PayPal Patent Aims to Front Your Crypto Purchases

PayPal may offer users a credit for cryptocurrency that they have to pay back later.

Sign up to uncover the latest in emerging technology.

PayPal doesn’t want you waiting around to make crypto payments.

The company filed a patent application for facilitating cryptocurrency-based transactions with a “time constraint.” Basically, PayPal’s method allows it to verify that a user owns a crypto wallet without knowing all of the user’s personal details, so that transactions can be done without waiting for conversions.

Converting a cryptocurrency to a fiat currency isn’t always a fast process, PayPal said, so time-sensitive transactions may be difficult for a user to complete. Time requirements “for completing a cryptocurrency transaction may hinder a user from performing the purchase transaction in a timely manner,” the company said.

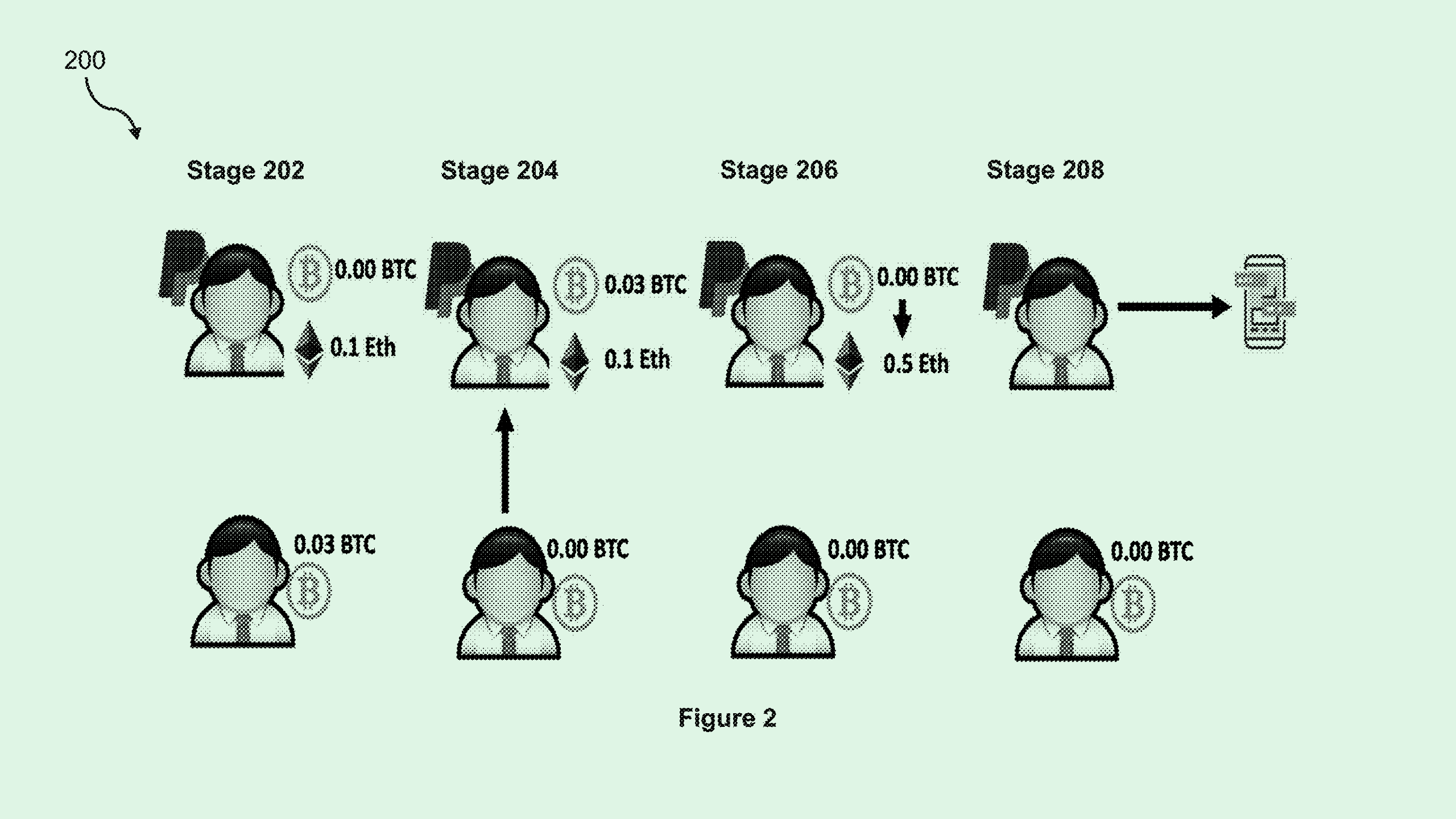

To perform this kind of transaction in a tight timeframe, this system works by extending a credit to a user to cover the transaction. Before extending that credit, the system verifies that the user has enough in their crypto wallet balance to cover the purchase, and that the crypto wallet is in fact owned by the user making the purchase.

A user’s balance can be easily verified at any point by accessing the distributed ledger that the wallet is connected to, Paypal noted. Ownership of the wallet itself can be verified by determining whether or not they have the private key associated with it using a mathematical calculation to generate verification data. This calculation can be done using a public key associated with the wallet, thereby confirming ownership without needing specific details on a user’s private key.

The risks of malicious attacks where the user may lie about being the owner of the wallet, or about having enough money for the purchase at all, is “greatly reduced” by this verification step, PayPal said. After PayPal fronts the money for the transaction, the user later pays off the credit.

To put it lightly, the crypto market has had a rough couple of years, with the downfall of companies like FTX, BlockFi, Voyager and Genesis, and Binance’s $4.3 billion settlement with the CFTC. Since its peak at $3 trillion in 2021, the overall crypto market has lost $2 trillion in value.

But in that time, traditional financial institutions and fintech companies alike have started building out their blockchain tech – among them, PayPal. Its patent activity spells out a concerted interest in blockchain, including a blockchain-based security system, a carbon-neutral blockchain protocol and a blockchain data compression system. The company allows users to buy, transfer and sell crypto both on the PayPal and Venmo apps, and launched its own stablecoin, PayPalUSD, in August.

This patent in particular identifies an obstacle to broader blockchain adoption, said Jordan Gutt, Web 3.0 lead at The Glimpse Group. “(PayPal) identifies that blockchains are not always the most efficient,” he said. “This could increase adoption and increase the applicability of using crypto in the real world.”

Along with mitigating the time suck on the user end, this could make it easier for merchants to adopt digital currencies into their own payment systems, said Gutt. The company already offers guides and solutions to help small businesses accept crypto at checkout. This tech could make that offering even more attractive, said Gutt.

Plus, Gutt added, there could be “a huge benefit for PayPal itself to offer this, to rack up interest and be more liquid with how they operate with cryptocurrencies.”