JPMorgan Patent Could Add Guardrails to AI in Banking

Given that AI systems can’t always be totally accurate, observing when they make mistakes could mitigate a lot of harm.

Sign up to uncover the latest in emerging technology.

As JPMorgan Chase plows ahead with AI integrations, it may be eyeing some guardrails.

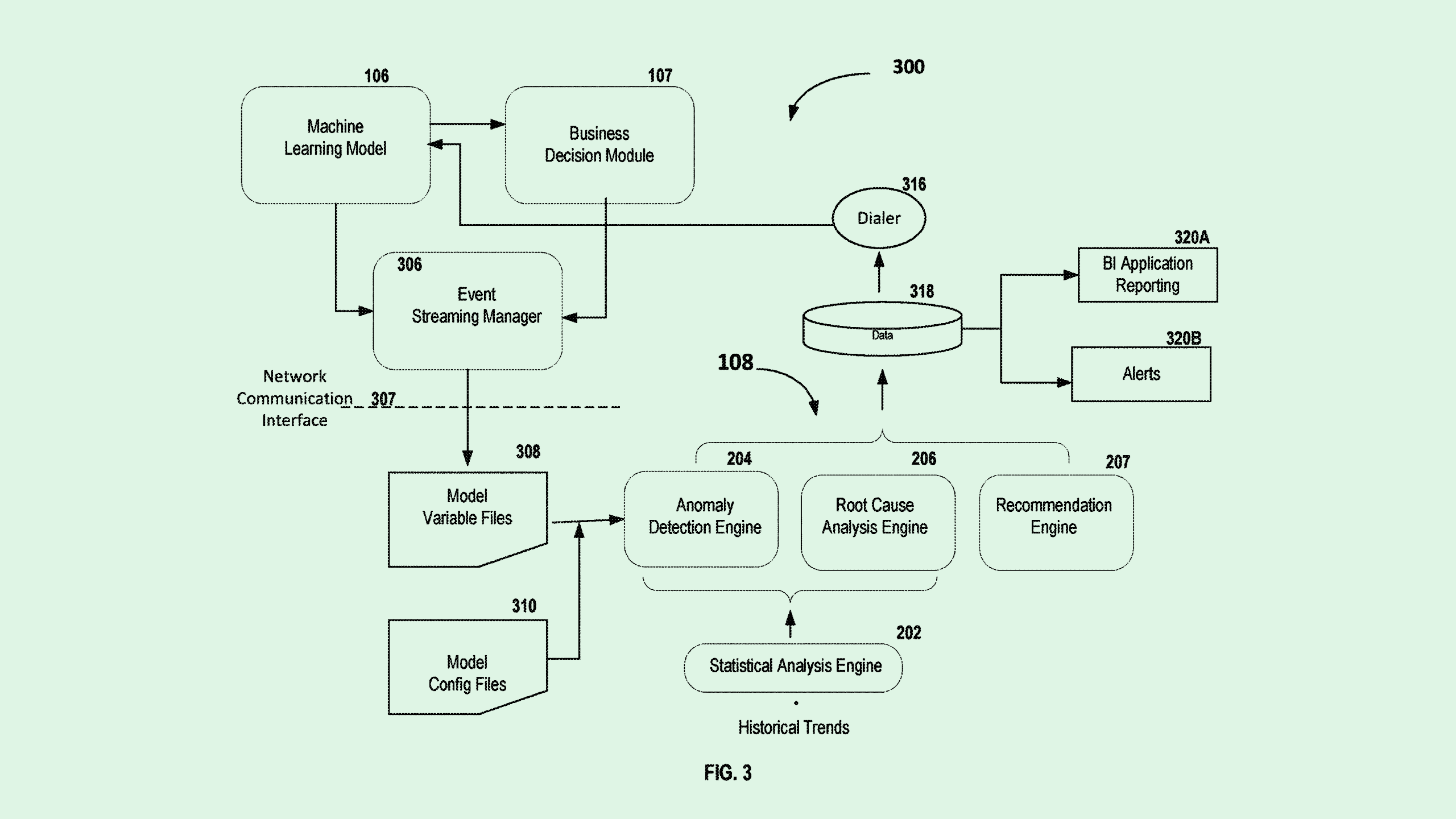

The financial firm filed a patent application for “determining machine learning model anomalies” and their impacts on business outputs. JPMorgan’s tech aims to track when an AI model may be going off the rails, and how wide of an effect that deviation could have.

“Because the typical enterprise deploys hundreds of machine learning models, it can be difficult, time consuming and daunting to evaluate each and every machine learning model deployed by the enterprise,” the bank said in its filing.

This system uses statistical analysis to track machine learning model behavior in real time, monitoring outputs in certain time windows and comparing them to previous equivalent time windows to determine drift.

For example, it may track outputs such as “fraud probability scores, business approval/decline decisions, the number of money movement transactions in a given window, model drift data,” and more by comparing them on one given week to the previous week, the company noted.

If the system determines the model’s performance has deviated too far from normal, it may track down the business impacts of that anomaly, as well as its root cause, and notify an operator to fix it.

JPMorgan has jumped headfirst into AI. The company’s patent history is packed with AI inventions, seeking rights over things like personal finance tools, bias detection, volatility prediction and more.

Its public commitment to the tech matches its fervor for AI IP. The company has debuted several tools in the past year that rely on AI to handle things like cash flow management and thematic investing, rolled out an AI assistant called LLM Suite to 60,000 employees, and promised to train every new hire on AI.

But with the firm’s excitement and the sheer speed at which it’s adopting AI comes several potential risks: A primary one is hallucination and inaccuracies. As this patent addresses, AI models have the tendency to make mistakes and, if those mistakes are unaccounted for, can exponentially grow them.

JPMorgan appears to be seeking its own way to control those risks, as well as assess the damage that’s been done, as it continues to step on the gas with AI adoption. Given that AI systems can’t always be 100% accurate, observing when they drift could mitigate a lot of harm, especially given the scope of customers that the financial institution serves.