AUM Fees May Shrink Next Year. Do Advisors Care?

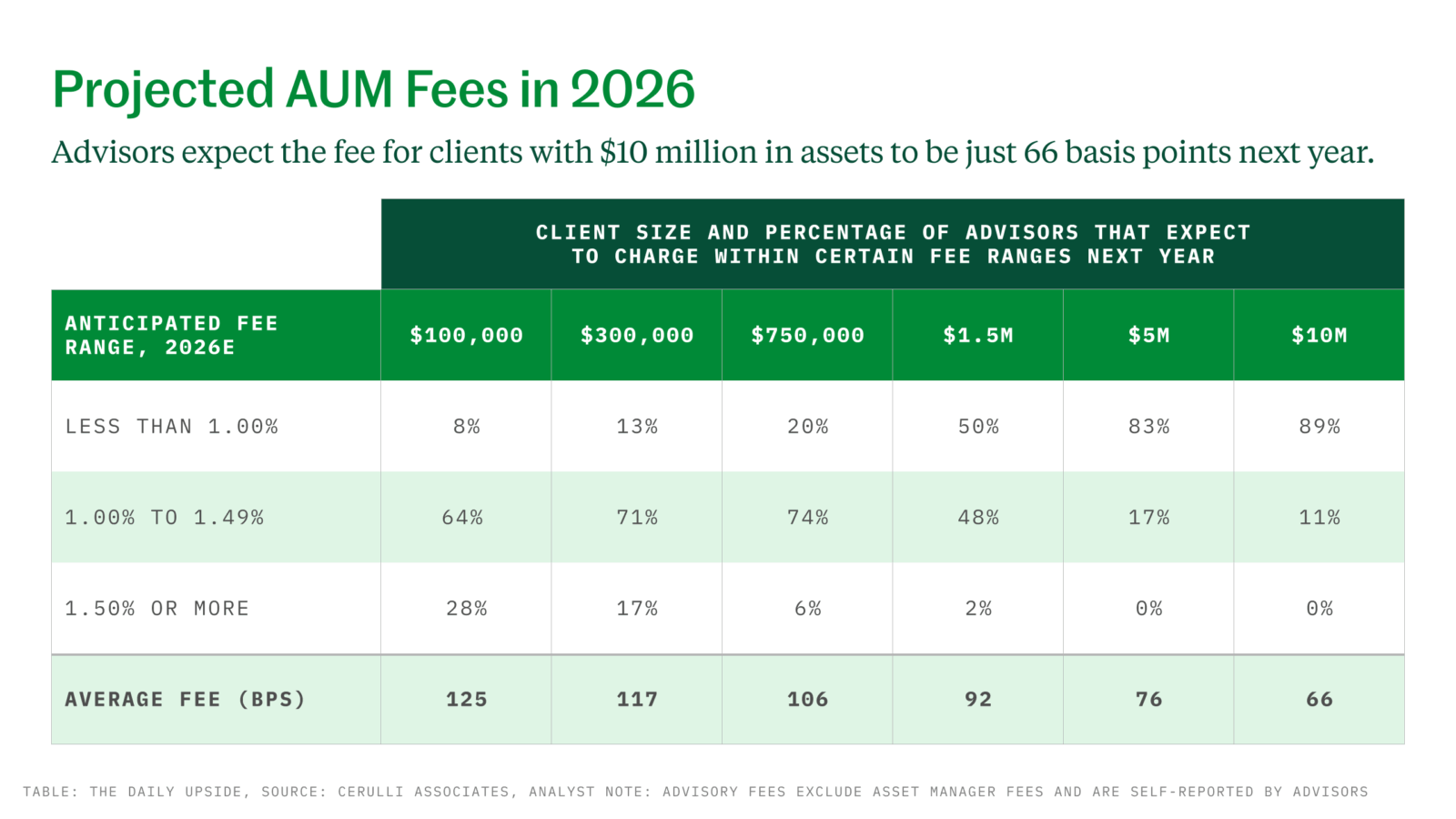

Clients with more than $10 million can expect to pay just 66 basis points on their assets in 2026.

Sign up for market insights, wealth management practice essentials and industry updates.

Sometimes, it’s OK to get a little creepy.

Advisors’ traditional AUM fees have remained stubbornly resilient, even as industry experts have been expecting them to drop for the better part of a decade. Now, advisors are also dealing with “service creep,” where clients expect additional services like tax and estate planning at the same price, and that’s starting to eat into bottom lines. “While this slow, yet steady, compression of fees may not greatly affect revenues overnight, advisors are being asked to provide more comprehensive services,” said Cerulli associate director Andrew Blake. “Today’s clients expect additional services for the same or lower fees, effectively reducing advisor ROI.”

Read the Fee Leaves

The industry already has a complex array of fee structures from fixed or AUM fees to flat fees for limited specific work, and even subscriptions paid on a monthly or yearly basis. According to Cerulli, clients with more than $10 million can expect to pay just 66 basis points on their assets next year, and that’s about half the 125 basis points expected on accounts with just $100,000. “There is only so much work you can do for a client,” said John Power of financial planning firm Power Plans, adding that advisors just can’t justify $50,000 a year on a $5 million portfolio.

For advisors that only offer standard Modern Portfolio Theory portfolios that rebalance every quarter, the value just isn’t there, said John Bell, an advice-only planner and CFP at Free State Financial Planning. Robo-advisors offer similar services at less than half the price, and charging 1%, even while offering comprehensive planning, is simply high, he said. However, there is a market for families that need planning but not ongoing management. “Now, if a client finds value and is OK with the cost, who am I to say that is wrong? The client can always vote with their feet,” he said.

Who’s Your Insurance Agent? Some 44% of advisors said they derive at least 90% of their revenue from advisory fees, but that could jump to 54% by next year. With pressure on fees, there are two ways forward for advisors: Increase AUM or offer expanded services, said Barry Flagg of Triangulum Financial. One of the highest margin services that clients have a “desperate need” to plan for is life insurance. With few advisors qualified to give advice on insurance, it adds value to the clients and opens up a new line of business.

“Life insurance is the last, largest, most-neglected — and worst-performing — asset in clients’ financial plans,” he said. “Given the lack of competition, it also adds a higher-margin line of advice.”