Visa’s Blockchain Efforts Could Give The Tech Better Reputation

Visa wants to make a one-size-fits-all blockchain.

Sign up to uncover the latest in emerging technology.

Visa is working on a blockchain for just about anything.

The credit card provider filed a patent application for a blockchain-based “universal record” system. Essentially, Visa’s tech uses blockchain as the base for a record-keeping system for a person’s entire life.

Visa noted that “separate types of information, such as medical information, academic achievement information, employee data, access rights, financial transactions, and any other suitable information can all be recorded in a single blockchain.”

Creating new blockchain systems can be so cumbersome that it’s a deterrent from using the tech at all, Visa said. “As a result, blockchain systems are often not created unless there is the high chance of … data tampering or the record-keeper has abundant disposable resources.” But Visa’s system aims to overcome that by keeping everything in one place.

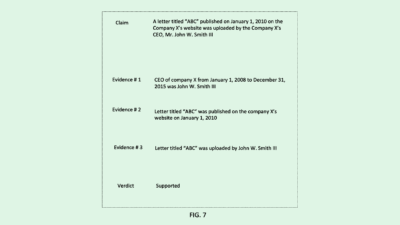

Essentially, Visa’s system combines multiple blockchain systems into a single entity, mitigating the need to create a new blockchain for every different type of record. Every entry into the ledger includes its own class identifier, or an identifier that indicates what kind of record an entry is, and each of these class identifiers is assigned to its own unique node.

When an entry is added to one of these nodes, it’s turned into a blockchain block, which includes the address identifier (which identifies the person who is adding the entry), the class identifier, and the data of the record itself. In order to add information to a node, a user must have a valid class identifier.

[[Photo: Pg. 2]]

Visa’s complex storage patent adds to the company’s mounting interest in blockchain. Its blockchain unit has been hard at work on a number of projects, including ramping up the use of Circle’s USDC stablecoin on its network and working on enterprise blockchain use cases.

In a September blog post, Cuy Sheffield, Visa’s head of crypto, compared blockchain’s current state to the early days of broadband internet. Sheffield noted that the company’s areas of focus with blockchain are global settlements, cross-border money movement and helping clients understand the tech.

But blockchain doesn’t have the best reputation. With the downfall of FTX and Sam Bankman-Fried, Binance’s $4.3 billion settlement with the CFTC, and the bankruptcy and subsequent wind-down of crypto lender BlockFi, crypto has potentially had its “last straw,” said Aaron Rafferty, co-founder of StandardDAO.

Blockchain integrations from long-standing financial institutions like Visa and Mastercard could change the industry. However, with products like what Visa is outlining in this patent, the word blockchain may not even show up on the consumer end, said Rafferty. For example, using blockchain as this patent suggests could enable rapid verification of employment history or medical records, he said.

“They’re not going to be talking about crypto,” he said. “They’re going to talk about the new capabilities that you have. But no one’s going to say ‘blockchain.’”

While it may seem a bit unnerving that a large financial institution like Visa wants to have domain over your personal records as this patent suggests, Rafferty noted that Visa already has a lot of your personal information as it stands and is widely used. The issuer reportedly has 4.2 billion cards out worldwide. “(Visa) isn’t just a transaction company. It’s an identity company,” Rafferty said. “They are the thing that everyone relies on to navigate in the world.”

“That’s probably the scarier thing — that they already do have all the information on all of us and know our behaviors and our habits,” said Rafferty. “(This patent) is more so how this can benefit everyone, not just Visa.”