Do Elections Matter to Markets?

Most advisors agree that elections have little impact on markets, but that’s not stopping investors from bracing their portfolios.

Sign up for market insights, wealth management practice essentials and industry updates.

Will the presidential election impact the markets? It all depends on who you ask.

For BlackRock founder and CEO Larry Fink, the answer is a resounding no. The leader of the world’s largest asset manager told a SIFMA conference last week that he’s simply tired of hearing that November’s election will have any lasting consequences. “The reality is, over time, it doesn’t matter,” he said.

Still, that hasn’t stopped advisors and portfolio managers from shifting a few things around. The majority of some 400 institutional investors surveyed by Prudential agreed that elections influenced portfolio allocation. “Markets tend to get a bit jumpy around election time,” said Aaron Cirksena, founder of the advisory firm MDRN Capital. “That’s usually short-lived.”

Fund Raising?

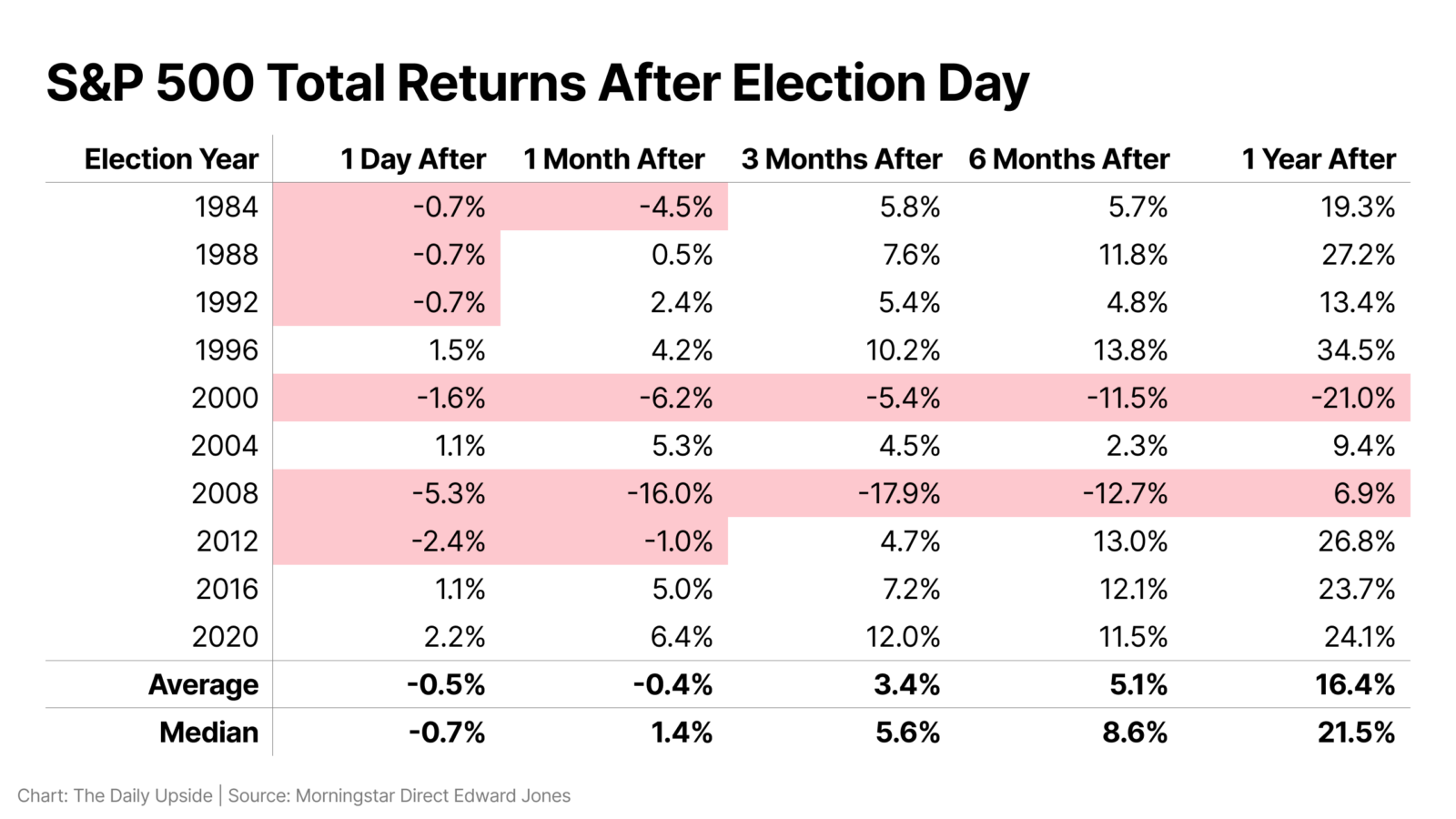

Stock market returns under both President Joe Biden and former President Donald Trump have been almost identical during their administrations. The S&P 500 returned 14% per year after dividends under each president, according to Edward Jones’ data. Going back a bit further, the index’s average annualized price return, not including dividends, was 9.6% when a Democrat won and 5.7% when a Republican won over the past 23 election cycles.

While the markets may not care who’s in the Oval Office, investors are bracing their portfolios for fallout come November anyway. More than half of investors globally said that elections are a factor in their decision-making, while just 1 in 5 said they didn’t matter at all, according to the Prudential study. The survey also found:

- 38% of US investors expect 2024 elections and their repercussions to influence portfolio changes.

- Roughly 4 in 10 investors said they have moved into cash to manage risk.

- Top concerns ahead of election day: the national debt, economic growth, and immigration.

Rock the Vote. Election time can be good for fine-tuning, but not big moves, Cirksena said. Historically, economic fundamentals will almost always pull the market back into balance within months post-election. Advisors may want to make minor adjustments, but overhauling portfolios just for an election rarely makes sense.

Strategies like dollar-cost averaging can help smooth out any wild swings and keep clients on track. For tax strategies, adjustments can help take advantage of the current tax landscape rather than bracing for major shifts, he said.

Keep in mind, market crashes and economic crises have happened during both Democratic and Republican administrations with every president — except George H.W. Bush — being in the White House during a bear market. Basically, free market capitalism just doesn’t care about politics. “Election-related shifts are often more noise than long-term disruption,” Cirksena told The Daily Upside.