JPMorgan Chase Continues AI Rampage with Volatility Prediction Patent

JPMorgan Chase wants to predict overly-aggressive investors with AI.

Sign up to uncover the latest in emerging technology.

JPMorgan Chase wants to read the stock market’s tea leaves even more closely.

The financial institution is seeking to patent a system for assessing “merger and acquisition vulnerabilities” in financial markets. JPMorgan’s tech essentially aims to predict when a “hostile party might take advantage of market climate” and attempt to take over a company.

This system keeps a constant eye on the markets, as “certain market climates and/or adverse events may give rise to conditions that make it more likely for such (hostile takeover) attempts to take place,” JPMorgan noted.

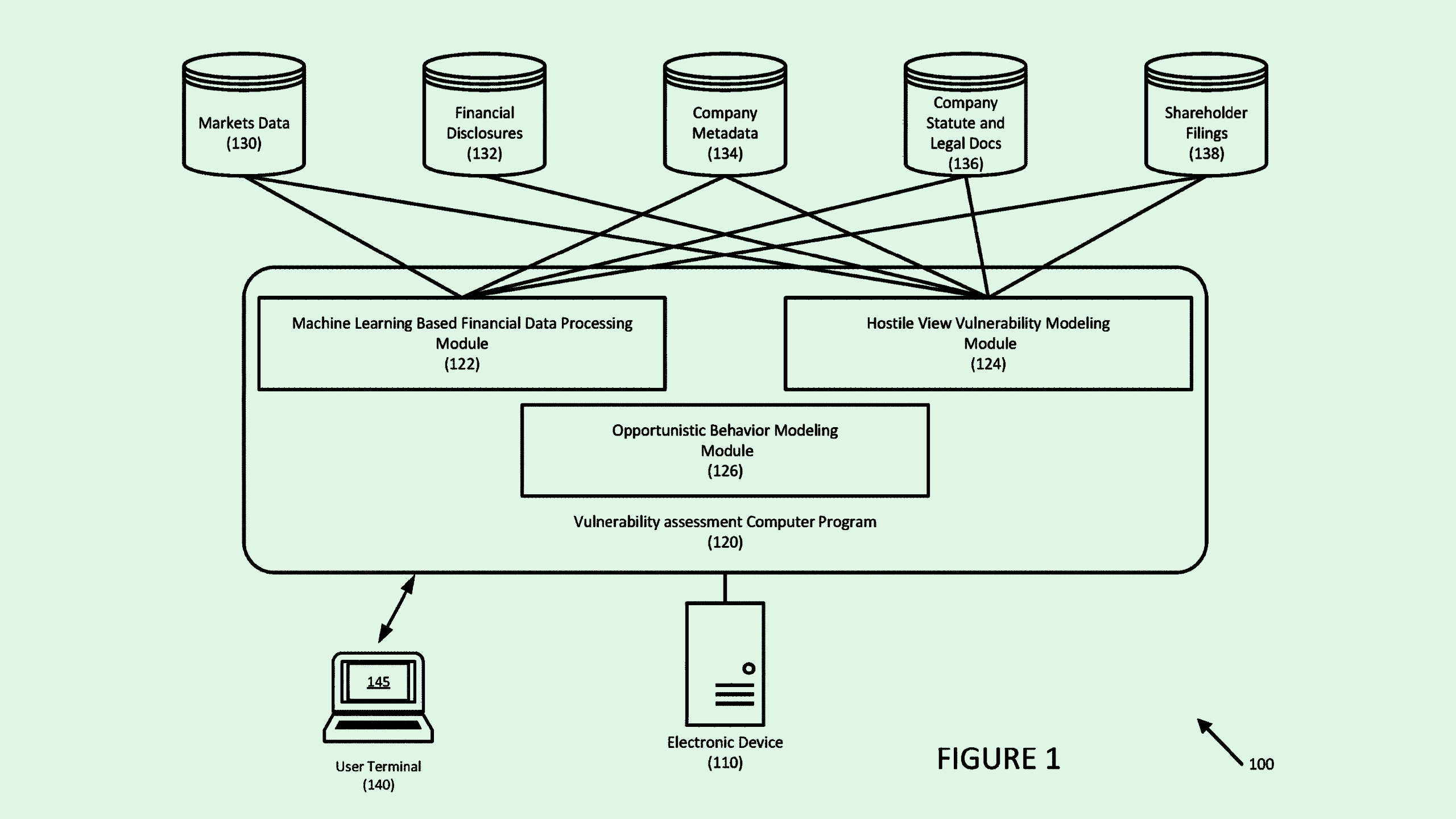

JPMorgan’s system monitors publicly available data related to companies, such as share price data, financial disclosures, legal documents, shareholder filings and more. The system also aggregates, cleans, and processes the data for each company so that it’s easier to make sense of.

This financial health data is fed to a machine learning model, which performs a “vulnerability assessment” on different companies and compares them to a “sector benchmark” based on the value and volatility of average companies in its specific industry. In addition, the machine learning assessment includes “opportunistic behavior modeling,” which identifies “a potentially aggressive investor appetite for a transaction based on the investor’s recent history,” JPMorgan noted.

Next, the system predicts the probability of an adverse event happening to the company, like a hostile takeover, and comes up with a risk score based on the company’s vulnerability. That prediction is then validated based on historical predictions made by this system. Finally, these findings would be published.

Though the financial institution didn’t note where these predictions would be published, it mentioned they may show up via a web application provided to “interested parties,” such as client executives or coverage bankers.

Compared to other financial institutions, JPMorgan is running full speed ahead into AI implementations across its organization. Its patent history includes AI-based inventions like personal financial planning, no-code machine learning and automated due diligence.

And its AI research goes far beyond the world of patents. In March, it launched a cash flow management tool that can reportedly slash human labor by 90%, and had more than 300 use cases for AI in practice as of its last annual shareholders letter. According to Evident AI, which ranks financial institutions on AI readiness, JPMorgan dominates financial AI research and implementation with more than 200 researchers on staff.

In an interview with CNBC, JPMorgan CEO Jamie Dimon said that AI “can do things that the human mind simply cannot do,” and will eventually “be used in almost every job.”

“This is not hype. It’s real,” Dimon told CNBC. “People are deploying it at different speeds, but it will handle a tremendous amount of stuff.”

AI is particularly well-suited to take on the tasks involving large amounts of clean numerical data, which banking and Wall Street happen to produce tons of. Because of this, the financial services industry is ripe for AI innovation: A report published in February from nonprofit research center the Burning Glass Institute and SHRM found that generative AI will be a major disrupter for white-collar finance jobs that spend a lot of time crunching numbers and making predictive models, like analysts, actuaries and accountants.

But the reward of increased productivity comes with its fair share of risks. AI still faces problems with hallucination, bias and privacy, which could make slip-ups particularly dangerous in fast-paced financial decision making. U.S. regulators and officials including the Securities and Exchange Commission, The Treasury Department, the Consumer Financial Protection Bureau and the Financial Stability Oversight Council have been sounding the alarm for the past several months over AI’s potential financial hazards, both in the personal finance and institutional contexts.

But as the tech sector continues to push AI innovation forward, major players of Wall Street may fear the cost of being left behind more than the risks that AI poses.