Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The conversation about the future of digital wallets is due to reverberate with the sound of real coins clinking in billions of virtual pockets. Analysts at Juniper Research predict that by 2026 — that’s in less than four years — $12 trillion in payments will be processed using the technology.

On Monday, the European Union made clear that it wants that enormous market to be open and monopoly-free. EU regulators threatened to fine Apple to the tune of billions for allegedly engaging in anti-competitive practices by denying rivals access to its mobile Apple Pay system.

Change in Apple’s Wallet

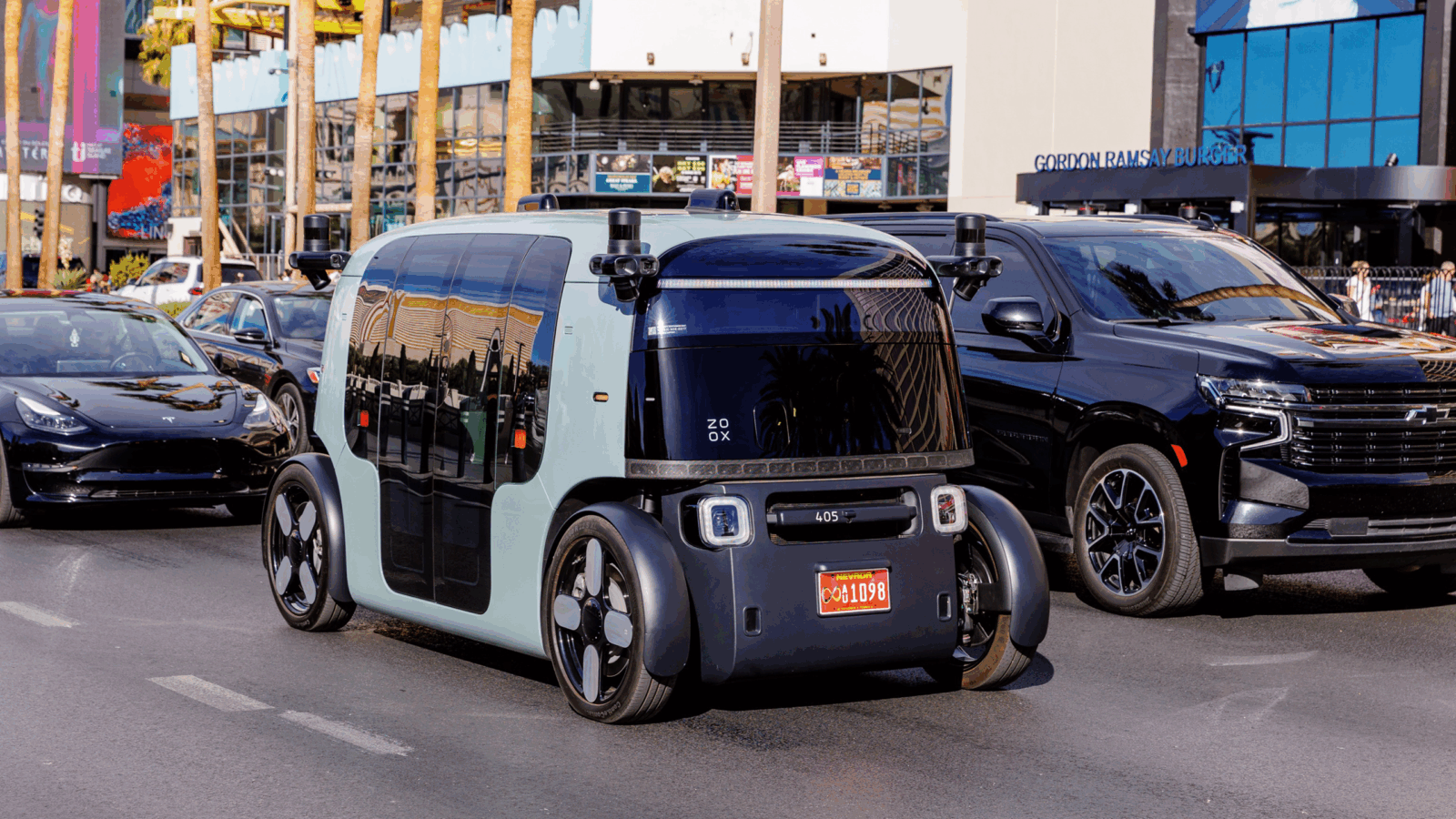

At the core of the spat is whose software gets to use whose hardware. The European Commission (EC) says Apple has blocked competitors from accessing the near-field communication (NFC) technology on its devices. NFC lets phones connect to payment systems, which in turn offer the convenience of tapping and paying for items at physical checkouts. Tap-and-pay uses software that lets you store payment methods, hence the moniker digital wallet.

Apple’s iOS mobile operating system has a 27% market share in Europe, according to data firm Statista. The EC’s charge — namely, that Apple had “restricted third-party access to key technology necessary to develop rival mobile wallet solutions on Apple‘s devices” belonging to better than a quarter of the people on the Continent — could come with headline-grabbing, multi-billion-dollar fines larger than Latvia’s GDP:

- Under EU rules, Apple could be fined up to 10% of its global revenue (that’s a potential fine of $36.6 billion, aka €34.85 billion). For now, the charges are part of a “preliminary view” in which regulators allege the company “abused its dominant position.” Apple still has the chance to respond before any formal conclusion is made.

- Especially hurt by Apple’s control are a consortium of French banks, including BNP Paribas, Société Générale and La Banque Postale. They developed their own payment system, called Paylib, but it can’t run on Apple devices (Google’s Android phones do allow it). Other services that can’t access Apple’s NFC tech include PayPal, Google Pay, Lydia, and Venmo.

Familiar Foes: Like a comic book hero-and-villain duo, Apple and the EC seem destined to do battle forever — in serialized installments, of course. Earlier this month, the EC added a second charge to an ongoing investigation into allegations that Apple has distorted competition in music streaming (the probe was triggered by a complaint from rival Spotify). And then let’s not forget that the two are still battling it out in appeals court over a €13 billion bill for alleged tax evasion — levied by the Commission in 2016 and overturned in 2020.