JPMorgan Chase May Use Blockchain to Check Facts

Core blockchain technologies themselves are being adopted at a more gradual pace.

Sign up to uncover the latest in emerging technology.

JPMorgan Chase wants to set the record straight.

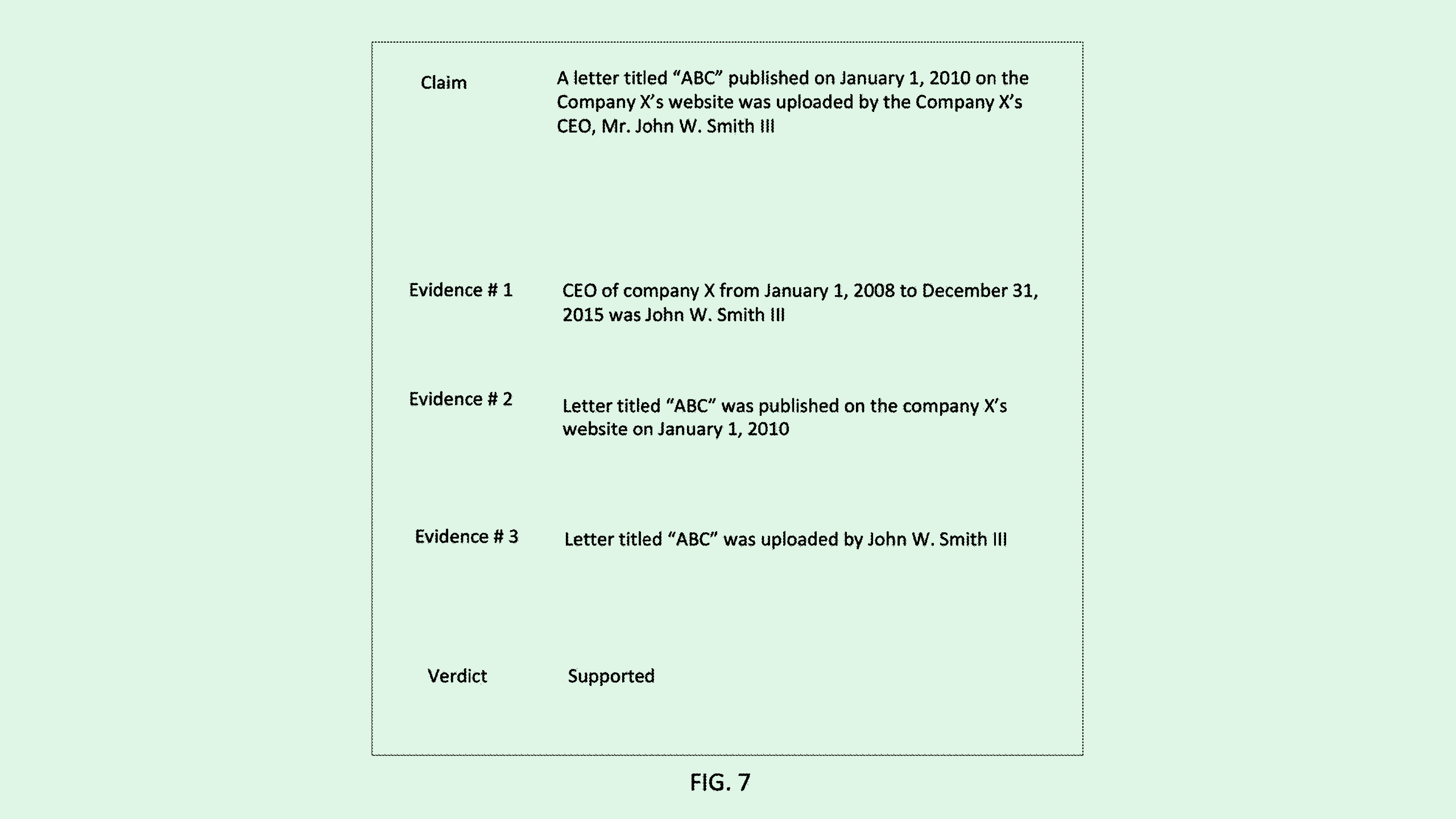

The financial institution filed a patent application for “fact verification using blockchain and machine learning technologies.” While blockchain is useful for verifying the integrity and origins of a document, “it is unable to verify if one of its claims is factually accurate,” JPMorgan said in the filing.

To amend this, JPMorgan will use machine learning to do the rest of the work. When a document is first submitted for verification, the system uses a natural language processing model to track down all of the “named entities” within it, such as people, places, or organizations, as well as their associated metadata.

The system then searches for previously authenticated documents that include those named entities. These authenticated documents are easy to trace using blockchain via their hashes (unique identifiers), serving as a reliable index to assist the model in fact-checking.

Then the system checks the presence and frequency of these named entities in previous documents to determine whether or not the new document’s text can be supported by previous claims.

While blockchain doesn’t have the ability to verify the validity of the content itself, AI models tend to go off the rails when not provided with proper data. Because of this, JPMorgan’s patent highlights the strengths and weaknesses of both blockchain and machine learning, and uses each technology to complement the other, said Jordan Gutt, Web 3.0 lead at The Glimpse Group.

“[Blockchain] has its core use cases of trust, tamper-proof, and scalability, but what that content is really has no bearing,” said Gutt.

It’s another example of the ways in which blockchain can be put to use outside of cryptocurrency — a concept that’s been explored by JPMorgan and other finance firms in the past, whether it be for financial audits, recordkeeping, or even “space-based” transactions. “The best use case for blockchain is when it’s not even visible to the end user,” said Gutt.

Though blockchain’s reputation has long been associated with cryptocurrencies’ volatility, the two have started “diverging” in recent years, said Gutt. As crypto has started to mature, so has the general public’s understanding of the technology. That could give more leeway for companies like JPMorgan to adopt it as a foundational technology.

“I think in 2021, people were shocked by the intense price action, and couldn’t differentiate blockchain from crypto,” he said. “But consumers are more educated now.”

So while crypto — particularly bitcoin — is currently seeing a rapid upswing following the election, its peaks and valleys have had less of an impact on blockchain as a whole. Instead, core blockchain technologies themselves are being adopted at a more gradual pace, said Gutt.

“They’re on two different trajectories. Crypto is one thing and core blockchain technology is another,” he said. “Blockchain has a clear, steady rate of adoption and crypto is super volatile.”