Mastercard Patent Speedruns AI Development

The company’s access to a vast well of user payments data could go a long way in creating far more powerful models.

Sign up to uncover the latest in emerging technology.

Mastercard may be looking at ways to take the work out of AI development.

The financial institution seeks to patent a system to “automate development of AI projects.” This tech aims to take work from previous AI projects and use it for other projects that may have common goals.

“Multiple artificial intelligence projects often share a common pattern and, as a result, the features generated for these different projects share a common pattern,” Mastercard said in the filing. Leveraging that can save time, money, and resources that would otherwise go toward doing redundant work, the company noted.

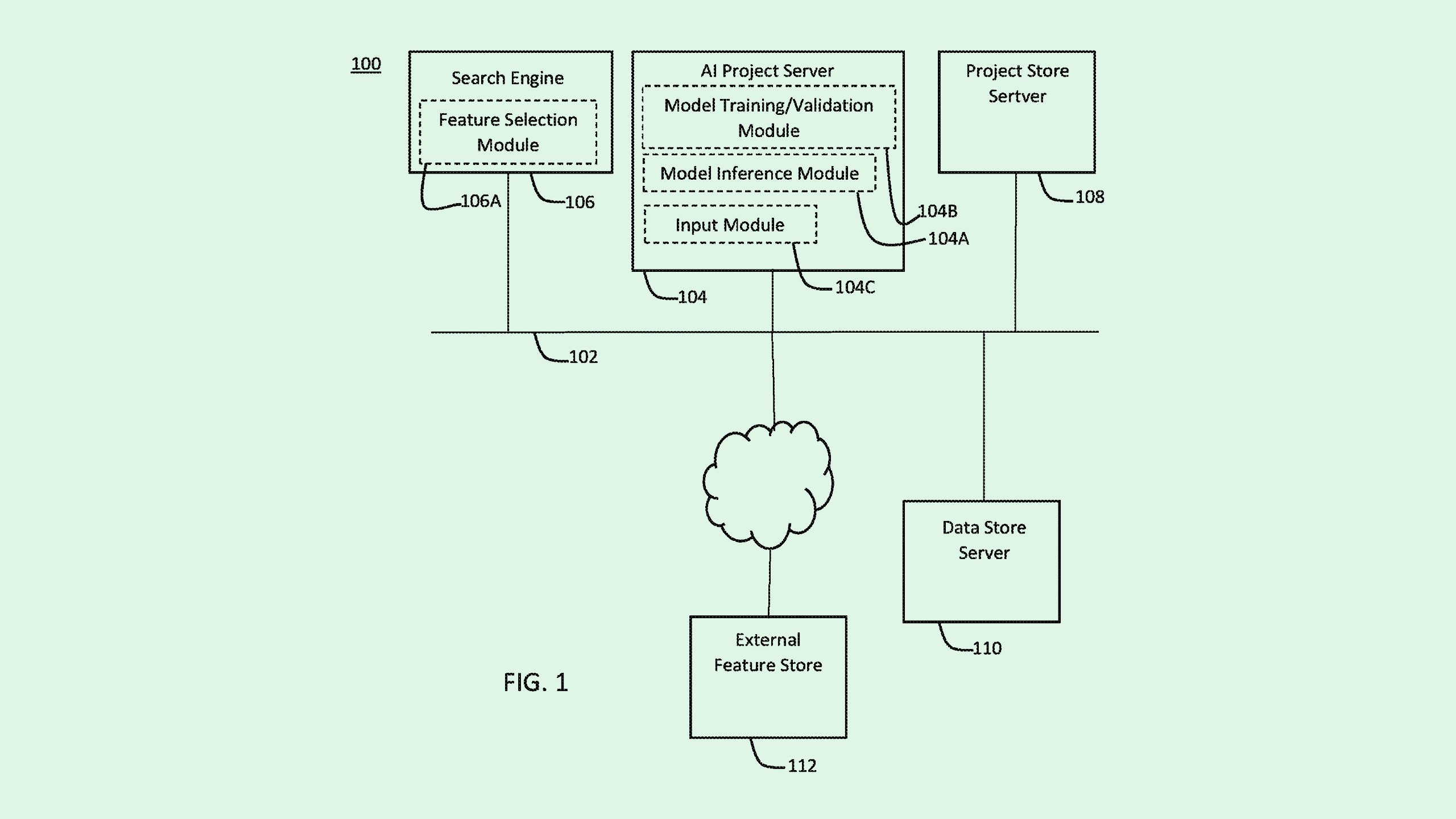

Mastercard’s tech involves two kinds of databases, one for datasets and another for past projects. On the user end, this system would include a search engine allowing users to describe what they’d like out of their AI project, which helps the system pick out which previous projects to pull from.

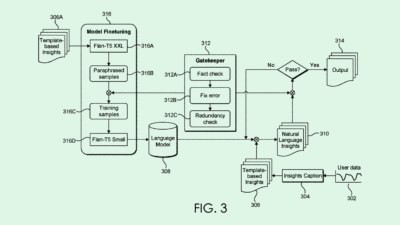

The final piece of this invention is the “artificial intelligence project server,” which oversees the creation and development of new AI projects using the data or features from previous work. This server includes a model training and validation module, which oversees the “creation, training, and validation of neural network-based models within new AI projects.” Once this is done, the completed model is added back to the project storage database.

Overall, this tech oversees an AI project from start to finish with minimal work needed on the user end and uses minimal resources

Mastercard announced plans late last month to use AI to track down compromised cards before they get into cybercriminals’ hands. Its new tech cracks down on the practice of card skimming, in which credit card numbers are stolen and placed on illegal websites.

Mastercard will use predictive generative AI to scan transaction data across billions of cards and merchants, aiming to “double the speed at which it can detect potentially compromised cards.” The company claims this can reduce false positives in fraud detection by up to 200%.

The financial services industry is ripe for AI innovation, and Mastercard is just one of several firms that have recognized its potential. Companies like Visa, PayPal, and JPMorgan Chase have also sought patents that seek to use AI for a range of capabilities, including fraud detection, due diligence, and personal finance tools.

This tech can also help with “back-office operations,” said Tejas Dessai, research analyst at Global X ETFs, including “categorization, improving lending processes, optimizing payment processes, underwriting, and more.”

And while AI is a natural fit for tracking down fraud or automating tedious tasks, access to data that companies like Mastercard have may present a much more lucrative opportunity: consumer targeting.

AI’s biggest strengths are prediction and pattern recognition. By analyzing user payment history, these companies can “leverage AI to tailor these perks to individual consumer needs and preferences better,” said Dessai.

“Financial services platforms with a consumer-facing presence could leverage AI to gain deeper insights into consumer preferences and improve monetization through avenues such as targeted advertising,” Dessai added.