Mastercard Catches Scalpers

Mastercard’s blockchain scalping detector could take on Ticketmaster, one expert told Patent Drop.

Sign up to uncover the latest in emerging technology.

Mastercard wants to make sure your Eras Tour tickets are legit.

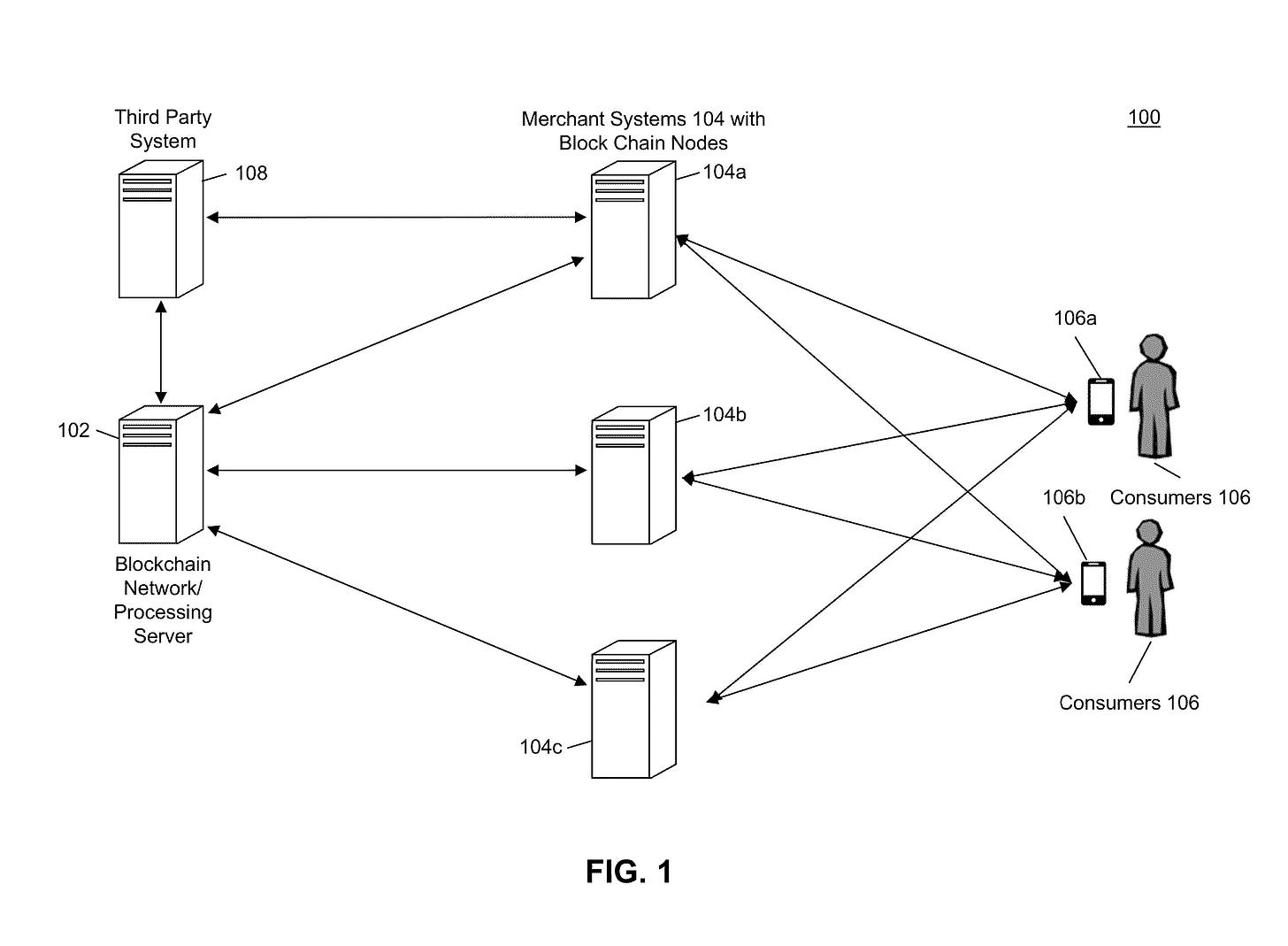

The credit card company filed a patent application for a system that aims to detect and reduce ticket scalping using distributed ledgers. Essentially, Mastercard’s system uses blockchain’s immutable record to prevent “an unauthorized transaction indicative of scalping.”

This system records transactions within a blockchain ledger embedded in the merchant’s payment network (aka, the network that connects all Mastercard’s point-of-sale systems together). It takes note of two types of data: product identifiers, such as the types of item and how many were previously purchased, and consumer identification data, including cardholder name, shipping and billing address, and payment information.

If a user tries to scalp products or tickets, the system will compare the current transaction to recent historical transactions to determine a “suspicion score” for the user’s profile. If that score is above a certain threshold, the system automatically declines unauthorized transactions “without having to modify existing point of sale systems.”

While many ticketing companies have sought to limit robot scalpers using captcha technology, this doesn’t prevent a human from buying an excess number of tickets or products to resell amid increased demand. Using Mastercard’s system, however, “scalping can be tracked across multiple merchants and in cases where a nefarious actor could traditionally evade detection, due to the tying together of transaction data and scoring thereof.”

Mastercard is far from new to the blockchain. The company sought to patent a system for converting digital assets into cash using mirrored accounting, announced plans in February to allow merchants to receive and settle digital asset transactions, and is in talks with digital banks and fintechs on a digital asset credit card. This patent takes it a step past crypto, applying blockchain as a base technology to merchant capabilities.

Mastercard’s tech has a few potential upsides, said Aaron Rafferty, co-founder of StandardDAO. For one, this tackles the scalping issue that the company laid out in its patent, a problem that made headlines late last year amid the whole Ticketmaster Taylor Swift Era’s Tour debacle (and subsequent government investigation). For reference, while Ticketmaster sold tickets to Swift’s highly sought tour for between $50 and $500, secondary sales were much higher, with some listed at $22,000 on resale site Stub Hub.

With Mastercard’s system, “blockchain is kind of that power player against fraud,” said Rafferty.

“(Mastercard) may get to disrupt Ticketmaster,” said Rafferty. “The fact that Mastercard is doing this, I think, should send sirens to the incumbent ticketing players in the space today.”

But because of the permanent nature of blockchain, using it in the context of ticketing can make a ticket “become much more than that,” Rafferty said. For example, you can track user behavior, give merchants a cut of resale values, or integrate rewards for ticket holders. And because Mastercard is already ubiquitous, this tech can likely integrate seamlessly under a user’s credit card or profile, Rafferty noted.

While plenty of blockchain companies have tried to take on ticketing, none have done so with great success. Why? “One of the cons of blockchain today is ease of use,” said Rafferty. “No one wants to use it. Everyone hates it.” Mastercard’s ubiquity, however, could solve that issue.

Have any comments, tips or suggestions? Drop us a line! Email at admin@patentdrop.xyz or shoot us a DM on Twitter @patentdrop. If you want to get Patent Drop in your inbox, click here to subscribe.