Goldman Sachs Files Blockchain Patent Despite Crypto Disinterest

Goldman Sachs may want to use blockchain for anything but crypto.

Sign up to uncover the latest in emerging technology.

Goldman Sachs may not be the loudest supporter of cryptocurrency, but a recent patent application may show that the company may be researching the tech.

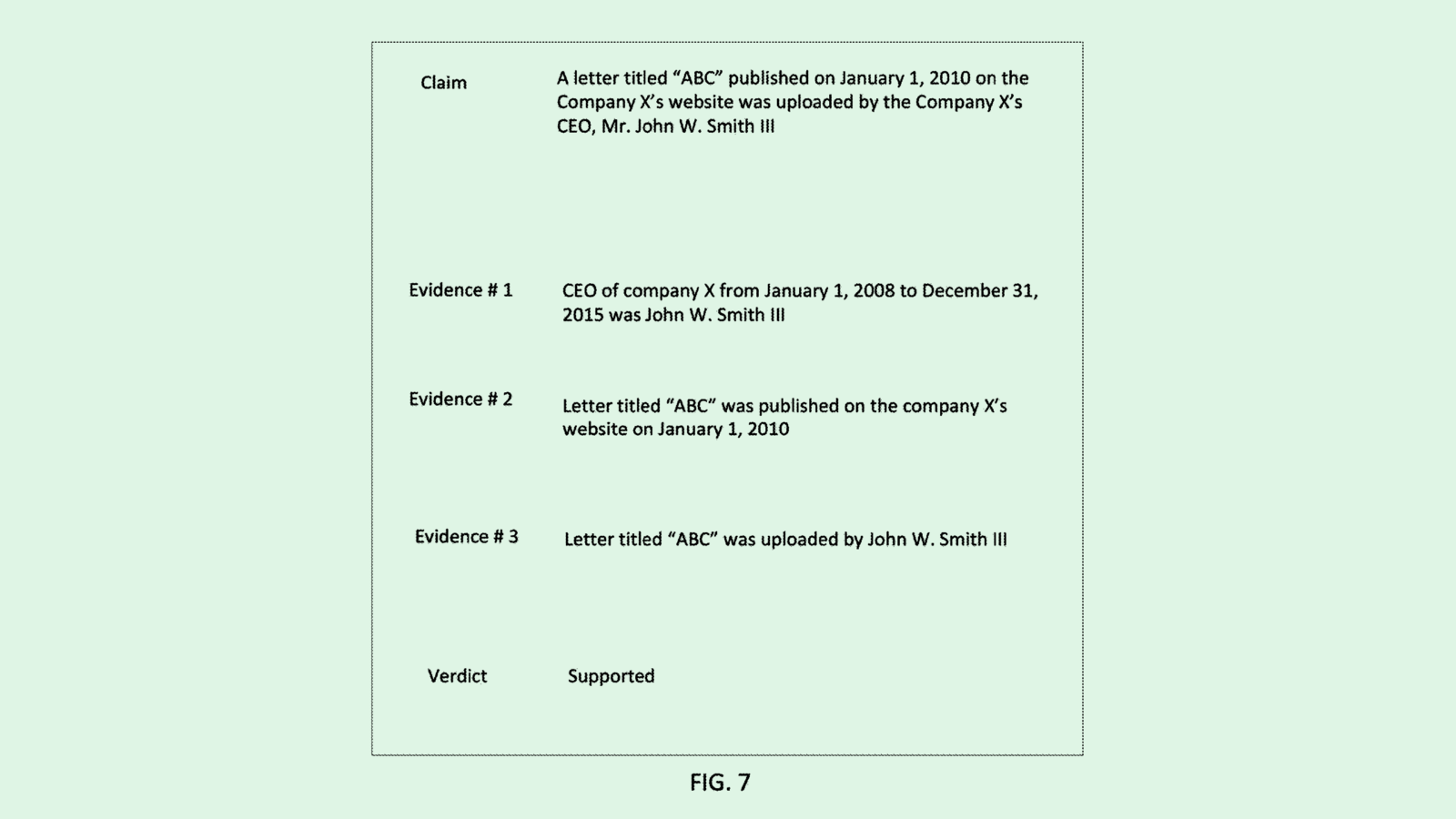

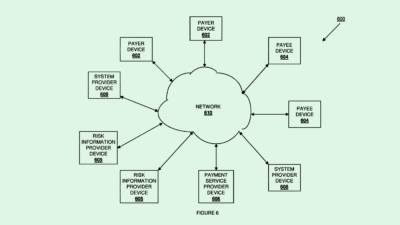

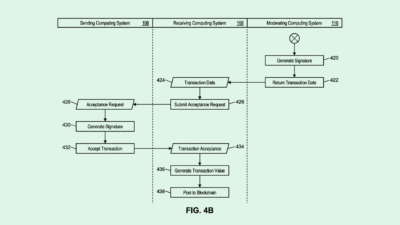

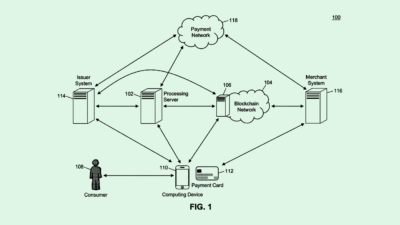

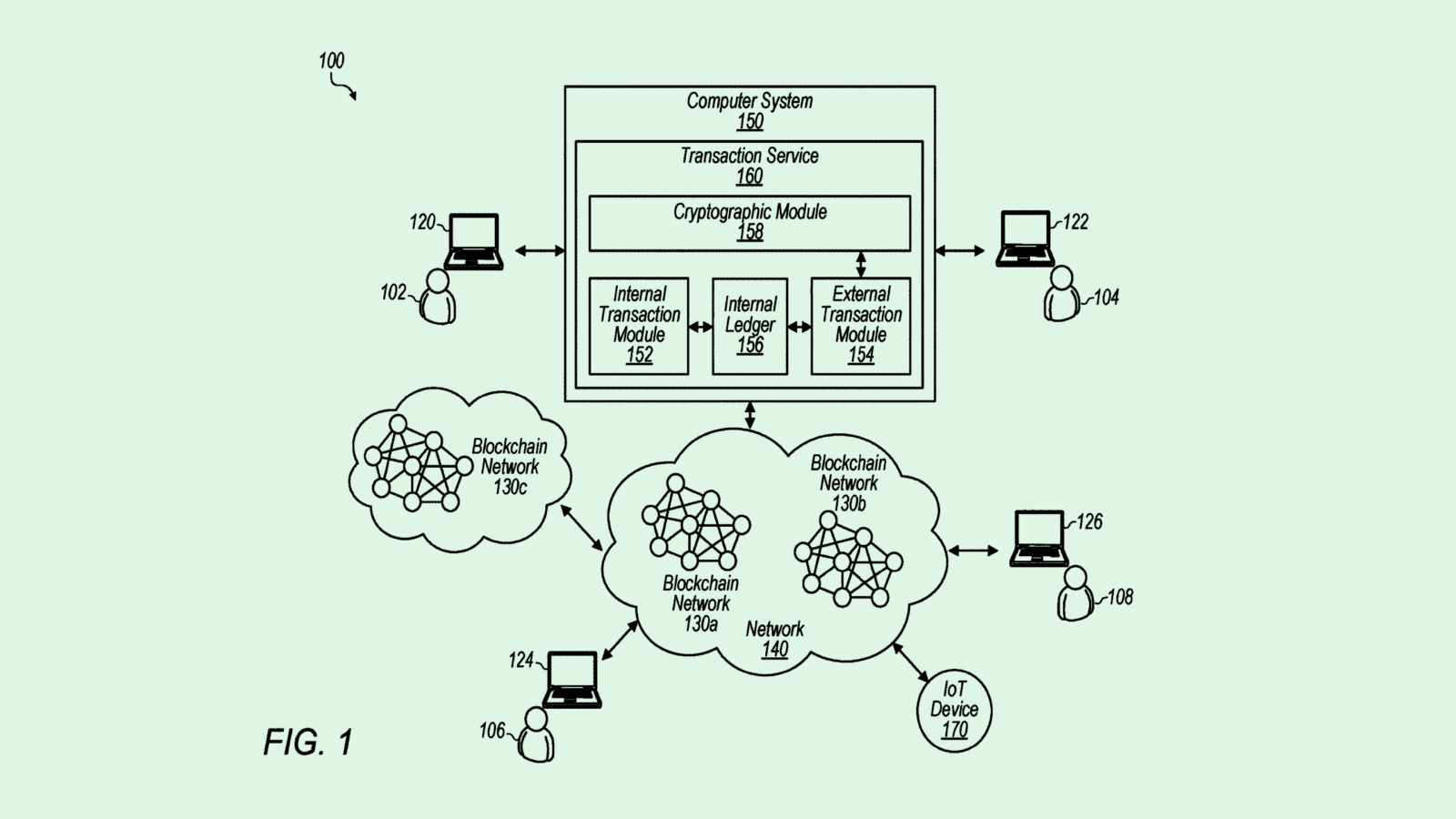

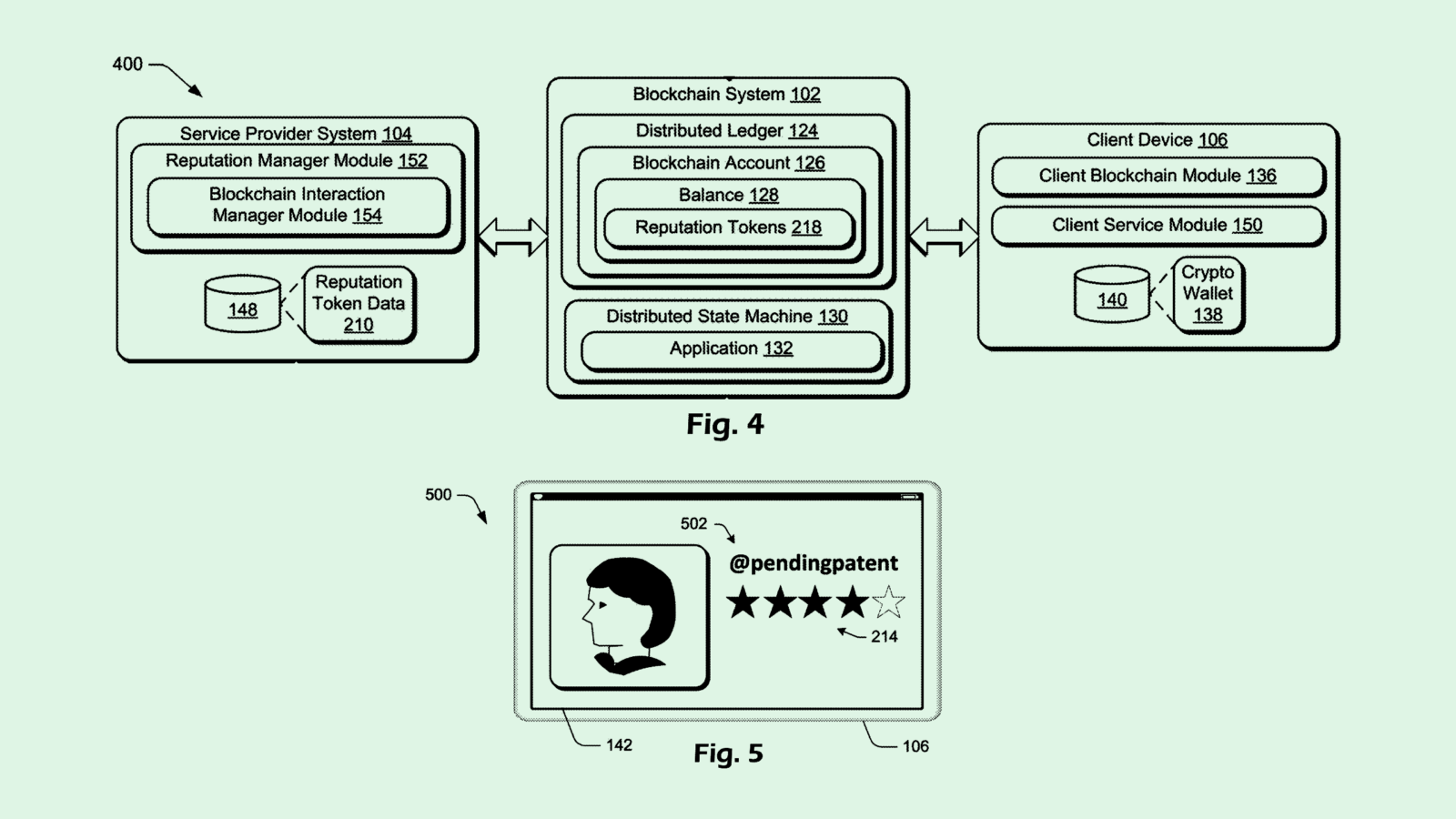

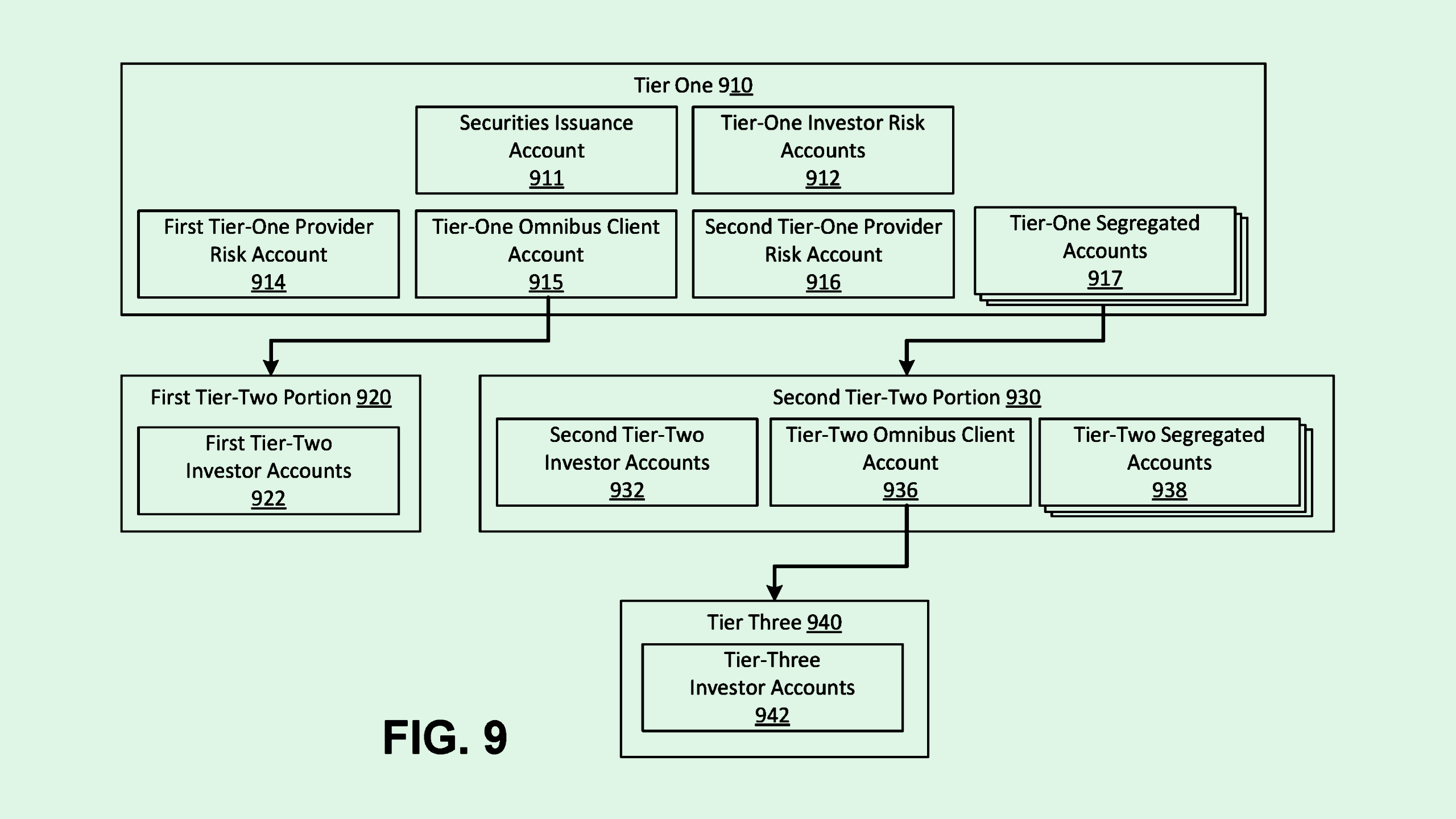

The financial institution is seeking to patent a “digital assets platform.” The filing essentially lays out an end-to-end system for trading and managing digital assets or “tokenized assets” using a distributed ledger, a.k.a. a blockchain network.

“Market participants desire a wide range of functionality with digital assets to mirror the rich tapestry of financial products that are possible with conventional, non-digital approaches,” Goldman said in the filing. “Conventional digital asset systems provide only a patchwork of functionality that meet only a subset of the demands (of) financial market participants.”

Goldman aims to patent an all-in-one platform to automate the servicing of digital assets. It would include a variety of services, including issuing and trading digital assets, custody, transaction settlement, and overall portfolio management.

Goldman listed several digital assets that may fall under this umbrella, including “digitally native” securities and non-securities, as well as tokenized real-world and digital assets. Additionally, to ensure that this platform complies with regulations, Goldman noted that it uses a “permissioned” distributed ledger, or one that requires permission to join and that’s hosted by recognized and legitimate institutions.

Unlike other financial institutions like BlackRock, Fidelity, and JPMorgan Chase, Goldman Sachs has been a naysayer of cryptocurrency. In early April, Sharmin Mossavar-Rahmani, chief investment officer of the bank’s wealth management unit, told The Wall Street Journal that the bank’s clients simply aren’t interested in crypto. “We do not think it is an investment asset class,” She said in the interview. “We’re not believers in crypto.”

But blockchain is far bigger than just cryptocurrency. Patent activity from several companies proves it can be used in many contexts, whether it be cloud computing, deepfake detection, or even keeping track of road salting.

And while it’s hard to “pinpoint a fundamental value” of cryptocurrencies, the underlying technology has major potential in financial services, said Dean Kim, head of equity research at William O’Neil.“This is a really huge opportunity for any company that’s going to be able to come up with a solid offering in terms of the blockchain platform.”

For Goldman, this tech could take many forms. The transparency and immutability of blockchain could allow for secure tracking and transferring of digital and physical assets, instantaneous settlement of securities, as well as detecting fraud or money-laundering, Kim noted.

While cryptocurrency gave blockchain a bit of a bad reputation, institutions like Goldman may be looking to repair it by ensuring that their uses of it are up to regulatory snuff. The involvement of major banks like this could help establish more trust in the tech at a time when it’s sorely lacking.

“I think what Goldman Sachs is trying to do is come up with a technology that is fool-proof, verifiable, and hack-proof, that they can offer in services to their clients,” said Kim.