Industry News

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Joe Duran on Active Management, Insurance and Following Sheep

Photo via Rise Growth Partners

-

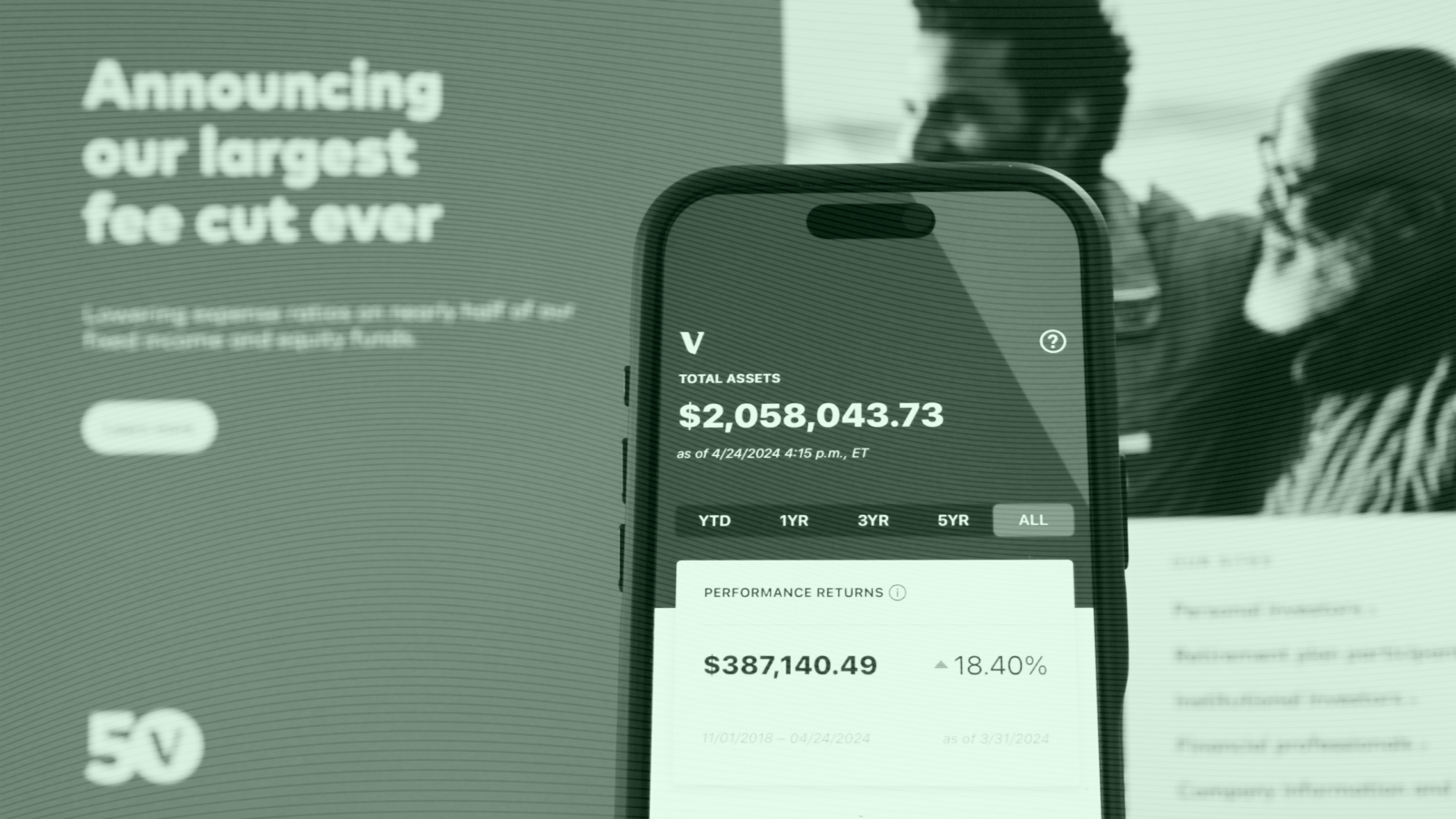

How Low Can You Go? Vanguard Slashes Fees on 87 Funds

Photo via Connor Lin / The Daily Upside