Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It’s hard out here for a magnate atop a $713 billion investment conglomerate.

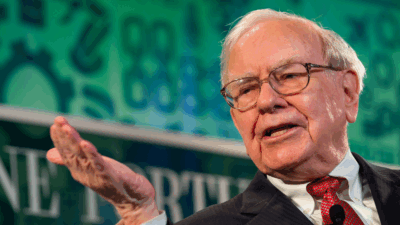

Berkshire Hathaway CEO Warren Buffett, arguably the world’s most closely watched investor, released his highly anticipated annual letter to shareholders on Saturday, the same day Berkshire reported its profits grew 45% in the last three months of 2021. His verdict? Stocks are overvalued, his old school businesses are doing just fine, and boy-oh-boy is it ever underwhelming looking for acquisitions right now.

Calling Out the Bull…

In his letter, Buffett sounded practically bored, noting nothing much “new or interesting” has happened at his company and that he and his lieutenant, Charlie Munger, find “little that excites us” on the stock market. Some have criticized the two for passively sitting on Berkshire’s $146.7 billion cash pile, but Buffet and Munger stubbornly insisted that stock valuations were too high.

The latest data comes down on their side:

- The average company in the Russell 3000 — an index of US companies big and small — has fallen over 30% from 52-week highs, according to the Financial Times, while Berkshire stock has gained 6.4% this year and the S&P 500 has fallen 8%.

- Buffett said Berkshire’s latest profits were driven by safe, longstanding bets he called “Our Four Giants”: its lucrative property and life insurance operations, the Burlington Northern Santa Fe railroad (which earned a record high of nearly $6 billion last year), utility company Berkshire Hathaway Energy, and a 5.6% stake in Apple — which Berkshire spent $31.1 billion on and is now worth about $161 billion.

“Deceptive ‘adjustments’ to earnings — to use a polite description — have become both more frequent and more fanciful as stocks have risen,” Buffett wrote in his letter, criticizing last year’s bull market. “Speaking less politely, I would say that bull markets breed bloviated bull….”

High on Their Own Supply: Berkshire spent $27.1 billion on buying back its own stock last year, and has already bought $1.2 billion more this year.

Big Bill: According to Buffett, Berkshire Hathaway — which has more domestic infrastructure assets than any American company — paid $3.3 billion in federal taxes in 2021 or 1% of all corporate taxes.