Is an Over-Concentrated Stock Market Fueling Volatility?

As the markets become increasingly reliant on a handful of stocks, experts say uncertainty could be a growing feature of equity investing.

Sign up for market insights, wealth management practice essentials and industry updates.

After a sizzling year, this week’s flash crash was a wake-up call to investors.

Sure, sell-offs are nothing new with market dips of 5% or more occurring at least once a year for the past four decades. But the VIX hit its highest level since pandemic circuit breakers were going off (remember those?) and the highest intraday jump on record on a meaningless Monday in August. With the stock market more heavily concentrated around a handful of stocks than it has been in half a century, those market whipsaws may be here to stay.

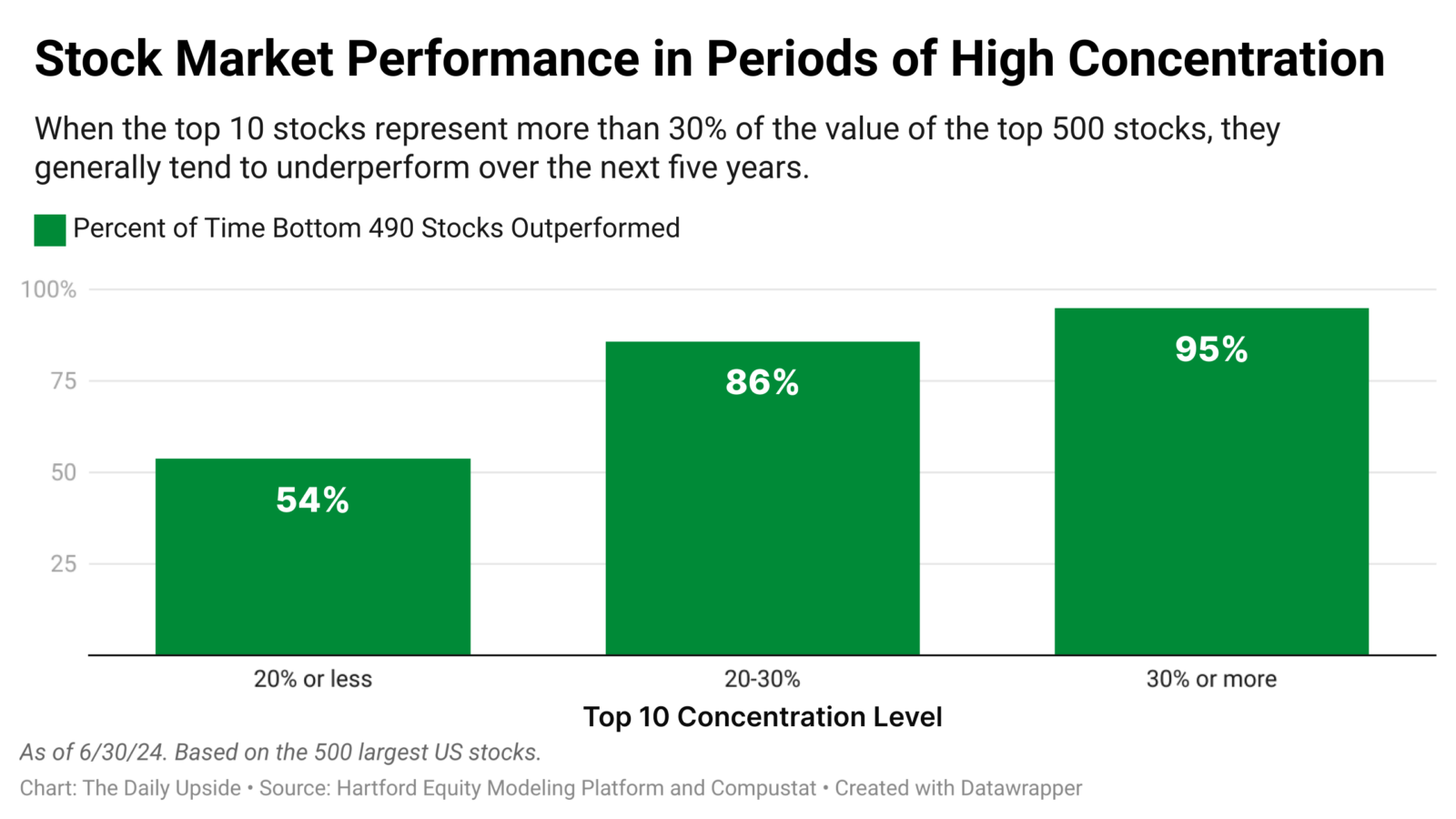

The top 10 stocks, including Nvidia and Amazon, now make up 36% of the equity market, according to new research from Hartford Funds. While the powers that be are still hoping for a soft landing, the historical data just isn’t buying it. “The story of concentrated markets has historically had a very unhappy ending,” the report found.

Not From Concentrate

High levels of concentration mean that things can go wrong quickly. One issue is the rise of passive investing. With about half of assets held in index-tracking ETFs and mutual funds, equities are increasingly bought and sold in bulk with little regard to the fundamental earnings of the underlying businesses, according to Christopher Davis, a partner at the New Jersey-based RIA Hudson Value Partners. “As the dust begins to settle, [the drop] seems to be more of a positioning-driven sell-off among quant and highly levered players,” he told The Daily Upside.

Not only are the top 10 stocks more heavily weighted, but they are also increasing at a much higher rate than earnings. This gap between their earnings and weights hasn’t been this great since the height of the dot-com bubble and the 1960s Nifty 50 Bubble before that, according to the research. There are some pretty ominous statistics in the Hartford data:

- When the top 10 companies comprise more than 30% of the largest 500 stocks, the remaining 490 outperform 95% of the time over the next five years.

- High concentration and valuation levels often precedes heightened volatility and pullbacks for the largest stocks.

There are certainly much larger economic forces at play, including global investing strategies like carry trades, which have popped onto the scene this week. And just looking at a single study never paints an entire picture. However, data suggests the stock market may be in for a rocky end of the year.

“This type of volatility will increasingly be a feature of markets,” Davis said. “There will likely be fewer periods in which the ‘fasten seatbelts’ sign will be turned off for investors.”

All That AI. The summer has certainly been tough sledding for this year’s highest-flying, and most concentrated, stocks. The tech segment was one of the hardest hit on Monday: Chipmaker Nvidia was down 6% and Microsoft fell 3%. The tech-focused U.S. Nasdaq 100 index also slipped 3% on Monday and slid 12% from a record high in July, according to Reuters. Investors are antsy that artificial intelligence has simply been overhyped.

“If we listen to what the market is telling us, investors want to see tangible profits from the immense AI capital expenditure spending spree,” Davis said. It’s likely one of the biggest questions that the market will have to answer in the coming years. “We are fortunate to have a client base that [like us] … treats sales as buying opportunities,” he said.