CFP Board CEO Kevin Keller to Retire After 18 Years

The organization dedicated to financial planning will engage an outside firm to help search for a replacement.

Sign up for market insights, wealth management practice essentials and industry updates.

What a run.

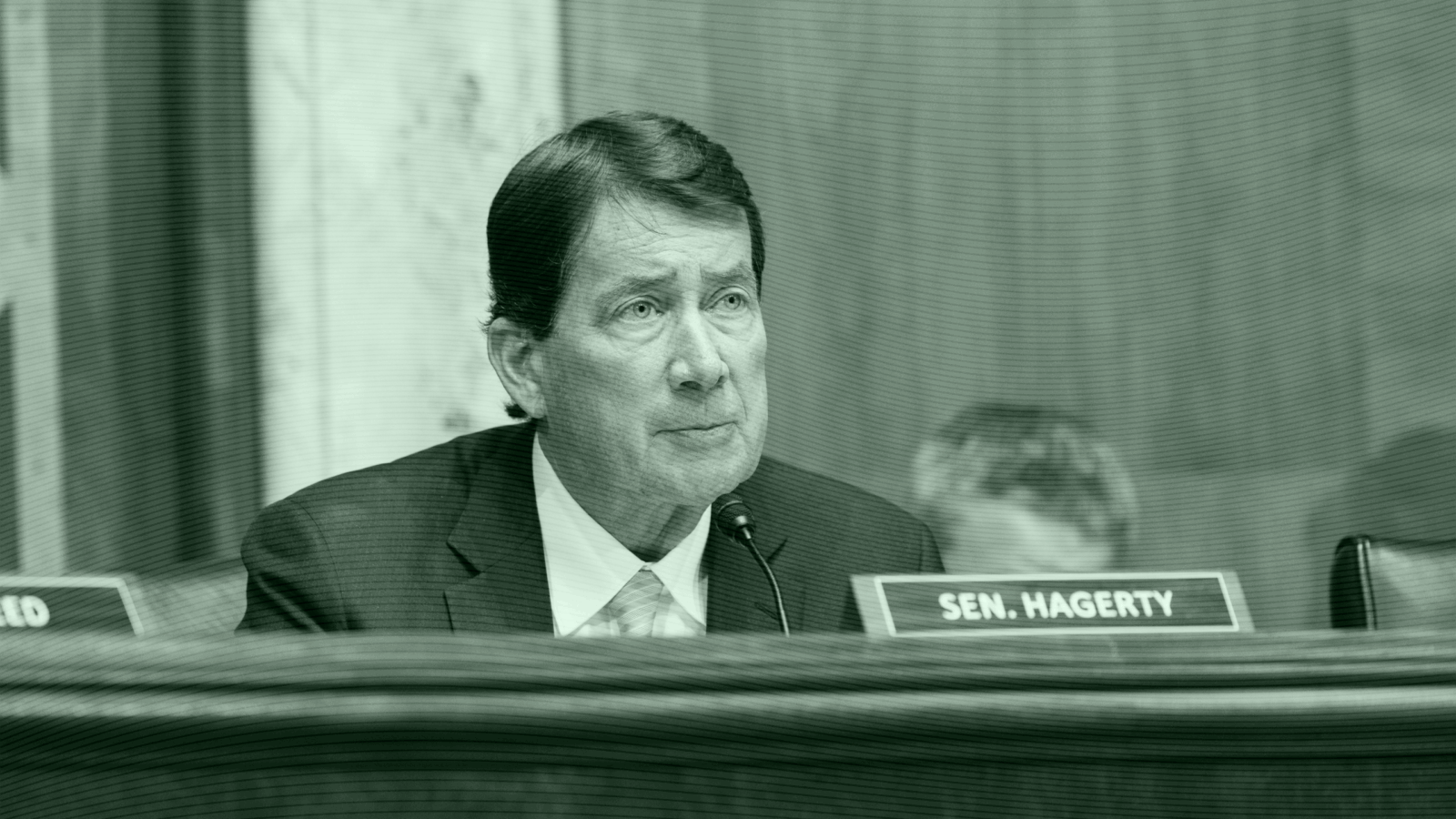

CFP Board chief executive Kevin Keller announced his retirement today after nearly two decades at the helm of one of the largest organizations dedicated to financial planning. Keller, who turned 64 this month, said he will step down from the body that oversees the CFP mark in April of next year, and plans to take some time away to contemplate his next move. The board will engage an outside firm in the coming months to secure a replacement.

“I tell people that this is the best job on K Street,” Keller said during a press dinner at his home in Washington on Wednesday. “And I mean that.”

Make a New Plan, Stan

Keller has overseen unprecedented growth for the organization and helped elevate the stature of financial planning in an industry that has long been dominated by brokerages and investment products. Under his leadership, the board made significant strides bringing financial planning into the public view and membership soared to a record 103,000 certificants. Record numbers of CFPs also now work at traditional brokerages like Edward Jones, LPL Financial, Merrill Lynch and Northwestern Mutual, according to a release:

- Keller also helped create the Center for Financial Planning, which aims to accelerate the growth of women and racially and ethnically diverse members.

- The CFP Board created 6,541 new certificates with a record 10,400 sitting for the exam last year.

“Kevin’s superpower is taking that strategy and being an effective leader,” CFP Board chair Liz Miller told The Daily Upside at the event. “It has been his vision that has brought us here.”

As Seen on TV. A main objective for the remainder of Keller’s tenure will be to diversify its membership and reach out to younger generations of potential planners. The latest CFP Board compensation survey found career satisfaction was through the roof, with 85% of professionals experiencing a high sense of personal fulfillment. The average CFP brings home $192,000 a year, according to advertisements from the organization.

While the CFP Board has witnessed significant growth — due in large part to successful advertising campaigns — it also faced widespread criticism last year for ads that some members said portrayed the profession as underworked and overpaid. The board said the campaign was meant to appeal to teenagers and has been amended.

“Part of leading well is leaving well,” Keller told The Daily Upside. “We’re committed to doing just that.”