PayPal Blockchain Security Patent Could Build Crypto Trust

PayPal wants to make crypto transactions less risky.

Sign up to uncover the latest in emerging technology.

PayPal wants to make sure your money’s going where it’s meant to go.

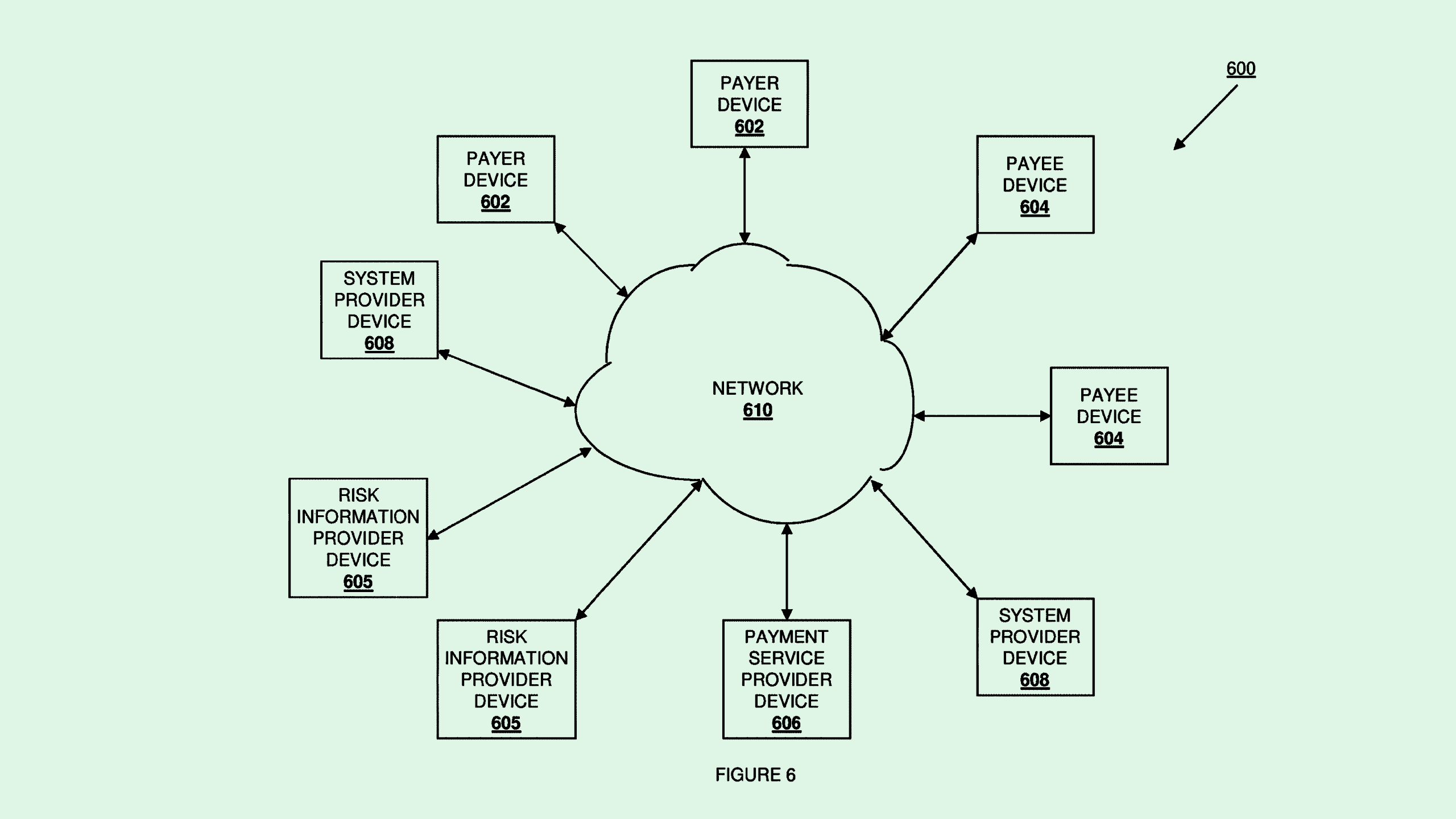

The fintech giant is seeking to patent “risk determination enabled” cryptocurrency transactions. That will assess the risk of a crypto transaction before it actually takes place.

PayPal wants to make it so that users making payments with crypto aren’t “forced to transact ‘blindly’ with parties that may be unknown or have unknown histories,” the company said in its filing.

When a transaction request is received, PayPal’s tech sends the payee a risk assessment, requiring the party to meet certain “risk criteria” prior to any money being exchanged. If the payee meets that criteria, the transaction is approved and added to the blockchain ledger. If they don’t, it’s halted or flagged.

This risk criteria may be crypto-specific, including things like account history, previous transaction activity, and previous disputes or reports against the user. Additionally, PayPal may check that the user’s IP address is valid, and that they’re “associated with an approved country or location.”

PayPal wants to be a major voice in the world of blockchain and crypto. The company’s patent history is littered with blockchain-based innovations, and its stablecoin, PayPalUSD, exceeded a market cap of $1 billion a year after its launch. The company’s recent partnership with Crypto.com also further embeds PayPal in the crypto ecosystem.

Still, people have trust issues with crypto, especially as scams continue to climb. According to the FBI’s 2023 Cryptocurrency Fraud Report, more than $5.6 billion was lost in crypto scams last year. And because of the immutable nature of blockchain, clawing back lost funds is incredibly difficult, said Jordan Gutt, Web 3.0 lead at The Glimpse Group.

“That’s why the whole industry has a bad light on it,” said Gutt. “There are a lot of scammers who portray themselves as legitimate businesses or ways to make money fast.”

Tech like this, while “standard for traditional payments,” could help improve trust in the crypto industry by preventing those scams before they happen, he said. Additionally, this could give merchants more peace of mind in accepting crypto, said Gutt, especially as it enables more and more merchants to buy, sell, and hold digital currencies.

“PayPal is able to use their years of experience in traditional payments … to try to make the blockchain world more safe and secure,” he said.