PayPal Patent Cuts Blockchain Energy Costs as it Ups Crypto Chops

PayPal’s patent figures out when to use (and not use) blockchain for crypto transactions.

Sign up to uncover the latest in emerging technology.

PayPal wants to grow its blockchain footprint without growing its carbon one.

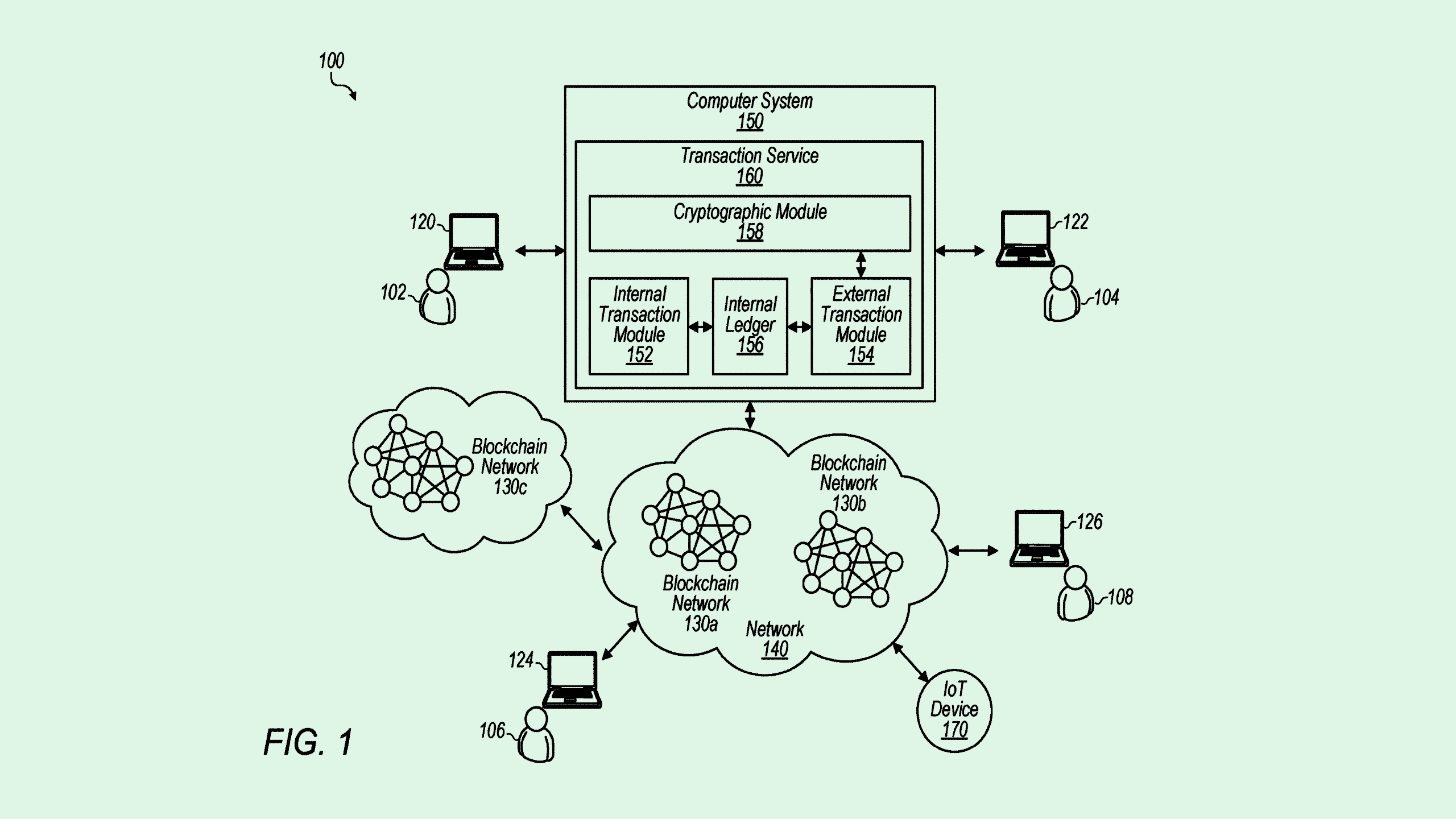

The company filed a patent for using an “internal ledger with blockchain transactions.” At its core, this tech aims to save power by recording some transactions on a less computationally-intense ledger, rather than throwing everything on the blockchain.

“One problematic aspect of blockchain technology is that transactions on the network may be computationally expensive for both computing nodes on the blockchain, as well as for a requesting computing device that initiated a transaction,” PayPal said in the filing. “These transactions may also have a substantive time delay.”

PayPal’s tech aims to overcome that issue by differentiating between internal transactions, or those that occur between accounts within PayPal’s ecosystem, and external ones, in which assets are transferred out. Instead of recording every digital asset transaction on the blockchain, this system would only record external transactions on the blockchain.

Those staying within PayPal’s ecosystem would rely on a so-called internal ledger for tracking. Accounts within its ecosystem would still have their own cryptographic keys used to perform digital asset transactions outside of the network.

When an account performs a digital asset transaction with an external source, PayPal’s tech consolidates transactions performed internally to synchronize the internal ledger with the blockchain one. By performing fewer, larger transactions instead of several smaller ones, this tech saves computing power “and financial costs associated with the use of such computational resources,” the company said.

PayPal has been pounding the pavement in the cryptocurrency space. The company launched its own stablecoin, called PayPal USD, last August. A year later, the digital currency has exceeded a market cap of $1 billion. The company also recently announced a partnership with Crypto.com that would allow users to link their PayPal wallets with the crypto exchange.

However, blockchain has a reputation for eating up tons of energy. According to the US Energy Information Administration, cryptocurrency mining accounts for between 0.6% to 2.3% of US electricity consumption. Global energy consumption from Bitcoin mining alone doubled in 2023, reaching 141.2 terawatt-hours.

As larger financial institutions and fintechs take an interest in crypto, the tech’s power usage could be a growing consideration. Tech like this could help the company not only save on the costs associated with ramping up blockchain transactions, but help it attain its previously stated goal of reaching net-zero emissions by 2040.

Plus, this isn’t the first time we’ve seen PayPal take an interest in making crypto greener: The company previously filed a patent application for a carbon-neutral blockchain protocol, which relies on “green wallets” to help offset carbon emissions generated by crypto transactions made on its platform.