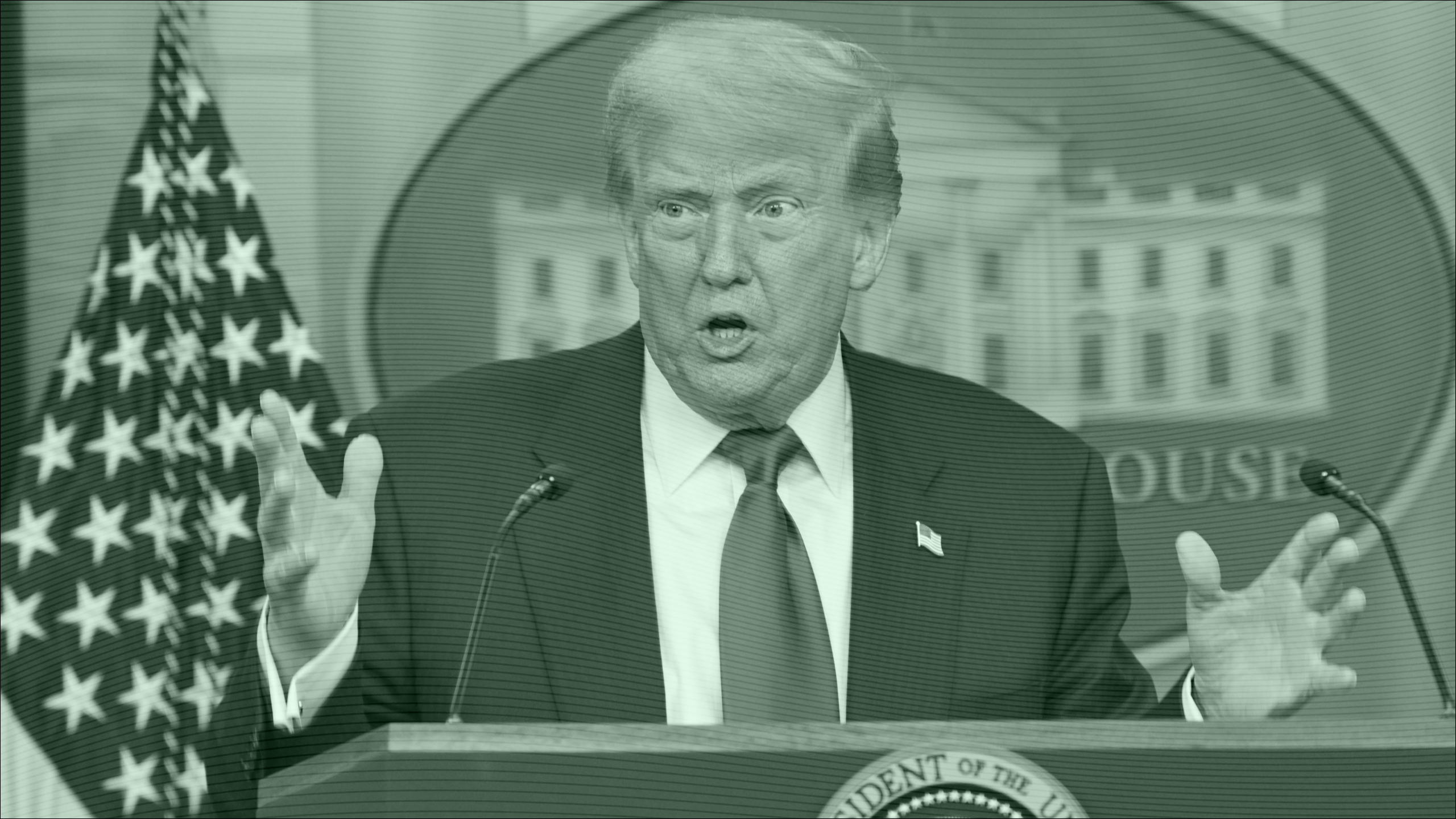

Advisors Calm Clients After Trump’s Latest Tariff Announcements

Financial plans are designed to weather economic uncertainty, but it can be hard for clients to remember that.

Sign up for market insights, wealth management practice essentials and industry updates.

Financial planning can sometimes feel like a moving target, especially during a Donald Trump administration. Here comes that curveball …

This week, the president unveiled plans to increase tariffs to at least 25% on key US trade partners including Japan, South Korea, and 12 others, while pushing the July 9 deadline for the resumption of so-called reciprocal tariff rates to Aug. 1. As a result, the markets took a small dip Monday, with the three major indexes posting their worst days in about three weeks. Only the Nasdaq has fully recovered from last Friday’s close. Sure, advisors plan for volatility, but it’s often the emotional toll on clients that’s hardest to manage. Reminding clients that it’s all about the big picture may feel exhausting right about now, but that just means it’s all the more necessary. “Our job as planners got harder for a simple reason: Telling people to think of the long game when the short-term feels suffocating is difficult,” said Ian Bloom, owner of Open World Financial Life Planning.

Tough Tariff Talk

Trump’s shifting tariff stance — which has led to the acronym TACO (Trump Always Chickens Out) — can sometimes lead to short-term turbulence more than long-term damage. Still, that’s not always clear to clients. “Most are fatigued by the constant stream of headlines,” said Trevor Johnson, founder of Dream Weaver Financial Planning. “The knee-jerk reaction is concern, but that’s where a steady hand comes in.” He reminds clients their plans are built to withstand political storms, not time them.

Certain sectors like tech could take a hit under tariffs, but announcements coming out of the White House or Truth Social should not force wealth managers to slam the brakes, Johnson added. “Many of these tariff threats are just that — threats — and will likely never materialize,” he said.

Don’t Overthink It. Today’s social and political anxiety, especially among left-leaning clients, can spill into financial fears, even when there’s no direct cause for concern, Bloom told Advisor Upside. “They see inconsistency and the erosion of major institutions as a long-term failing in the country,” he said, adding that he often tells clients historical market performance isn’t always tied to political climate. “Emotionally it can be very difficult to get clients to see a hopeful future,” Bloom said.