JPMorgan Adds to Space Ambitions with Off-Planet Payments

The bank’s out-of-this-world patent for “space-based payments” relies on blockchain networks, satellites and stablecoins.

Sign up to uncover the latest in emerging technology.

Even on Mars, you probably can’t escape paying bills.

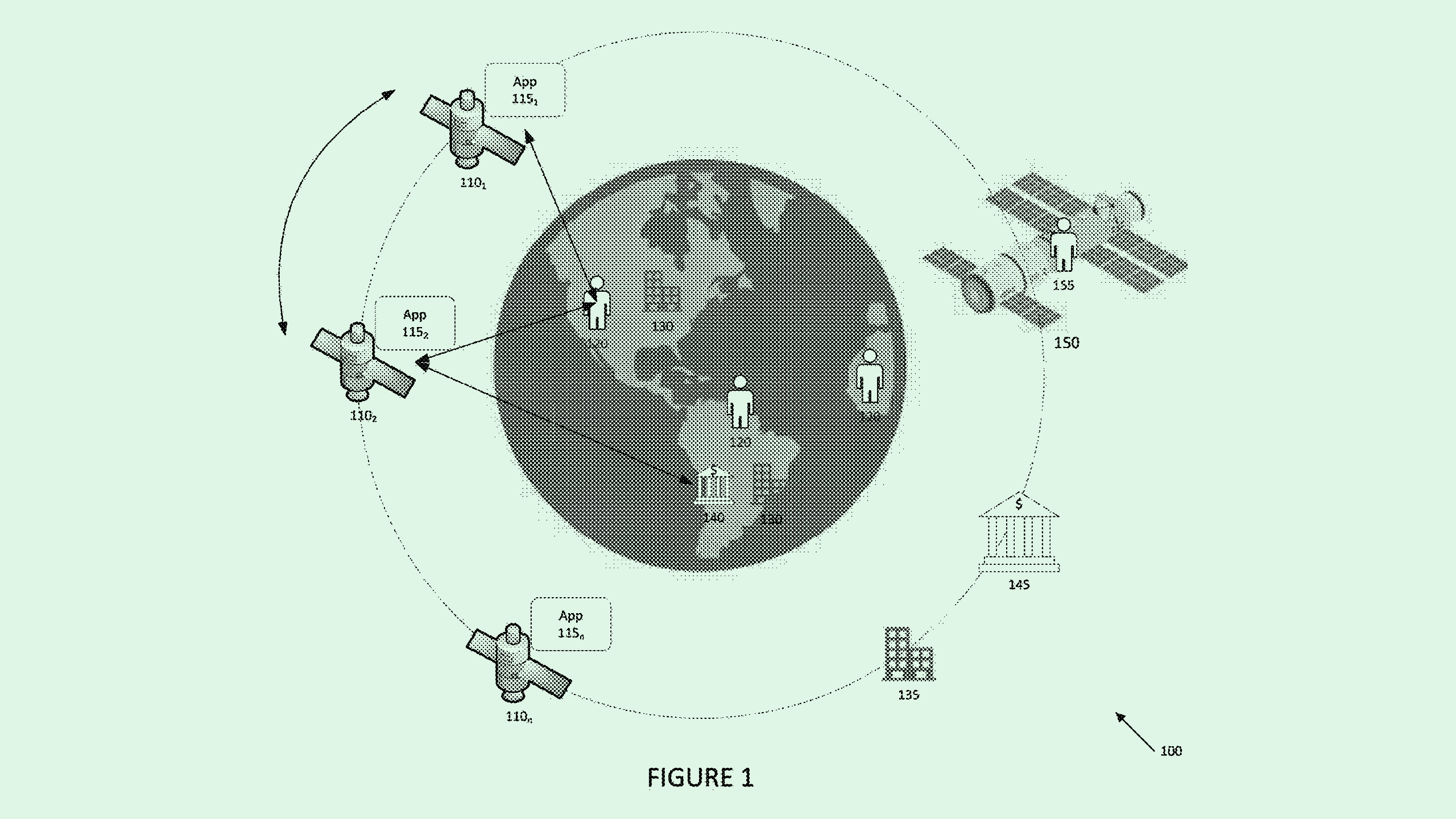

JPMorgan Chase filed a patent application for a system capable of “space-based transactions.” The financial firm essentially aims to allow for payment connectivity between off-planet machines and on-planet ones.

“Over the coming years, space-related services, exploration, tourism, and expansion will expand, driving a need for payment rails to connect humans and machines beyond Earth’s atmosphere,” the firm said in its filing.

JPMorgan’s filing lays out a system for finding satellites that are capable of making payments, and using blockchain and stablecoins as a base for transactions. To break it down: If a person makes a blockchain-based payment and the first satellite discovers that it is incapable of completing the service due to the person’s location, the satellite identifies one or more others that are capable of completing the payment.

For example, if the person or satellite moves out of range of the “Earth-based station” for its distributed ledger network, the first satellite would hand over the job of payment to the other one. If both satellites are out of range, the transaction may be conducted on a “side-chain” to hold the transaction until it’s back in range of the Earth-based station. And if the first satellite is unable to connect to another, the transaction is queued until communication is restored.

The financial institution noted a bunch of potential use-cases for this tech, including foreign currency exchange, payments for space-based real estate, retail payments made in “space vehicles” or “space-based settlements,” as well as a “new space-based currency that may be based on an alliance of Earth nations, or as an independent governing body.”

As outlandish as this sounds, it’s not the first time JPMorgan has taken an interest in facilitating payments in the cosmos. The company started working on blockchain in space in 2021 through its fintech arm Onyx, testing Ethereum-based transactions between satellites for the foundation of a platform called “SpaceBridge.” This patent, updated most recently in September of 2023, may be an extension of that work.

By getting into this tech before space tourism has made its mark, JPMorgan may be seeking to gain an edge in a nascent industry ahead of other industry players, said Dean Kim, head of equity research at William O’Neil. “They see this as an opportunity to distinguish themselves from competitors,” he noted.

Commercial space travel is highly expensive and limited to only wealthy customers, said Kim. SpaceX and Blue Origin, both of which were founded by billionaires, have each only shepherded a handful of very wealthy passengers into orbit, with three of SpaceX’s passengers in 2022 paying $55 million each.

Because the industry only reaches those with deep pockets – and is likely to stay that way for the foreseeable future – securing a patent on tech like this would give JPMorgan access to a lucrative clientbase, he noted.

Plus, in the interim, tech like this could potentially be useful for facilitating highly secure stablecoin transactions here on Earth, said Kim. And because stablecoin payments mitigate losses from foreign currency transactions and wire transfer fees, this tech could also prove valuable to the bank’s high-earning clients, he said.

“They could make payments a lot more efficient by using off-planet satellites to make secure payments from one country to the next,” Kim said. “It’s super-secure, because it’s going through a satellite channel as opposed to the internet. That’s where I think they could add value, especially if you’re moving large amounts of money.”