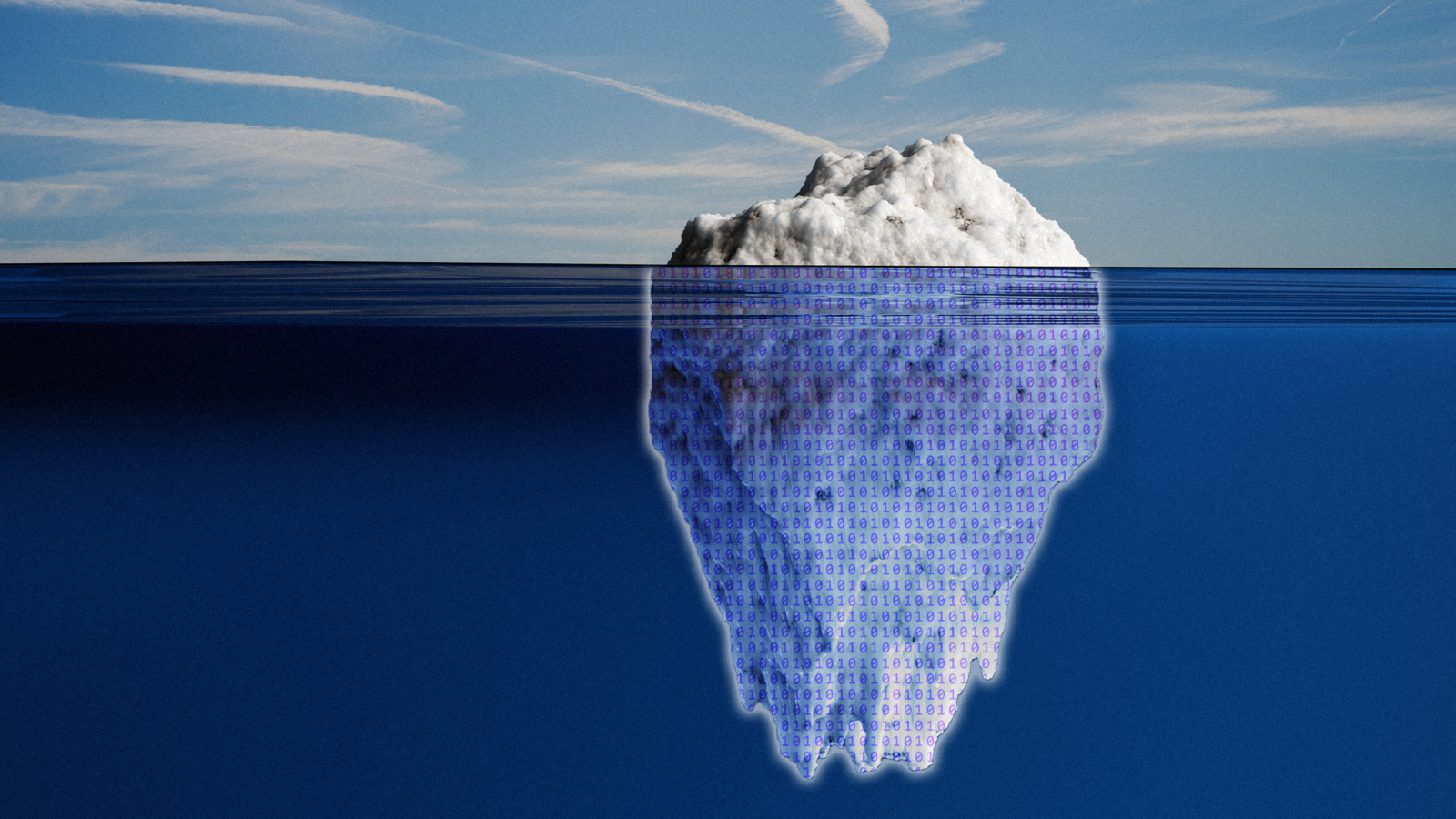

AI, like the internet, is poised to change the world. Money is pouring into the sector at breakneck speed, while investors have been more enthusiastic for tech IPOs than Philadelphia sports fans are for The Birds. As Altman told The Verge last month: “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.” There are also data points of concern: The US Census Bureau’s biweekly survey of 1.2 million businesses shows AI adoption among companies with over 250 employees falling in recent weeks. Harrison Kupperman of Praetorian Capital wrote last month of a “shocking” discovery: “The AI datacenters to be built in 2025 will suffer $40 billion of annual depreciation, while generating somewhere between $15 and $20 billion of revenue. The depreciation is literally twice what the revenue is.” He reckons revenue will need to “grow roughly tenfold, just to cover the depreciation.” All things considered, there is still reason to believe the AI boom is on sturdier ground than 2000:

- The Roundhill Magnificent Seven exchange-traded fund, which tracks the world’s biggest and most influential tech companies, currently trades at roughly 35 times forward earnings. That’s not comparable to 2000, when the forward price-to-earnings ratio of the Nasdaq 100 was 60 (currently, it’s 32).

- Perhaps more crucially, the Mag 7 companies driving the AI boom are not speculative, unproven companies with “.com” attached to their names. Apple, Microsoft and Alphabet are trillion-dollar firms that are profitable and have resilient balance sheets. Pets.com is not the driving force behind the International Data Corporation’s estimate that year-over-year spending on AI will grow by nearly 32% between 2025 and 2029, when it will reach $1.3 trillion.

Those are the Rules: Tech company IPOs, especially in crypto or AI-related fields, have experienced big pops this year, only to decline after initial investor enthusiasm. Which, regardless of whether there is a bubble, warrants keeping something Altman told The Verge in mind: “Someone is going to lose a phenomenal amount of money. We don’t know who, and a lot of people are going to make a phenomenal amount of money.”