Mastercard Blockchain Patent Could Make Financial Audits Easier

Mastercard might use blockchain to straighten out transaction records.

Sign up to uncover the latest in emerging technology.

Mastercard wants to set the record straight.

The credit card giant filed a patent application for “transaction processing with complete cryptographic auditability.” This adds a layer of trackability and transparency to transactions using a blockchain ledger.

Mastercard’s tech aims to give a user or business auditability of all their transactions in the event of a dispute, as well as “eliminate or strongly mitigate the possibility of the record being tampered with.”

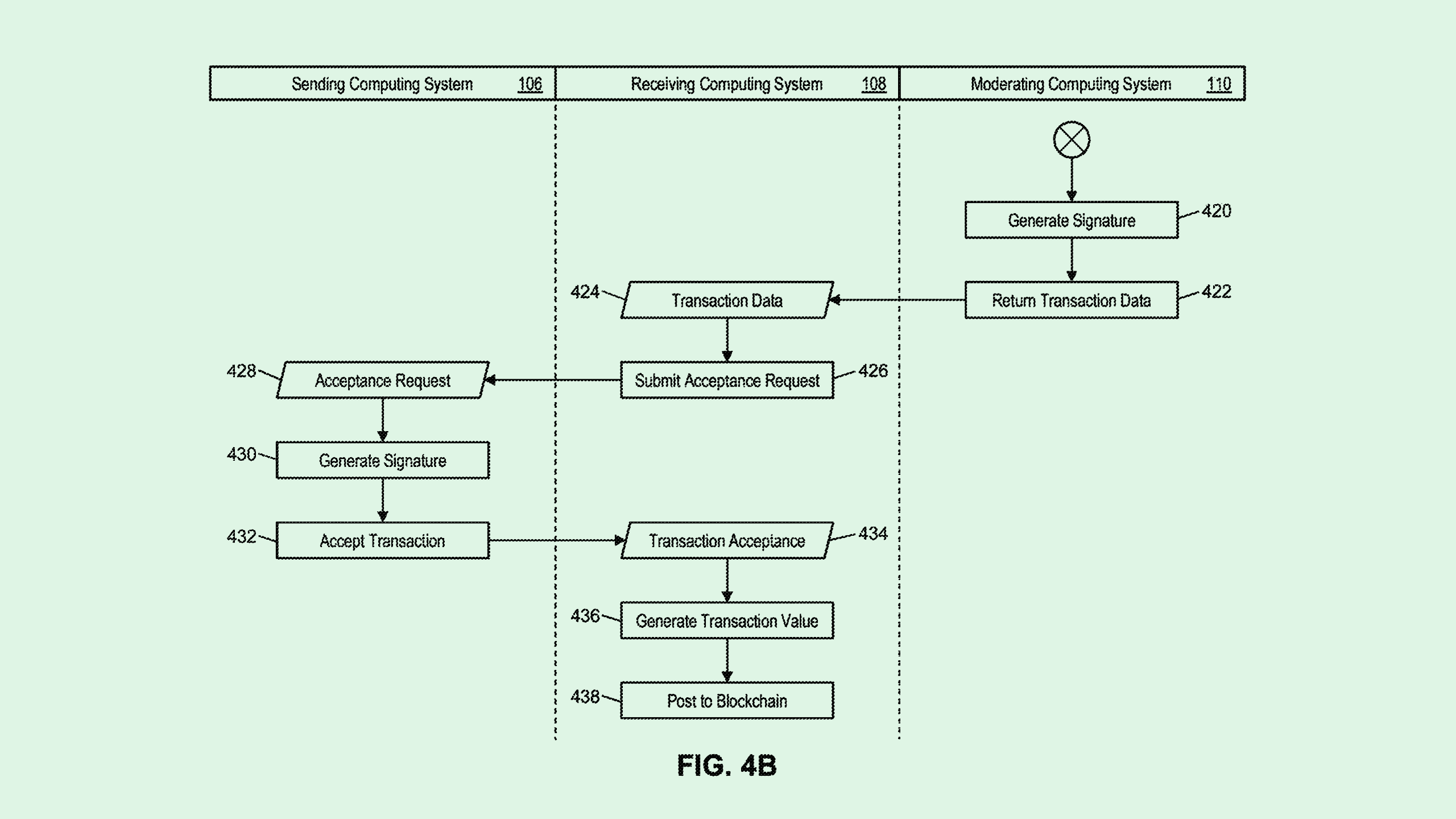

When a transaction is requested between two parties, a “third party” moderator is used to verify the details, and a digital signature is generated as a means of verification. The server that’s processing the transaction then creates its own digital signatures, adding a layer of cryptographic verification to ensure the transaction’s validity.

Once the transaction is confirmed, both the digital signatures and the details of the transaction itself are stored on a blockchain, ensuring that the record is secure, tamper-proof and immutable.

Mastercard is far from new to the blockchain landscape. The company has filed tons of patents that use blockchain both for cryptocurrency and other use cases, such as ticket tracking and fraud detection. It’s following pace with fintech and finance firms like PayPal, Visa, and JPMorgan Chase, all of which have filed patents for blockchain-related tech.

This patent plays to blockchain’s biggest strengths — immutability, transparency, and security — without being explicitly related to cryptocurrency, said Jordan Gutt, Web 3.0 lead at The Glimpse Group.

“It’s using the best of blockchain technology,” said Gutt. “Mastercard wanted to find a use case for blockchain that could actually help them in solving real-world problems.”

This invention alone presents several potential use cases, Gutt said. In one example, the filing discusses its capabilities in real estate transactions, such as escrow payments, which are “usually slow, expensive, and error-prone,” Gutt said. But this tech can provide an additional layer of trust and transparency in the purchase of any hot-ticket item, he said.

And with the amount of purchase disputes that a company like Mastercard deals with on a regular basis, an immutable ledger could help merchants and customers easily track where payments went awry. “This patent could help either party without extra time and effort,” he said.

“It seems like a great use case, and in the future, could save them money on a lot of different auditing tasks and reduce fraud,” said Gutt.