Why Apple No Longer Trades Like a Tech Firm

As the rest of Big Tech embark on one of the greatest capex ventures in human history, Apple is practically spending pennies by comparison.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Nearly 20 years after the debut of its famous “Think Different” ad campaign, Apple continues to live up to the slogan. Increasingly, investors are noticing.

The Cupertino, California-based company’s 40-day correlation to the Nasdaq 100 fell to just 0.21 last week (a correlation of 1 equates to perfect alignment), according to recent Bloomberg data, marking the starkest difference between the iPhone-maker and the tech-heavy index since 2006. It’s a trend that started early last year and looks likely to continue.

Return of the Mac

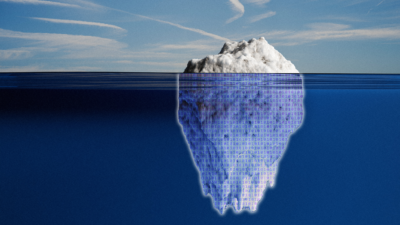

Actually, Apple isn’t so much “thinking different” as it is “thinking like John D. Rockefeller,” who made bank operating as an oil refiner while letting others take the costly risk of oil drilling. Today, as Apple’s Big Tech brethren embark on one of the greatest capex ventures in human history, Apple is spending pennies in comparison and relying on third-party models to power its in-device AI ambitions. And as AI cannibalizes software firms left and right, Apple continues to sell hardware by the boatload.

It’s enough to differentiate the company’s stock from its peers:

- Apple has climbed more than 7% over the past month, compared with a slight decline in the broader Nasdaq and a nearly 5% skid in the Roundhill Magnificent Seven ETF (which includes Apple).

- On Tuesday, Bloomberg reported that the company is accelerating development of three AI-powered devices: smart glasses, a small device that could be worn as a pendant or a pin, and new versions of AirPods featuring a camera system. The devices will be built around the planned AI version of Siri.

“Apple is a sleeping giant in AI,” Nick Grous, an associate portfolio manager at ARK Invest, posted on X this week. “In past platform shifts, the winner wasn’t the first app; it was the company that controlled the hardware and the ecosystem. Apple still does.”

Memory Game: Perhaps Apple’s biggest roadblock? Soaring memory costs, which are bedeviling the entire tech industry amid the hyperscaling of AI data centers. In January, CEO Tim Cook warned that the memory shortage — and resulting price hikes — could eat into margins as soon as the current quarter. Meanwhile, AI firms are outbidding the company for memory chips from key suppliers for the first time in, well, recent memory.