Mastercard Continues Crypto Crusade with Seamless Transaction Patents

Mastercard’s interest in this tech could help legitimize crypto in the broader scheme of traditional finance.

Sign up to uncover the latest in emerging technology.

Mastercard may be continuing its crypto bid: The credit card issuer filed two patent applications for systems to facilitate blockchain-based transactions.

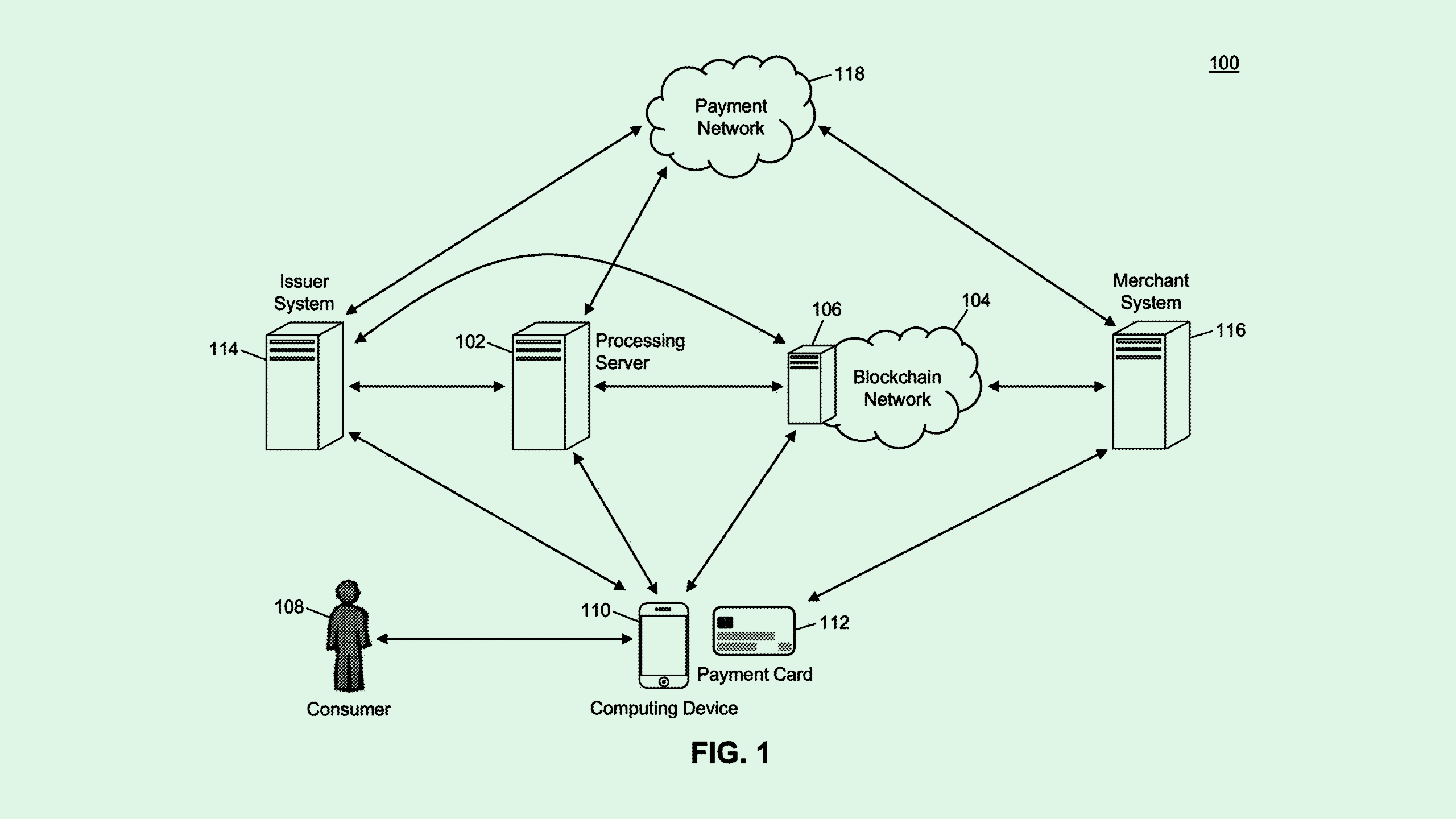

First, the company sought to patent a system for “facilitating trustless payment transactions using smart contracts.” To put it simply, Mastercard’s filing describes a system for processing a blockchain transfer using a card payment network, which could allow it to facilitate seamless crypto transactions within its existing framework.

“There are a lack of systems for enabling a consumer to utilize blockchain currency in a transaction conducted with a payment card,” Mastercard said in the filing.

Mastercard’s tech first creates a smart contract within a blockchain network. Then, once both the computing system requesting money (such as a merchant) and the one sending it (the user’s bank) authorize a transaction, that smart contract is executed, and the agreed-upon sum of digital currency is transferred where it needs to go. This process is automatic and doesn’t rely on a middleman, making it secure and “trustless.”

Additionally, the company sought to patent a system for converting “digital assets to fiat currency.” This would make it easier to get cash for your crypto.

When a person wants to make a transaction, this system first validates that they’re authorized to make it, then determines the equivalent fiat currency for whatever amount of crypto they’re transacting.

Then, using a tactic called mirrored accounting, that transaction is copied onto a secondary blockchain designed to manage the conversion. This recording process makes transactions more traceable and transparent. Finally, the system confirms that the transaction was added to the secondary blockchain, and the fiat currency is transferred.

Mastercard has long sought to up its cryptocurrency chops. These filings add to a laundry list of patents for things like crypto wallet failsafe technology, blockchain ticketing systems, and fraud detection tech.

And earlier this month, the credit card firm announced that it’s launching a crypto debit card in partnership with digital asset exchange Mercuryo. The euro-denominated card allows users to spend their digital currencies at any of Mastercard’s 100 million merchants. In August, the company launched a pilot of a crypto-to-fiat card in partnership with blockchain platform MetaMask and crypto payments firm Baanx.

Though these cards are in early stages, Mastercard’s tech could make the process safer and more seamless for consumers, while also opening the door for merchants to accept the currency without hassle, said Jordan Gutt, Web 3.0 lead at The Glimpse Group.

Digital assets have a reputation for being volatile and complex. However, Mastercard’s involvement could help legitimize crypto in the broader scheme of traditional finance, Gutt said, and patents like these could help the firm build out its infrastructure before pushing for broader adoption.

Plus, locking down IP in this area could give Mastercard a lead over finance and tech firms, like Visa or PayPal, that also have an interest in crypto.

“If a known brand like Mastercard is continuing to innovate there, then there has to be a true use case,” said Gutt. “And right now, it’s difficult to use your crypto in the real world, but these patents could allow people to actually use them in day-to-day payments.”