mastercard

-

Klarna’s BNPL Debit Card Goes Head-to-Head With Banks

Photo via Andre M. Chang/ZUMAPRESS/Newscom

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

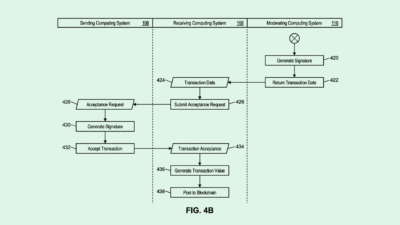

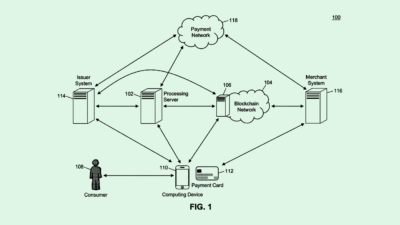

Mastercard Buys Startup That Will Help You Manage Pesky Subscriptions

Photo via Connor Lin / The Daily Upside

-

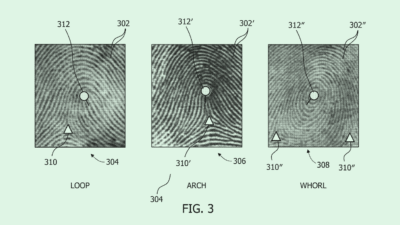

Mastercard Wants to Make Biometrics More Accurate

Photo by Cottonbro Studio on Pexels