JPMorgan Chase’s Patent Tracks Data with Blockchain

JPMorgan Chase may want to put blockchain to work.

Sign up to uncover the latest in emerging technology.

JPMorgan Chase may be looking to take advantage of blockchain’s good qualities.

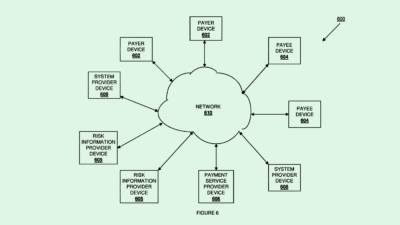

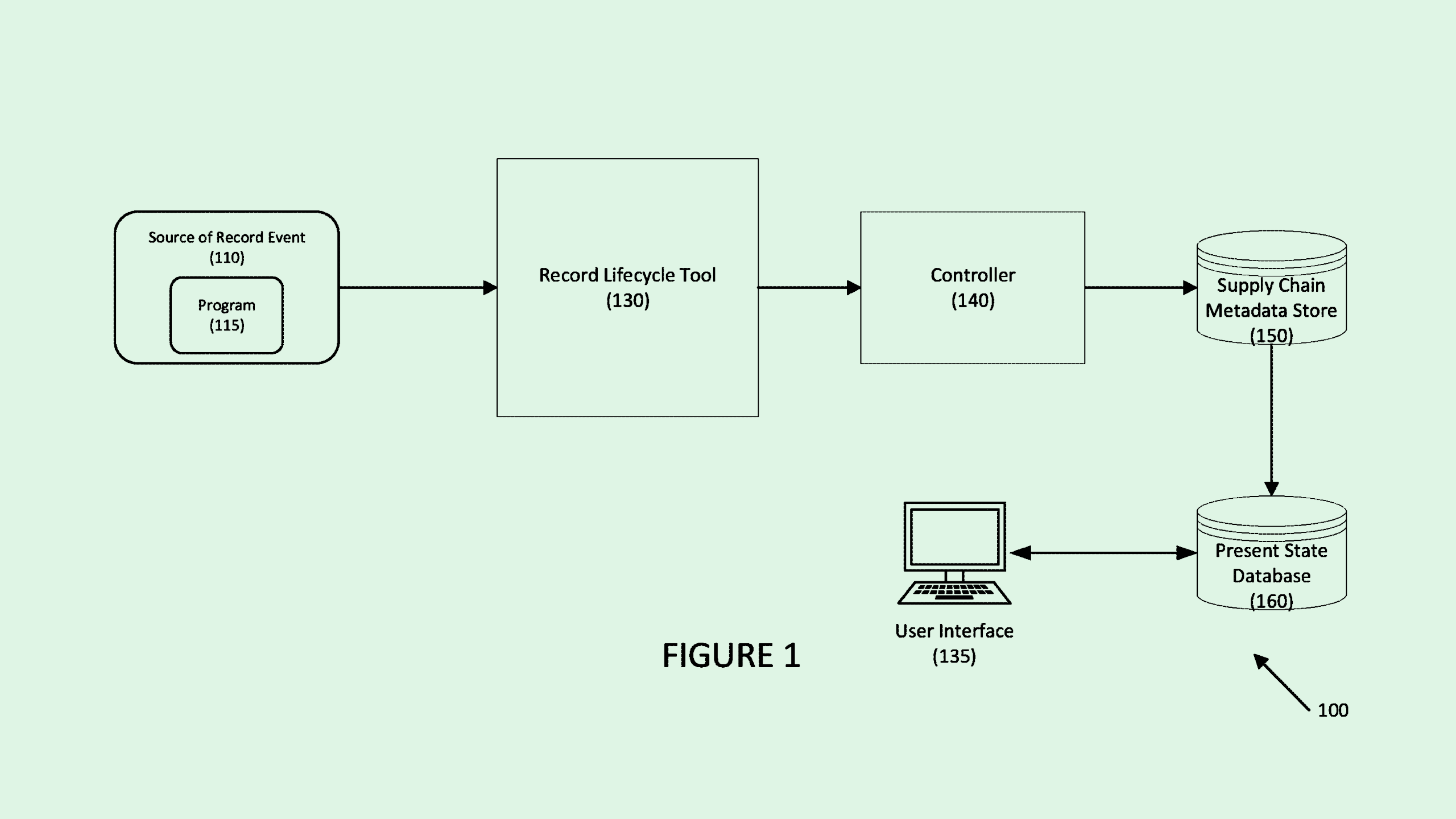

The financial institution filed a patent application for “tracking data lineage and record lifecycle using distributed ledgers.” As its title implies, this tech uses the traceability and immutability of blockchain to verify the integrity of digital records.

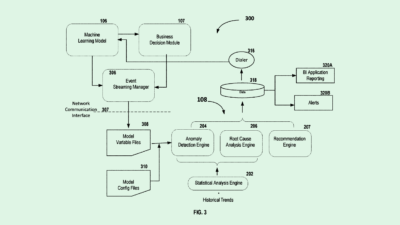

JPMorgan noted in its application that tracing the movements of data requires “a considerable amount of manual effort,” but is “necessary to meet various regulatory requirements and to understand the impact of legislation,” such as the EU GDPR and California’s Consumer Privacy Act.

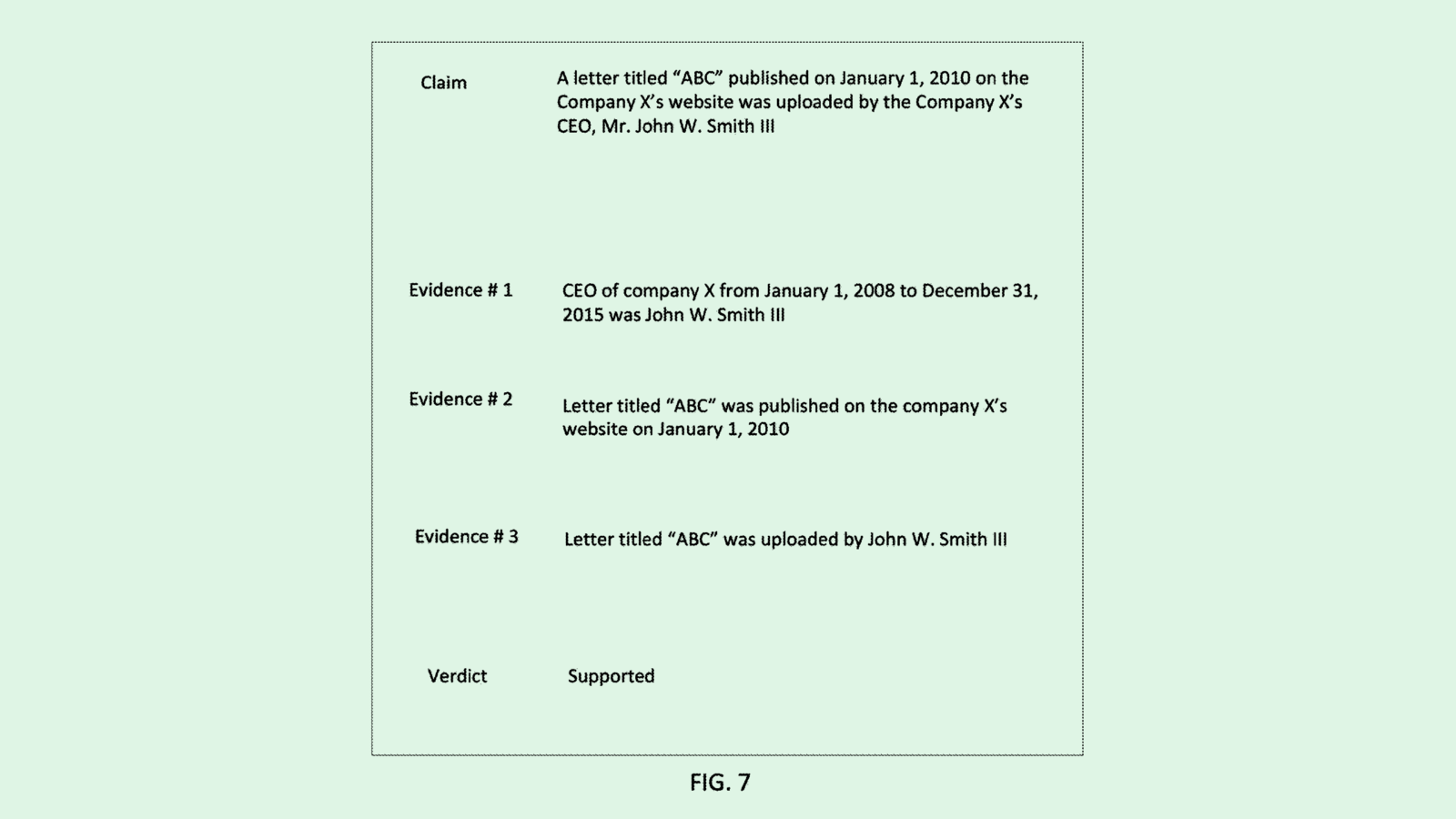

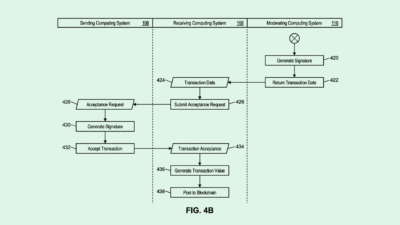

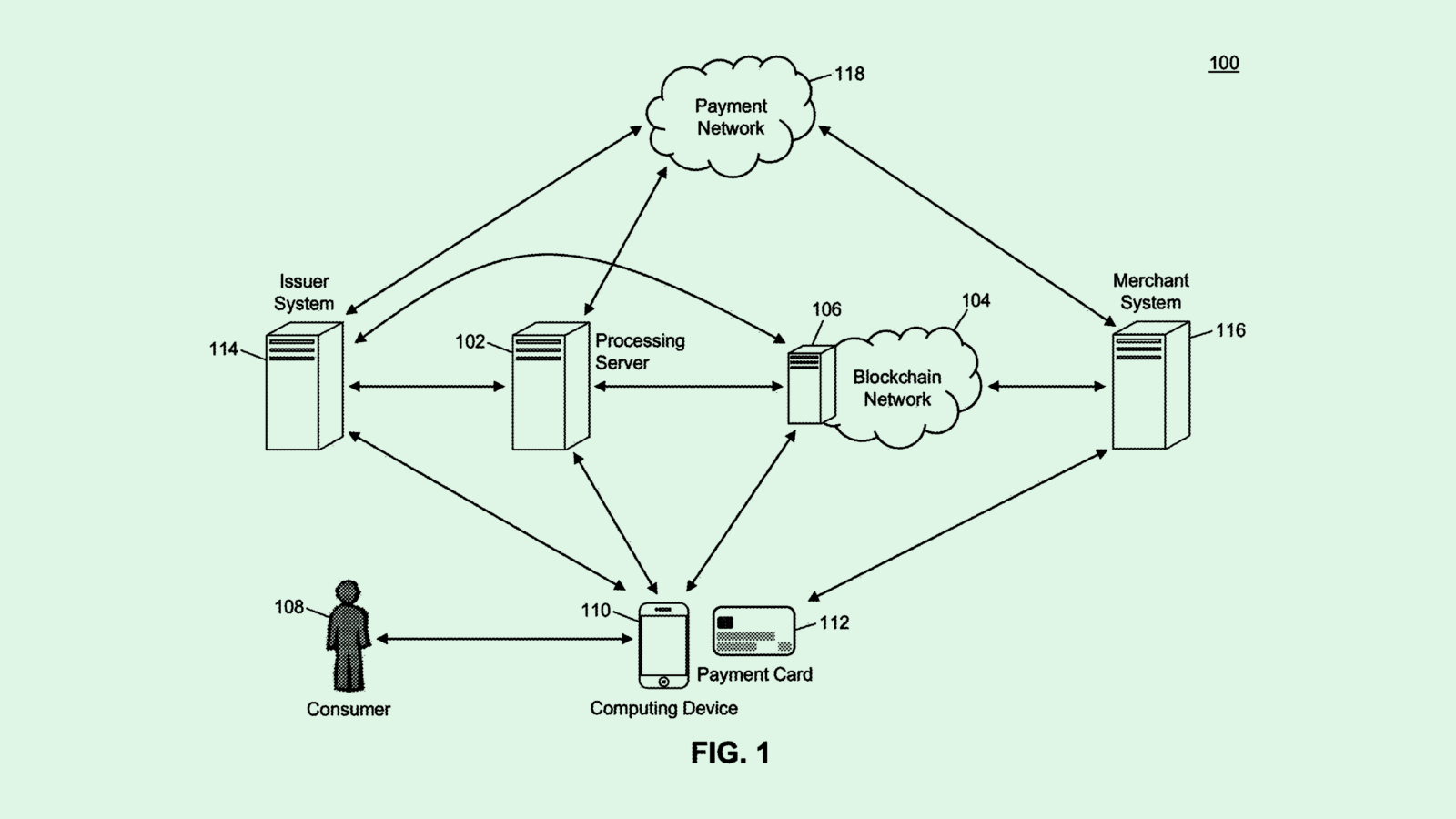

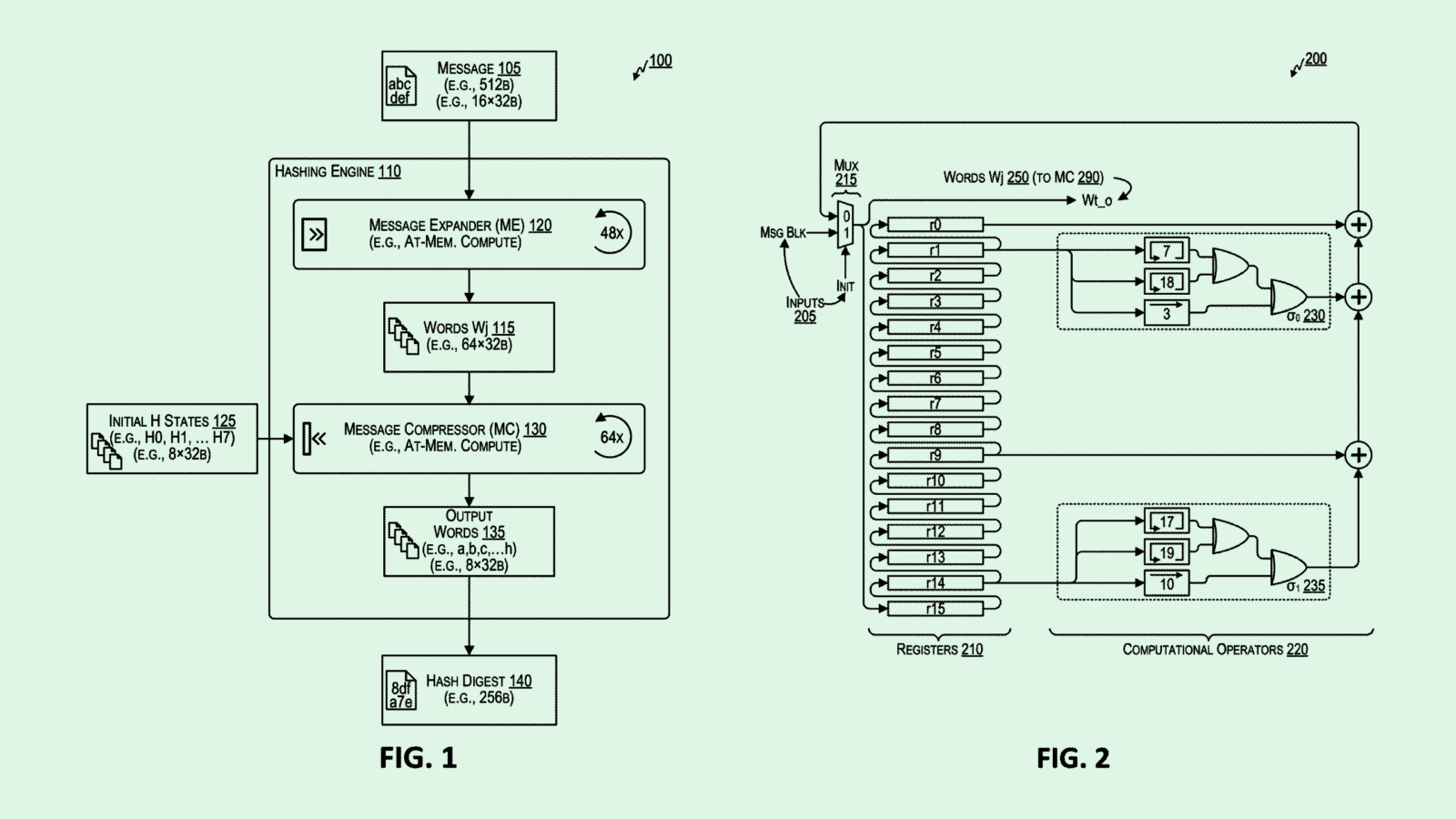

Any time a “record lifecycle event” occurs — such as the creation, modification, or deletion of a digital record — this tool creates a “recordable artifact,” as well as metadata describing the data itself. The metadata is then digitally signed by this system, verifying its authenticity. Along with this, a “hash” of the data is created, giving it a unique digital fingerprint.

The artifact, hash, and metadata are stored in a “verifiable and immutable” database using distributed ledger or blockchain technology. If a user needs to access a certain digital record, a new hash is generated for the record’s current state, and the system provides a digital trail of all relevant storage locations and metadata.

The point is to make data and record-keeping transparent, using blockchain to “provide a trusted audit of data flows.”

This patent isn’t the financial institution’s first rodeo with blockchain. The company launched Onyx, which it called the first “bank-led blockchain platform for the exchange of value, information and digital assets,” in 2020 following the launch of its own digital currency, JPM Coin. Onyx offers an ecosystem of blockchain-based enterprise tech, including digital infrastructure for asset and data exchanges, programmable payments, and even space-based blockchain transactions.

And despite CEO Jamie Dimon’s distaste for Bitcoin — which he called “the pet rock” in an interview earlier this year — he told CNBC that “blockchain is real. It’s a technology. We use it. It’s going to move money, it’s going to move data. It’s efficient.”

JPMorgan isn’t the only firm that sees blockchain’s potential blockchain. Companies across many industries have been researching ways to put blockchain to good use, including avoiding fraud, tracking down deepfakes, personal record-keeping, or even keeping track of road salting.

That’s because blockchain’s biggest assets — transparency and immutability — are applicable to numerous industries. Using it for a strong record-keeping and data-tracking system can be helpful in any business that passes lots of confidential data back and forth.