JPMorgan Chase’s Robo-Investor

Chase wants to make a due diligence Tinder for companies and investment bankers.

Sign up to uncover the latest in emerging technology.

JPMorgan Chase wants to get its bankers “on the apps,” or, more precisely, its app.

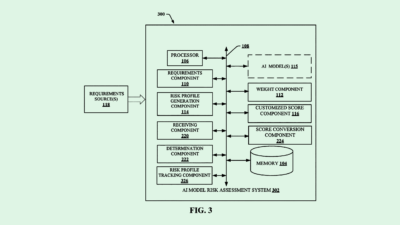

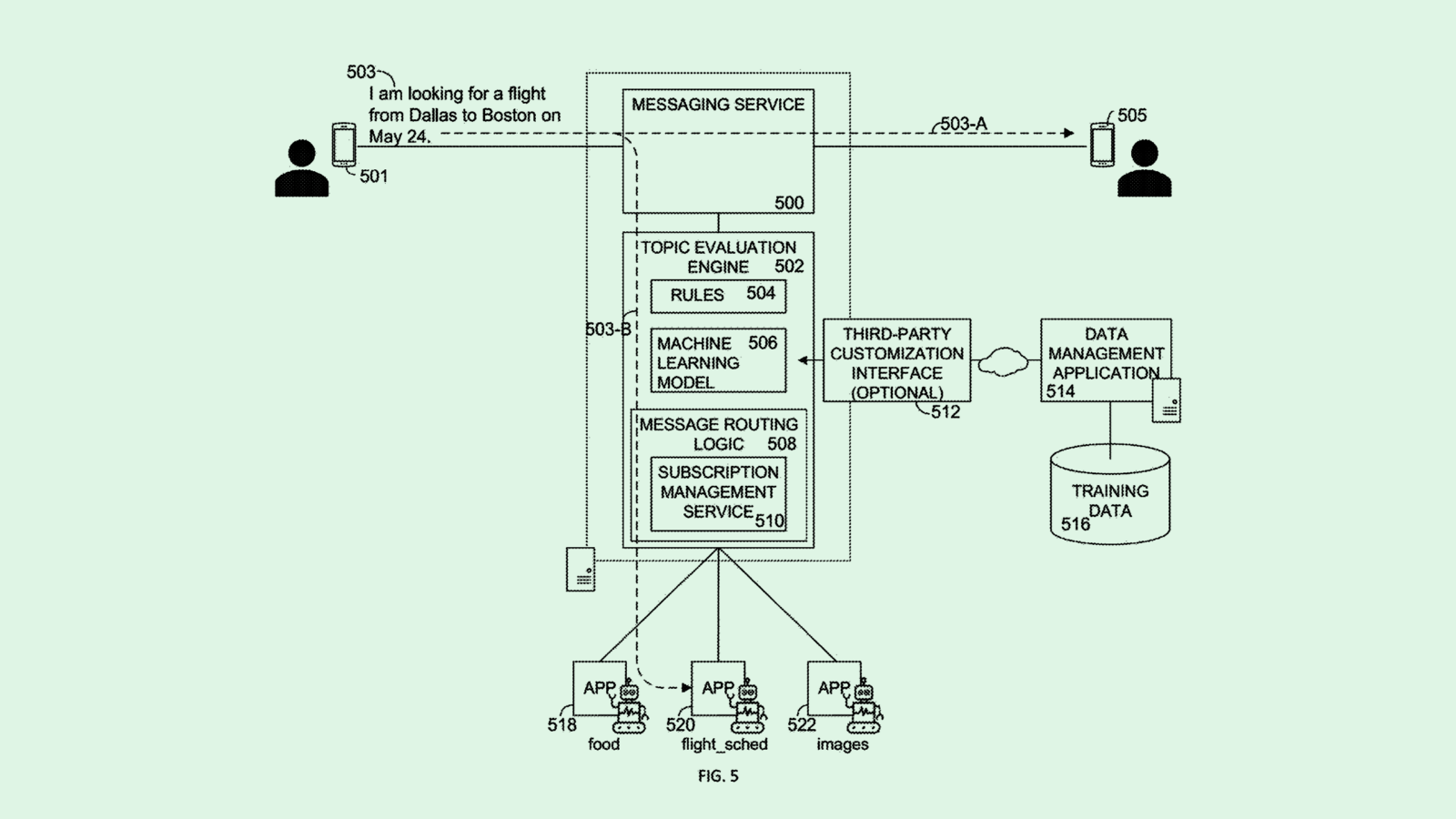

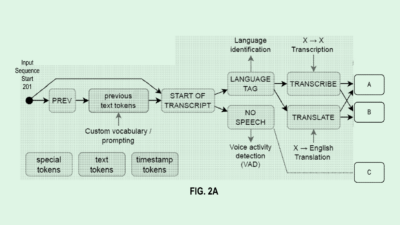

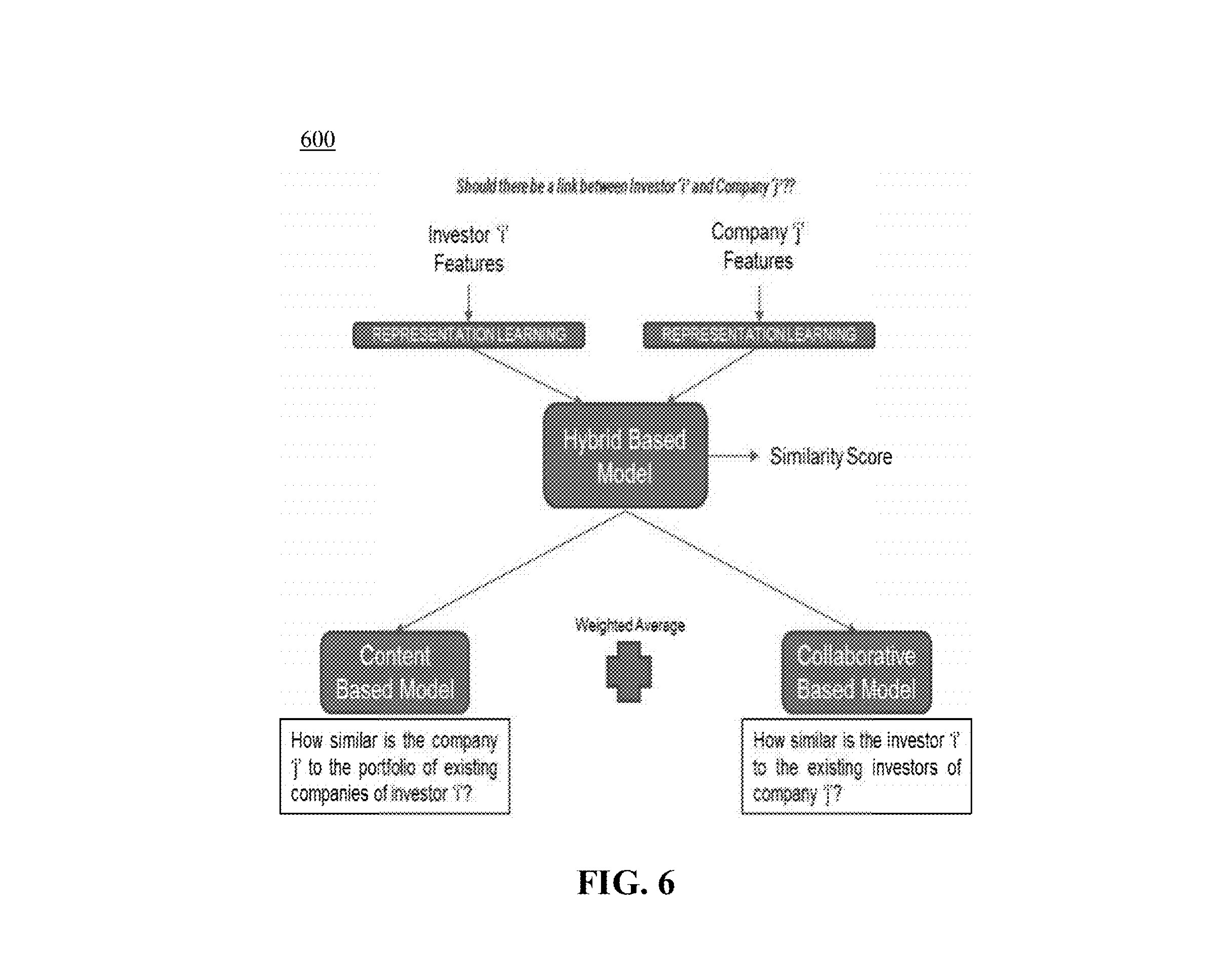

The company is seeking to patent a method for “matching investors with companies.” First, this system collects a whole lot of data. On the company side, this system will collect information on factors like a company’s focus and market size, existing capital raised, its age and location. On the investor side, this system will take into account factors like an investor’s industry preferred “funding style.”

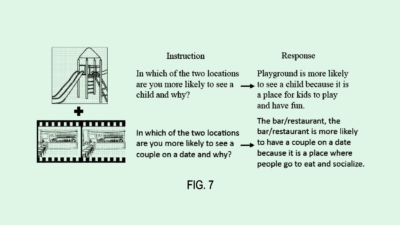

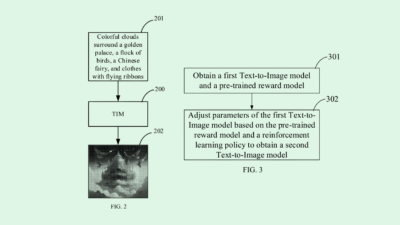

Then, using an AI-based algorithm, this tech then spits out a “similarity metric” to tell whether a company-investor pair will make a good match, as well as a rationale as to why the algorithm decided they were a good fit. Think of it like a dating app with much higher stakes. It’s still unclear if interest in “long walks on the beach” will be factored in.

JPMorgan noted that this tech has the potential to save time and money on the manual match-making process, taking out the need for human labor to analyze companies’ track records and performance, or source inventors. Basically, it’s financial Tinder but for due diligence.

“Matching investors and companies and providing explanations is typically very expensive … it also brings about human errors and the results are often dependent on the individual experience and expertise of humans involved in this process,” JPMorgan said in its filing.

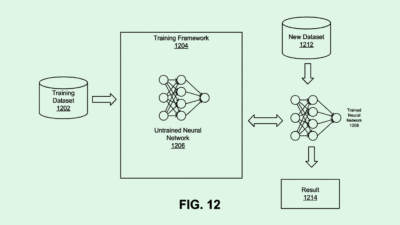

The fact that JPMorgan is working on this tech makes sense given the company’s massive investment in creating tech in-house. Despite the shaky market conditions, the institution sought to hire around 2,000 engineers back in September. In January, the company ranked at the top of Evident AI’s index for AI integration among global banks, taking the No. 1 spot for categories like talent, innovation and transparency.

CEO Jamie Dimon has also been loud about his support for the tech, saying that JPMorgan will spend “hundreds of millions of dollars per year” on A.I. efforts across the bank. In the company’s letter to shareholders released in early April, Dimon said the company already has more than 300 AI use cases in production, including “risk, prospecting, marketing, customer experience and fraud prevention,” as well as throughout payments processing.

“AI and the raw material that feeds it, data, will be critical to our company’s future success — the importance of implementing new technologies simply cannot be overstated,” Dimon said.

While the tech in this patent filing will likely be deployed internally, the company could also make a solid paycheck by packaging this tech as AI-enabled investment support for other financial partners, like venture capital firms, private equity firms or angel investors, Captjur’s Bob Bilbruck told me.

“Institutional investors are looking for investments that are can’t-misses,” said Bilbruck “They may be looking at licensing that to all their downstream finance partners that are looking for more intelligence around those investments and ways to do that research.”

And though this tech isn’t terribly complicated, it’s another example of AI integrating into industries that traditionally required human expertise, taking over everything from doctors calls to data centers. Maybe deploying the shrewd eye of an AI algorithm might help JPMorgan stay away from, well, investment missteps.

Have any comments, tips or suggestions? Drop us a line! Email at admin@patentdrop.xyz or shoot us a DM on Twitter @patentdrop. If you want to get Patent Drop in your inbox, click here to subscribe.