payments

-

Klarna’s BNPL Debit Card Goes Head-to-Head With Banks

Photo via Andre M. Chang/ZUMAPRESS/Newscom

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

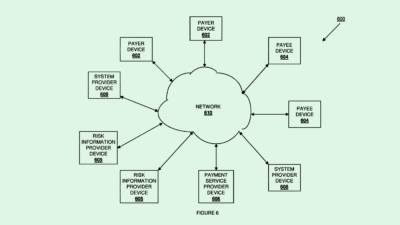

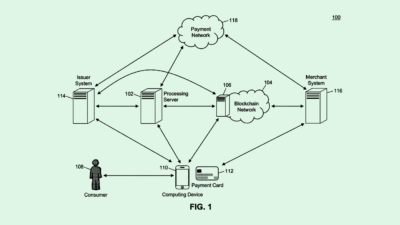

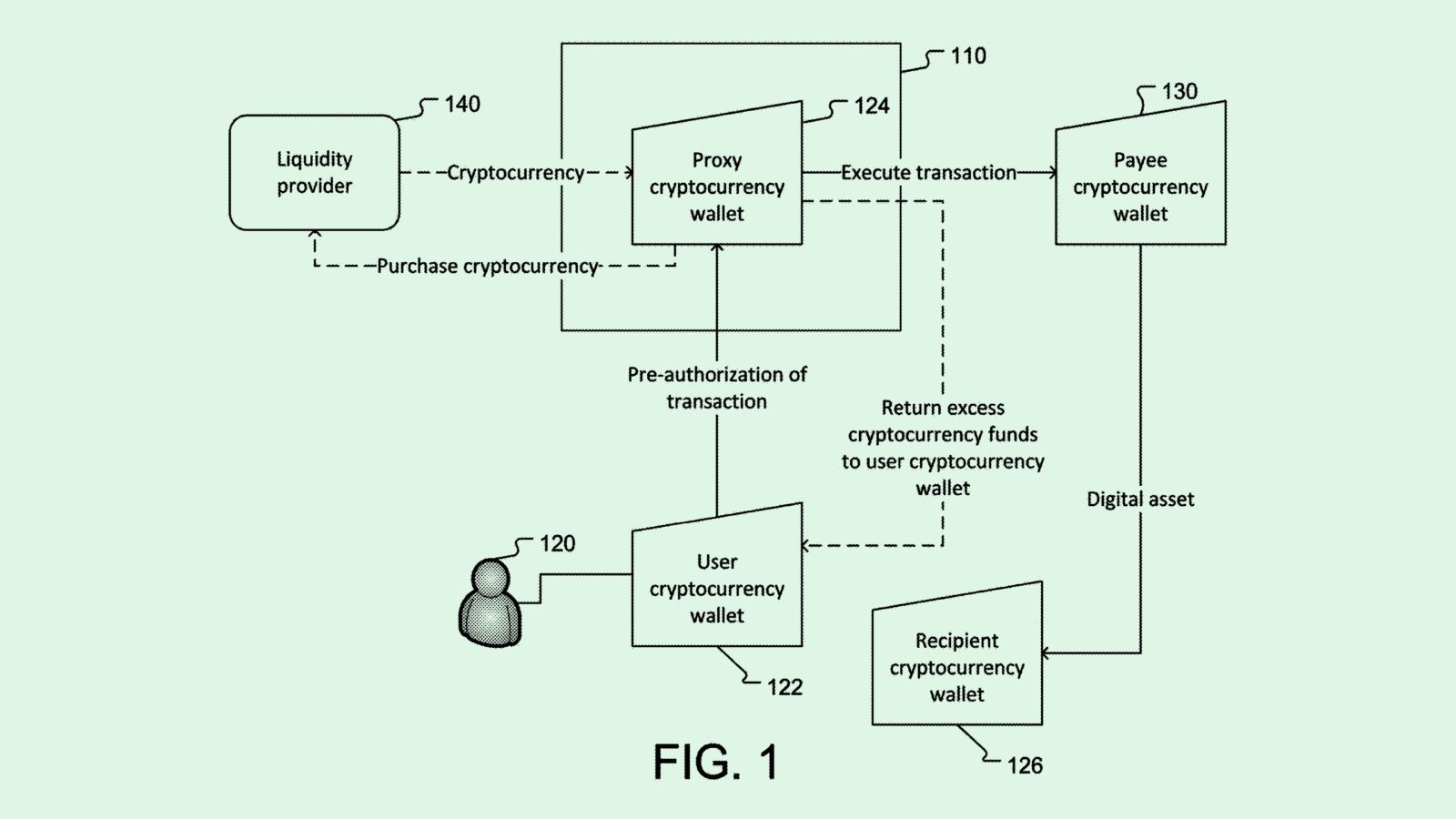

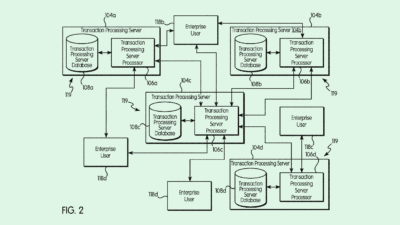

Stripe Seeks Blockchain Patent As it Plays Crypto Catch-up

Photo via U.S. Patent and Trademark Office