Can a Texas Stock Exchange Really Lock Horns with Wall Street?

The Texas Stock Exchange is hoping to become the center of a new financial mecca in the Lone Star state when it launches next year.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Freedom fighting is front and center in Texas lore, from its war for independence in the 1830s to a curious referendum to secede from the good ol’ US earlier this year. The Lone Star state’s next battle will be for the right to take some of the world’s most lucrative firms public.

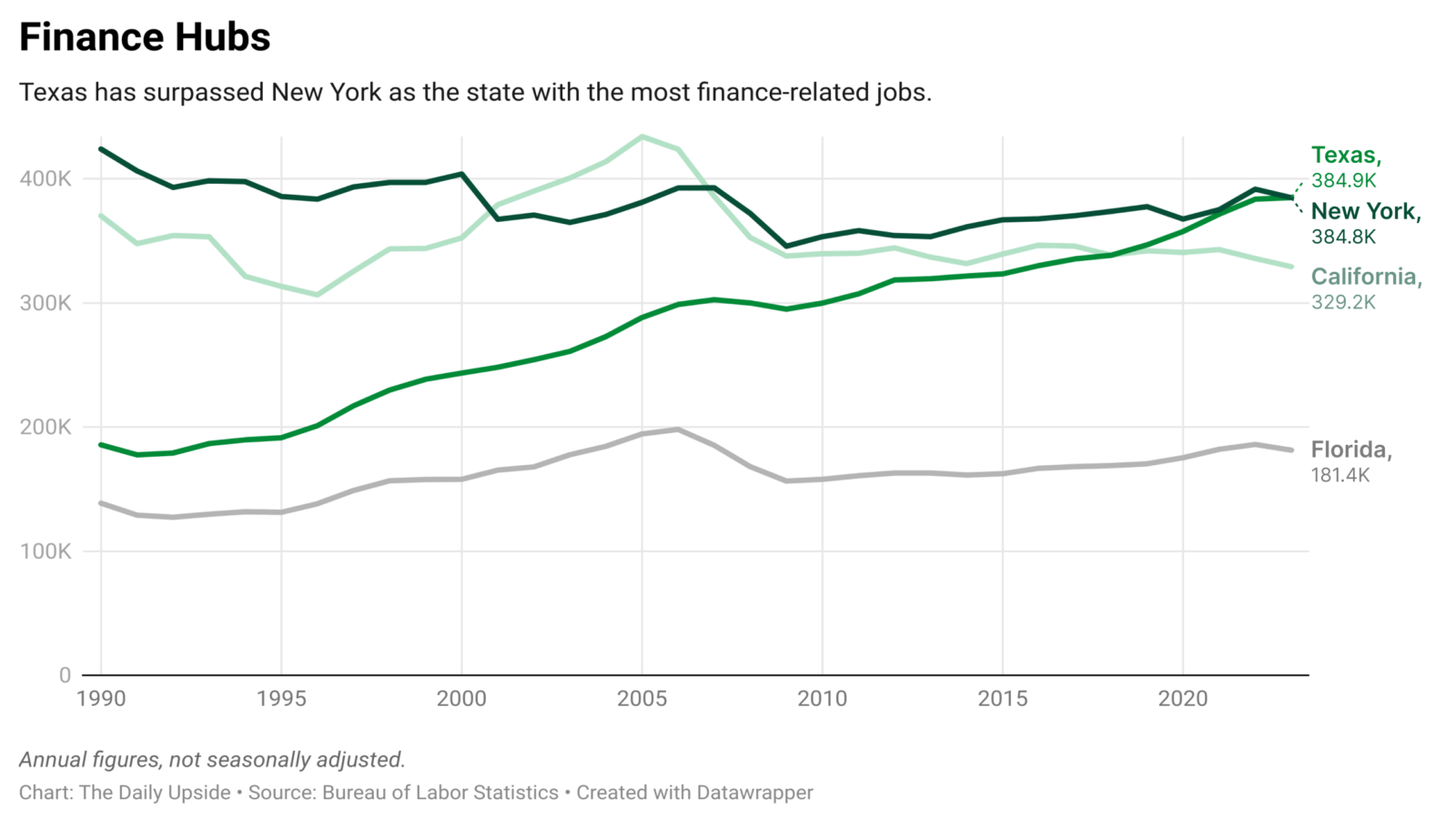

Dubbed Y’all Street, Dallas is in the midst of a financial renaissance. The state boasts a burgeoning financial sector with relatively lower taxes and laxer regulations that now hosts more financial professionals than New York City itself (yep, we double-checked). The crowning jewel is a new stock exchange slated to launch in 2025 that’s fixin’ to go toe-to-toe with current kingfish like the New York Stock Exchange and Nasdaq.

Advocates say the new exchange isn’t all hat and no cattle either. The Texas Stock Exchange (TXSE) secured $120 million in funding from dozens of investors, including prominent financial services firms like BlackRock and Citadel Securities, earlier this year. But, can Texas’ budding finance scene support an exchange that will likely have to compete with two of the largest on the planet? It’s a tough ask, but analysts say the well-funded exchange would likely vie over smaller domestic and foreign listings with boutique markets in Toronto or Boston, at least initially.

Southern Comfort

Texas’ economy ranks as the eighth-largest in the world, topping Canada and Russia, and leans heavily on the energy sector and its oil legacy. But it’s also leading the Sun Belt resurgence, home to more Fortune 500 companies than any other state. Big Tech companies like Tesla, Oracle, and Hewlett Packard have already fallen for Texas’ Southern charm, as well as financial firms, like Charles Schwab, which was once synonymous with San Francisco before moving to Westlake five years ago.

The flood of prominent businesses is due in large part to taxes. Fisher Investments, one of the country’s largest independent advisors, for example, headed south last year after Washington state’s Supreme Court upheld a new capital-gains tax on the wealthy. Now, Goldman Sachs is in the midst of a $500 million plan to construct a 14-story office building for over 5,000 bankers and investors in Dallas. That could result in the financial firm’s second-largest office … behind New York.

“It would be extremely difficult for any region to become a financial hub as a starting point,” Waco, Texas-based economist Ray Perryman told The Daily Upside. “But this emergence has been ongoing for quite some time.” Over the past 20 years, Texas has seen triple-digit growth in investment banking and securities jobs, compared with just 16% in New York, according to Bureau of Labor statistics cited by Perryman. “Look across the Dallas skyline today and you’ll see the cranes evidencing the city’s ongoing progress,” he said.

New York City, as well as the exchange hotspot Chicago, have been hit with sluggish growth in a relatively slow recovery from the pandemic, Perryman added. Although those cities will clearly remain key money centers, expenses are also notably higher in both cities — for workers and their employers. “Wall Street will remain the center of financial activity for the foreseeable future, but Y’all Street has an excellent opportunity,” Perryman said.

Nasdaq and the NYSE declined to comment.

‘Go Woke, Go Broke’

Texas has been the epicenter of “anti-woke” critics that take aim at firms perceived to be putting environmental, social, and governance causes before investors’ best interest. BlackRock has become a bullseye for ire over its ESG strategies from conservative lawmakers who have divested approximately $13.5 billion in assets from the company’s funds. (Its investment in TXSE has been seen as an olive branch.)

Now, the established exchanges are also facing backlash over similar rules that compel listed companies to maintain board diversity requirements or publicly explain why they don’t. “It’s the ‘go woke, go broke’ philosophy,” said Vijay Marolia, CIO of the investment firm Regal Point Capital. Backers of the Texas Stock Exchange pledged to be more “CEO-friendly,” according to The Wall Street Journal, although TXSE CEO James Lee said his company is “apolitical.”

There are more than 5,200 private-equity backed companies in the state, according to a release, some of which may be ready to list on an exchange that isn’t perceived as overly costly and over-regulated. By providing an alternative for companies looking to go public, the Texas exchange may gain noteworthy market share. “TXSE cares about meritocracy,” Marolia said. “[It’s] not worried about all the noise.”

Poker Face. With heavyweight backing from major players like BlackRock and Citadel, the Texas Stock Exchange could position itself as a refreshing alternative to the NYSE and Nasdaq, especially for companies tired of red tape. For Robert Hodgins, a manager at hedge fund Sand Hill Road, the big investments from the industry’s top names made a splash, but it could be an upstream swim.“It feels like a classic Texas gamble: bold but risky,” he said.

History hasn’t been kind to upstart exchanges. One of the most recent, The Long-Term Stock Exchange, was formed with the idea of creating long-term investments that result in sustainable capital. Formed in 2016, the firm started trading in 2020 after waiting years for regulatory approval. It now has just two companies listed on its exchange, according to a New York Times report. In total, there are about a dozen exchanges in operation in the US today. The big two, NYSE and Nasdaq, make up about 42% of the global market cap, according to Visual Capitalist.

While TXSE may have an uphill battle, there are numerous advantages that could play out in the Lone Star state’s favor this time. It may not take down the Wall Street heavyweights, but hey, at least it won’t have to list on those Yankee exchanges up North.

“It’s hard not to appreciate the Texas spirit,” Hodgins said.