JPMorgan Chase Patent Highlights Wall Street’s Growing AI Obsession

“The risk of not making the most of the technology is much higher.”

Sign up to uncover the latest in emerging technology.

JPMorgan Chase wants to make sure you don’t quit on your financial goals.

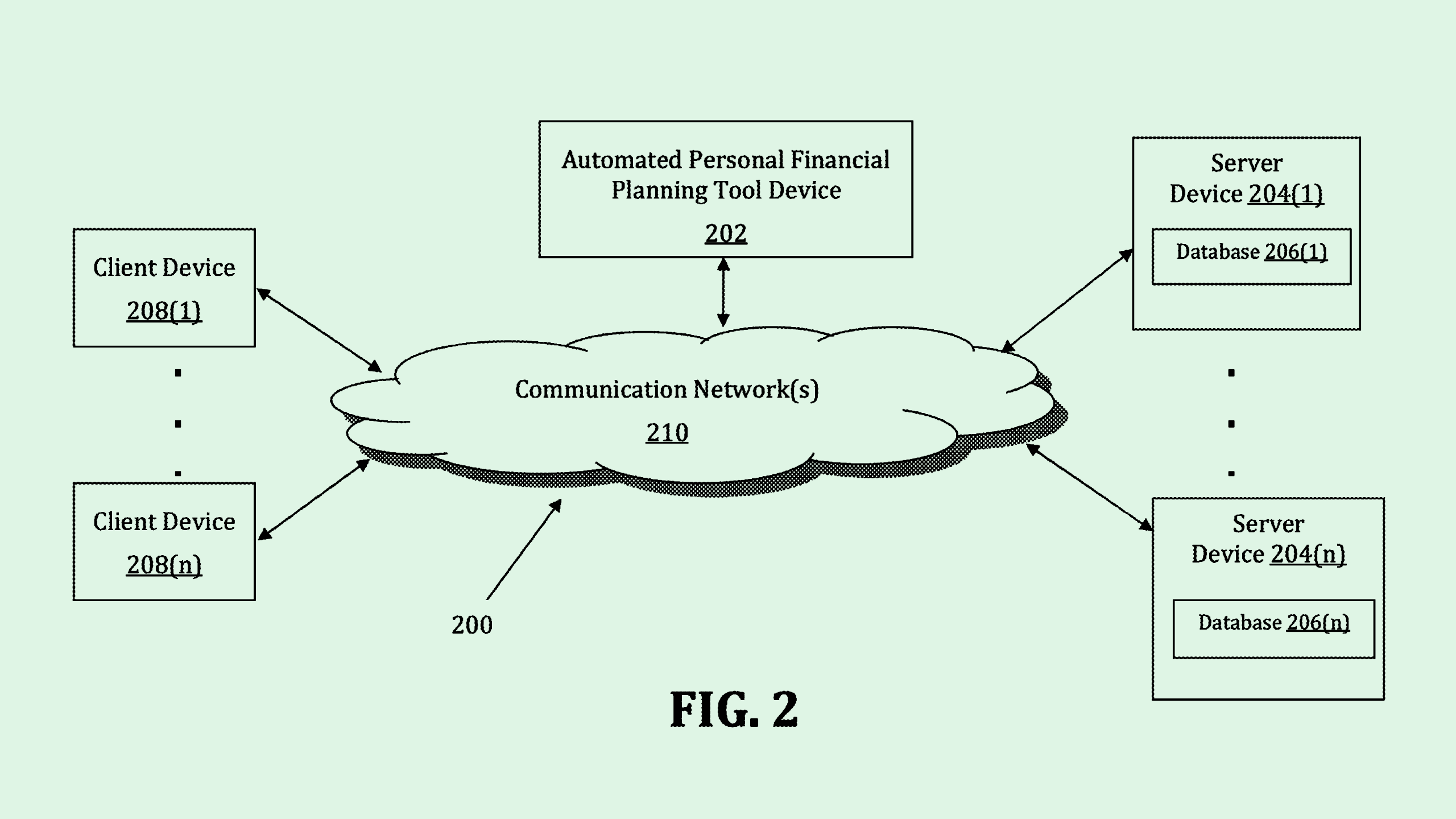

The bank filed a patent application for a system to use artificial intelligence for “personal financial planning.” JPMorgan’s system is akin to using a personal trainer rather than going on a crash diet: It gathers information about your spending habits and goals, and builds financial plans you can stick to.

“Alternatives to speaking to an advisor include personal finance assessment tools and questionnaires which offer semipersonalized advice to users based on their input,” JPMorgan noted. “However, these tools fail to recommend actionable points of advice on a more personal and detailed level.”

JPMorgan’s system takes in information on a user’s current financial state – such as income, expenses, investments, and savings – and monitors their spending habits to find out where their money is going. Next, it processes information about their financial goals, such as

saving up a certain amount of money or paying down their debts.

Once the system has all of this information, it defines a set of actions that the user could take to reach this goal, and assigns each of them a probability indicating how likely the user is to take that action. For example, it may recommend decreasing certain discretionary spending habits over others, such as cutting out online shopping versus cutting out weekly coffee runs, based on the likelihood that the user can stick to that budget.

Finally, JPMorgan’s AI algorithm balances this information and designs a plan with the maximum “likelihood of execution.” It gives the user a step-by-step plan to achieve those goals and calculates the feasibility that all steps can be successfully completed.

If its patent activity shows us anything, it’s that JPMorgan is working hard to embed AI functions throughout its operations. Its patent history includes an investor-company matchmaking tool, “data science as a service,” no-code machine learning systems, and an AI tool that does due diligence for you.

The company has been public about its commitment to the tech, too. It launched a cash flow management AI tool that’s being used by around 2,500 clients, according to Bloomberg, and it claims it has cut human-oriented work by 90%. CEO Jamie Dimon said in the annual letter to shareholders last year that the company has more than 300 use cases for AI in practice. And Dimon said earlier this week at the Australian Financial Review Business Summit that the company is making AI “part of the management conversation.”

“Finance offers plenty of room for innovation,” said Tejas Dessai, research analyst at Global X ETFs. “Right from front-office tasks of customer relationship to due diligence, primary research, collateral creation and modeling, there’s plenty of knowledge work that will eventually end up automated or outsourced to these intelligent AI agents.”

AI tends to be really good at performing the main function of financial processes: analyzing numbers and making predictions based on them. But the risk rises as AI becomes more entrenched throughout Wall Street. AI tends to hallucinate and make mistakes when asked questions outside of its purview, and it can adopt biases if trained wrong and left unchecked.

In an interview with 60 Minutes in December, Federal Reserve Chairman Jerome Powell said the organization is researching AI’s impact on employment, distribution of wealth, and productivity, noting that the tech “needs to be appropriately regulated.” The Financial Stability Oversight Council classified AI as an “emerging vulnerability,” citing cybersecurity issues, privacy concerns, compliance, and accuracy problems.

Dessai notes that these problems can often be resolved with “time, data, and specific training,” he said. “But there’s also a human training aspect associated with these systems. People have to learn to use and prompt design processes with these models effectively, and that’s going to be a long learning process.”

Plus, as every industry rushes full speed ahead to implement AI into their processes, no one wants to be left behind. “The risk of not making the most of the technology is much higher,” Dessai said.