Bitcoin Sinks to 14-Month Low amid Plot Twist in Safe-Haven Story

The cryptocurrency market has lost half a trillion dollars in value since last Thursday, according to CoinGecko data.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Bitcoin has tumbled to levels not seen since 2024, nosediving to nearly $72,000 Tuesday before bouncing back a bit. Now, Citi analysts are eyeing $70,000 as the next big testing point for the coin — and some X users say crypto investors will hold it at least above $69,420.

The crypto market lost half a trillion dollars in value since last Thursday, CoinGecko data shows, with bitcoin dropping below key thresholds including $75,000. Bitcoin’s down about 40% since its October record of more than $126,000. The No. 1 crypto’s slide has raised concerns about its place in the financial landscape and how investors view the volatile asset.

It’s Hard to Bounce Back

Bitcoin rose to new highs last year under Trump’s pro-crypto administration, as both regulators and major financial institutions buddied up with digital assets. But every big party is followed by a hangover. The coin was hit hard in October, when $19 billion of leveraged bets were liquidated in about a day, and no amount of ibuprofen has helped it recover.

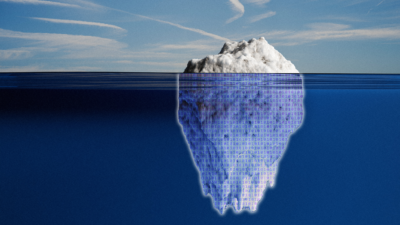

Instead, the narrative that bitcoin is “digital gold” that can act as a safe-haven asset could be unwinding. Rising geopolitical tensions don’t seem to be boosting the coin, which is also facing a psychological hit at the end of a four-year cycle that has coincided with past price drops (it could be a self-fulfilling prophecy). At the same time, the spiral in sentiment is taking place amid crypto’s falling out with the same institutions whose backing last year helped legitimize the sector:

- The Clarity Act, a sweeping framework for regulating crypto that the industry has been waiting on, has hit an impasse. A White House meeting on Monday aimed at advancing the legislation failed to make progress, as banks and crypto companies disagreed over stablecoin incentives such as interest rewards.

- Coinbase pulled its support of the bill last month, claiming banks’ insistence on nixing the rewards was anticompetitive. From there, the gloves came off: At the World Economic Forum, JPMorgan CEO Jamie Dimon is said to have told Coinbase CEO Brian Armstrong, “You are full of s—,” The Wall Street Journal reported. Regardless of who is in the right, the beef between Wall Street and crypto could make bitcoin appear less secure.

Gold Nonstandard: The debate over whether bitcoin is “digital gold” enters semantically tricky territory when the price of gold itself is in flux. In the month through Monday, gold proved more volatile than bitcoin, Bloomberg found. Crypto companies also increasingly own more gold, tying their fate to the physical asset: Stablecoin company Tether has more gold than most central banks. But conversations comparing the two could be missing the point. Bitcoin whale Michael Saylor reiterated on X this week that “Volatility is Satoshi’s gift to the faithful.” For the cryptocurrency’s most faithful HODLers, one bitcoin is always worth the same amount: one bitcoin.