Stripe Fraud Detection Patent Could Restore Trust in Crypto

Stripe wants to fortify blockchain transactions with it’s latest patent.

Sign up to uncover the latest in emerging technology.

Stipe wants to make sure your transactions are all above-board.

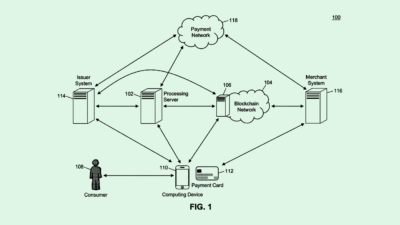

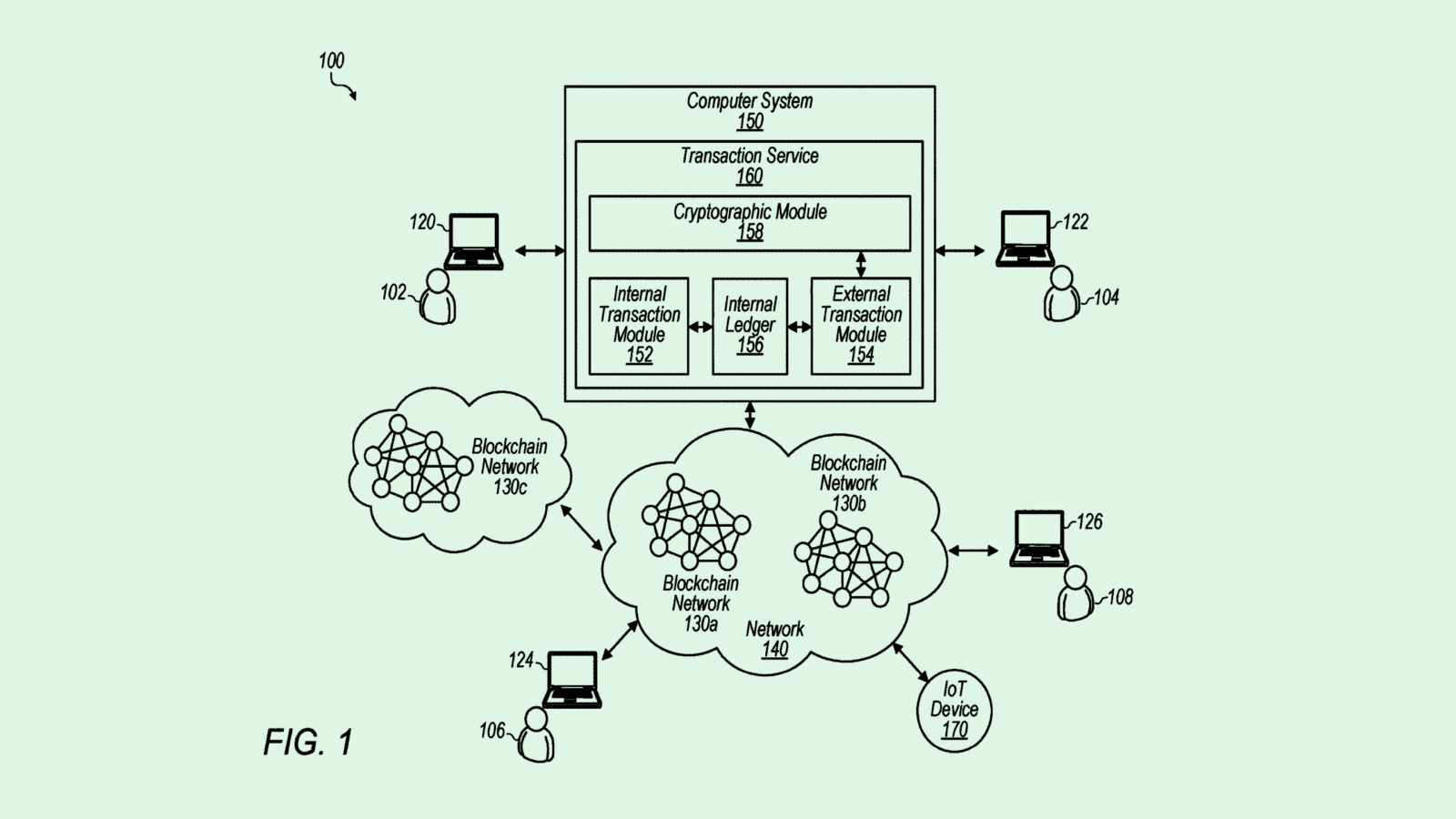

The company is seeking to patent “computer modeling for fraud detection in blockchain-based transactions.” As Stripe steps back into the world of cryptocurrency, this tech aims to identify vulnerabilities and stop them in real time.

“Bad actors have created … novel and sophisticated methods and systems to take advantage of this technical shortcoming that is specific to virtual currencies,” Stripe said in the filing. “Therefore, electronic payment systems and applications face technical challenges in protecting their users against fraud.”

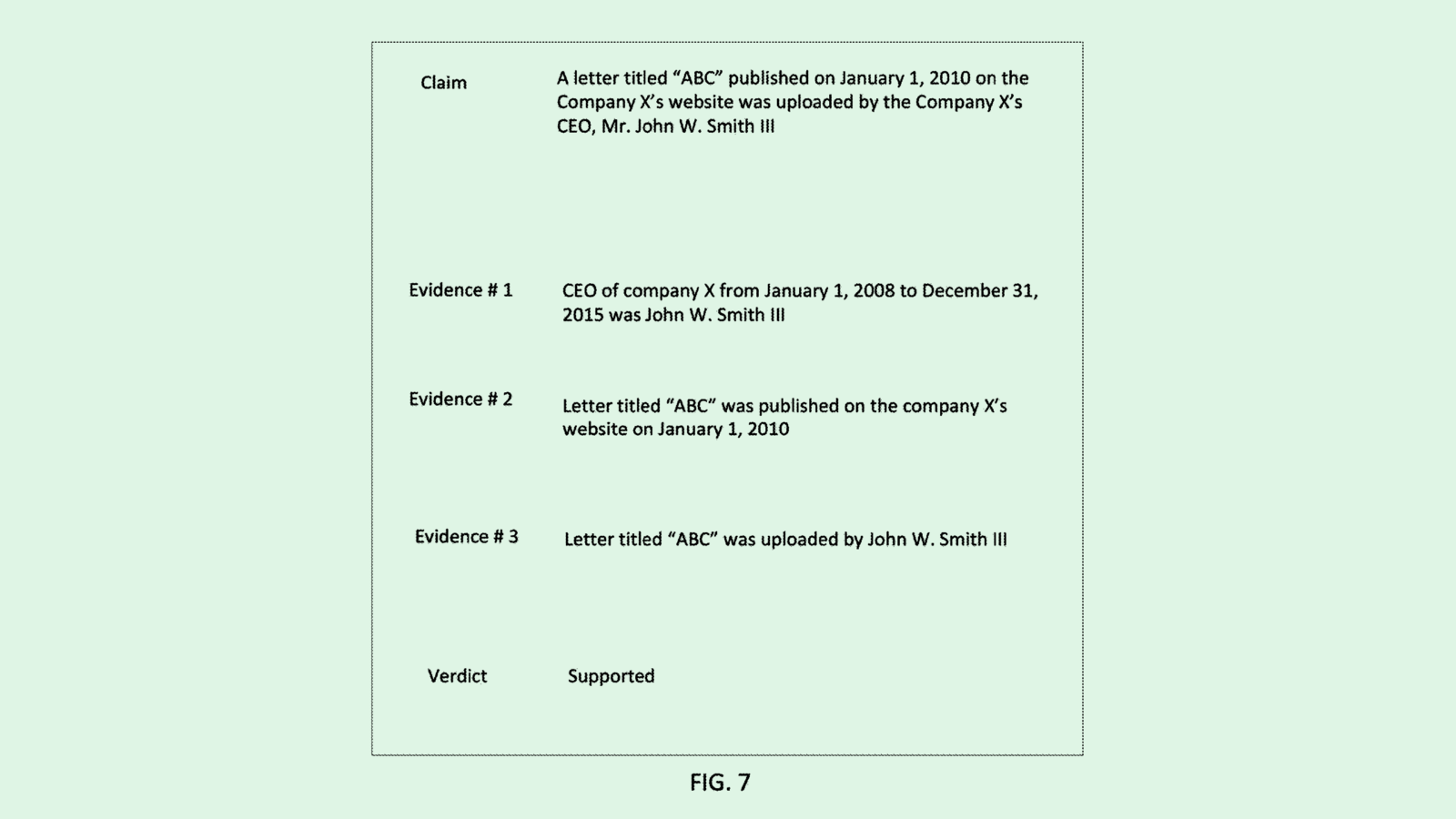

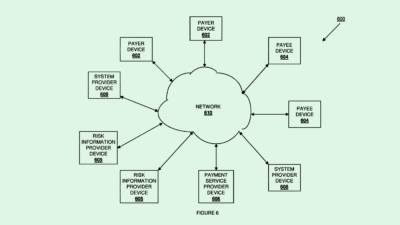

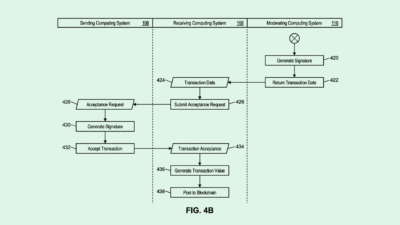

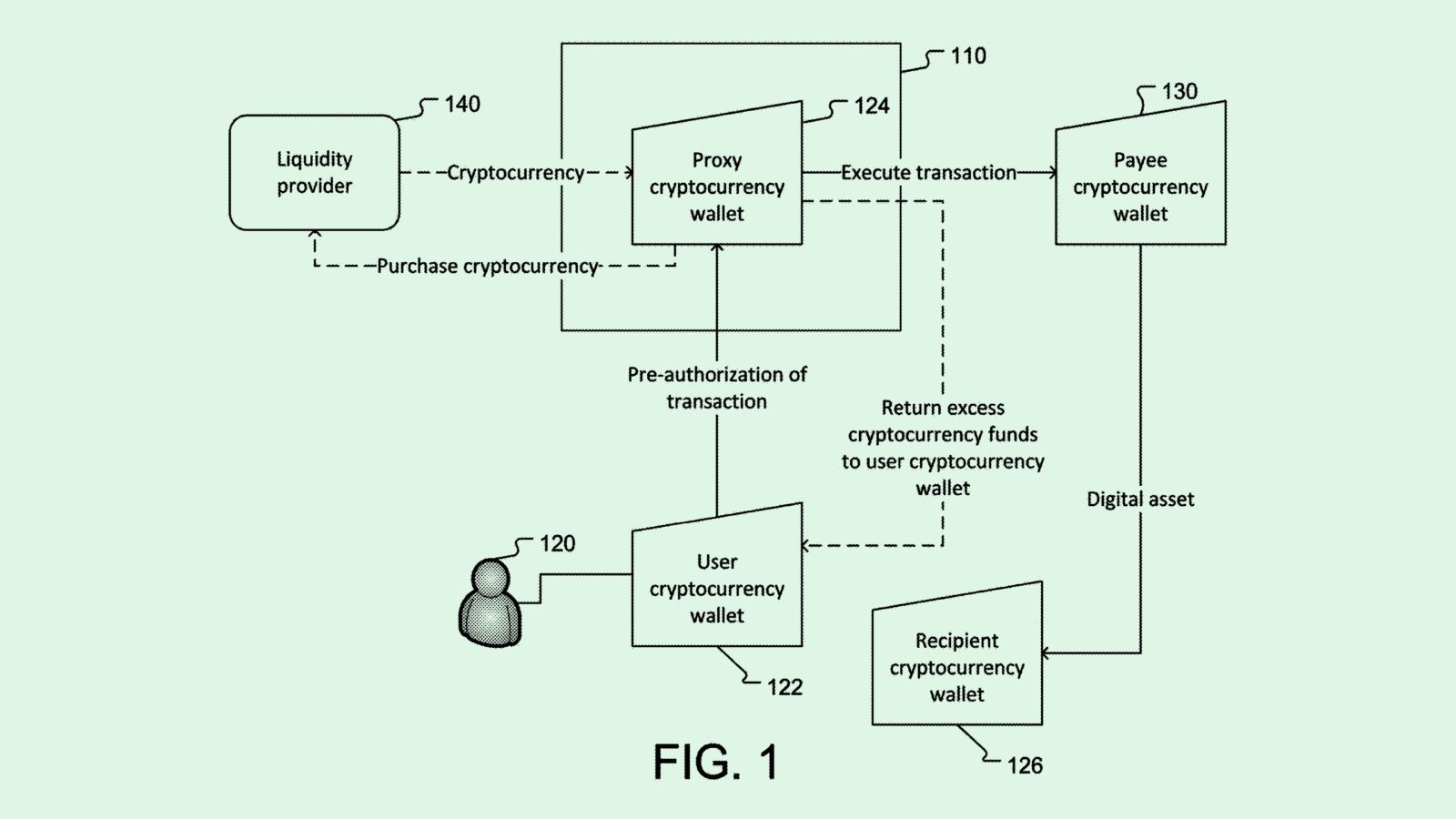

To mitigate fraud, Stripe’s tech relies on a trained machine learning model to monitor and detect when something seems out of the ordinary. When a user is about to perform a blockchain transaction, the model kicks into gear, and compares the current transaction to similar ones to determine a risk score.

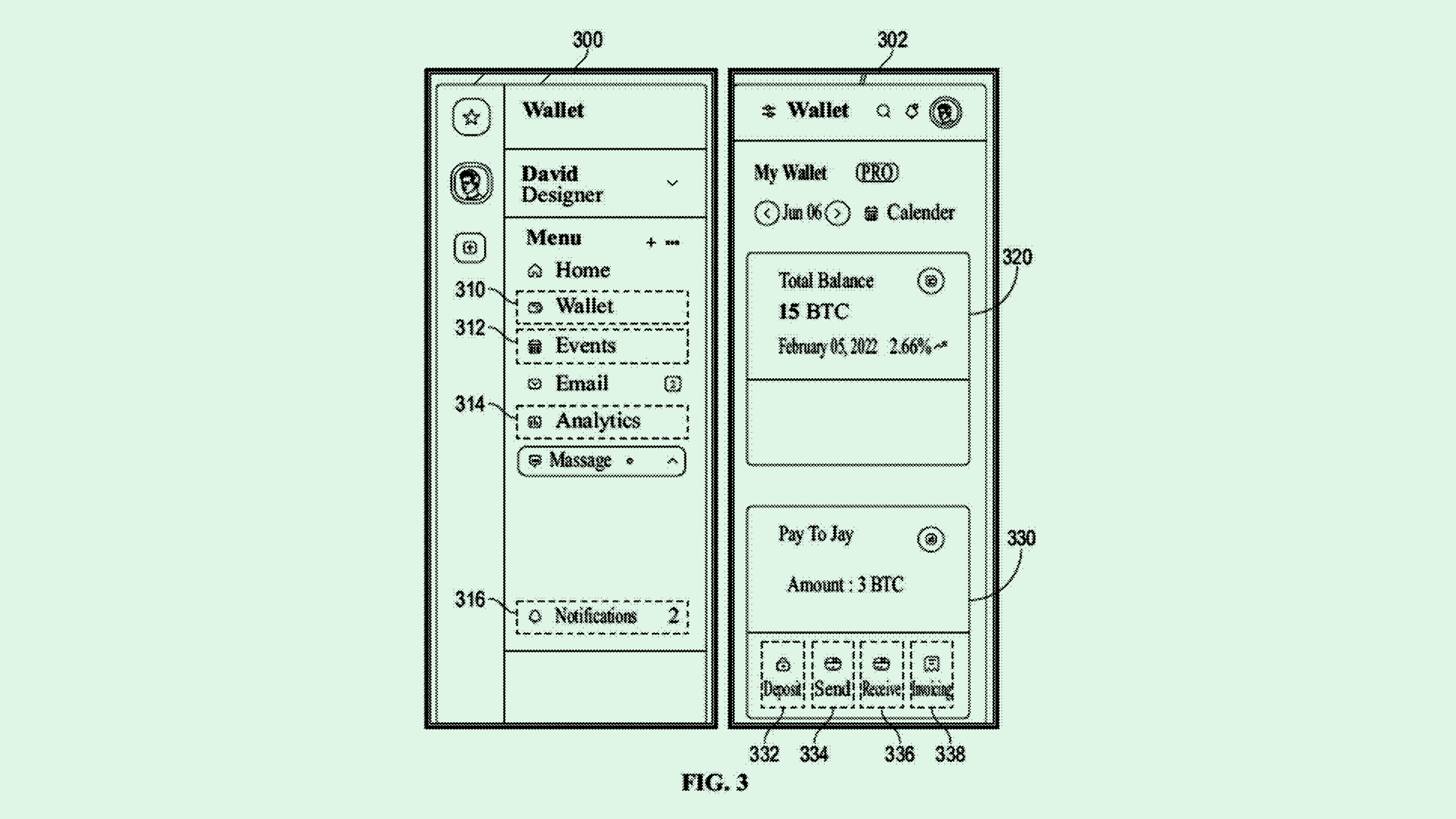

Some facts that might indicate a higher risk score include fraud or dispute history related to an account or IP address, transaction amount, or number of transactions. If the score is high enough, then the user performing the transaction is warned via their digital wallet’s user interface. Stripe’s system may tell a user that a transaction is “in review” or block it entirely.

Stripe took six years off of cryptocurrency, and only reintroduced blockchain into its repertoire in April, starting with USDC Stablecoins, a digital currency pegged to the US dollar. Earlier this month, the company announced a partnership with crypto exchange Bitstamp to support Stripe’s fiat-to-crypto onramp across the EU.

The company had initially pulled back on cryptocurrency in 2018, claiming that it was too unstable. But as it once again tests the waters, this tech may help it steer clear of user scams. Though blockchain has transparency and immutability down pat, fraud detection tech like this could help boost trust in cryptocurrency transactions, said Jordan Gutt, Web 3.0 lead at The Glimpse Group.

“In an ideal world, all exchanges and decentralized protocols would have some type of fraud detection, but that’s just not the case right now in the industry,” said Gutt.

Plenty of firms have sought to take advantage of blockchain’s transparency and security for non-crypto purposes, such as data tracking, deepfake detection, and cloud services. But Stripe’s ubiquity as a payments tech provider, its reentry into digital currency, and its efforts to prevent fraud could help give the tech a better reputation, said Gutt. Plus, making it easier and more trustworthy for its network of merchants to accept digital currency only serves to help adoption, he said.

“The tides are changing a little bit,” said Gutt. “They probably see a strategic opportunity here to take their existing position and expand their share of the market.”