Advisors Wary of Fixed Income Ahead of Trump 2.0

The next administration may look to increase tariffs and lower taxes, which could spell higher inflation and lower bond prices.

Sign up for market insights, wealth management practice essentials and industry updates.

Lower taxes, increased spending, heavier tariffs? The bond market can be notoriously hard to predict, but Trump’s election may have just made it impossible.

While stocks have been on a tear since the former president was reelected to the White House, fixed income has been far less predictable. ING strategists said in a note last week that bonds have been acting strangely as investors weighed the GOP’s plan of lower taxes and higher tariffs. “Historically, we’ve never seen a rate-cutting cycle where the 10-year yield consistently rose after the first cut,” they said.

It’s made for a confusing few weeks for advisors, and has become an issue that will almost certainly spill over into traditional 60/40 portfolios come 2025. “Trumponomics presents both opportunities and risks,” said Arron Bennet, CFO at Bennett Financials. “Post-election, advisors are closely analyzing fixed-income.”

Outlook Not So Good

The 10-year Treasury yield surged to touch 4.5% at the end of last week, the highest since May 31, enticing some investors to make big wagers. While proposed tax cuts and increased spending sound like a home run, they could also drive up inflation, meaning higher yields and lower bond prices. There are also significant risks that the growing national debt could reduce US creditworthiness.

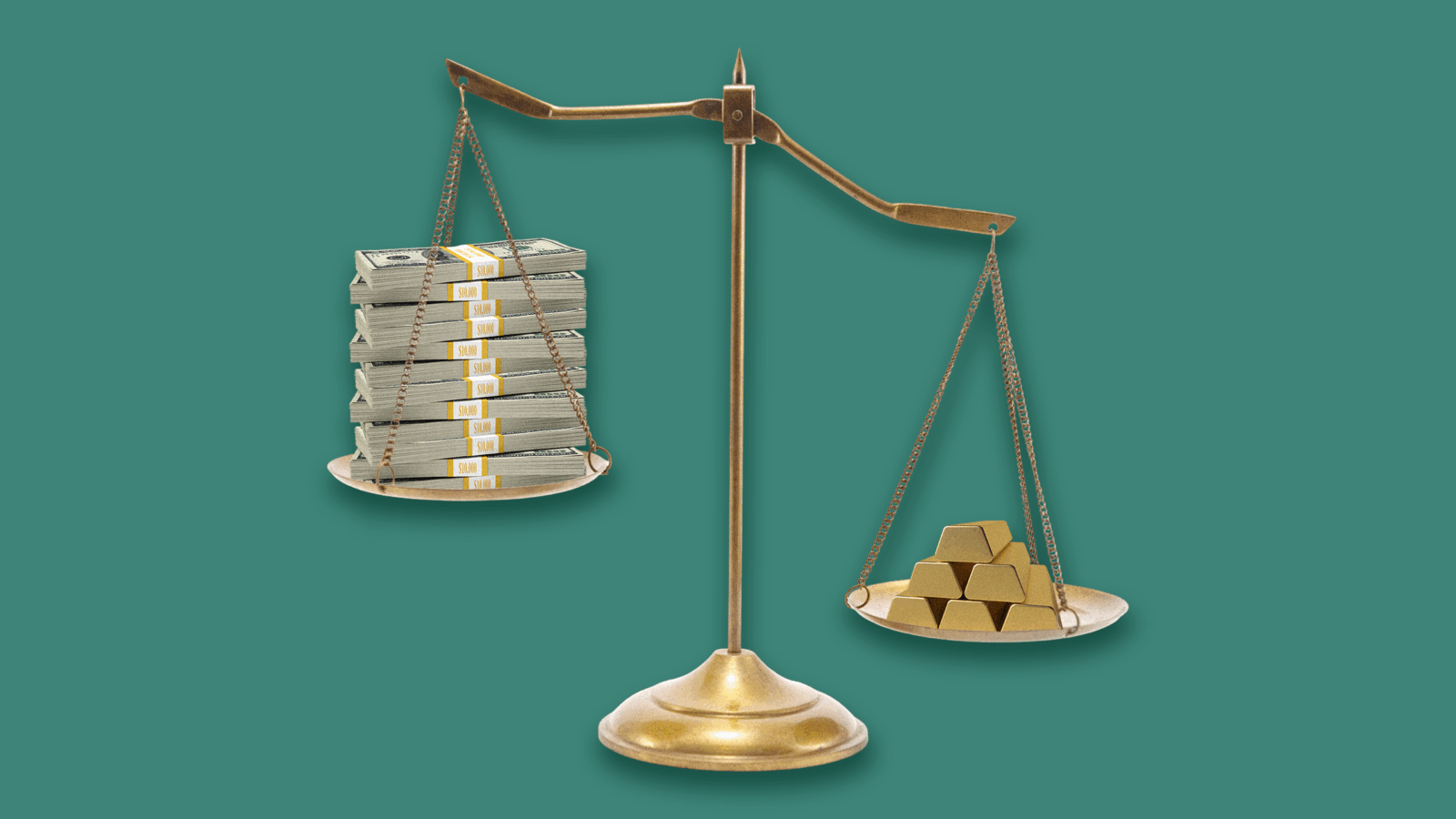

“We caution advisors to not be overly dependent on longer-term bonds as their equity hedge,” said Steve Cucchiaro, CEO of 3Edge Asset Management. Instead, shorter-duration Treasuries and hard assets like gold could be ways to protect clients from an equity downturn, he said, adding that a tariff war could lead to a global “economic slowdown.”

Hat TIPS. Treasury Inflation-Protected Securities (TIPS) have become a real area of interest. In addition to the yield, the products pay out on the Consumer Price Inflation index, meaning those investments are built to keep up with inflation. The real yields (after inflation) are above 2% on many of the securities and they’re quickly gaining ground with the investing public:

- Yields on certain durations of TIPS are near their highest levels in roughly 15 years, according to the Wall Street Journal.

- Investors poured $42.4 billion into mutual funds and exchange-traded funds that specialize in TIPS in 2021.

Where Does It Hurt? For advisors, though, the safer plan may be to hold tight. Fixed income provides an important safety net, even in the face of inflation, according to Cynthia Luna, a CFP and advisor with Moonshot Financial Group. It’s also necessary to keep a total portfolio’s risk levels in line. “Let’s not forget that we feel pain from perceived loss more than we feel happiness from gains,” she said. “It’s important to be prepared for volatility.”