Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Of all the wild financial stories of 2020, few captured the zeitgeist of 2020 better than Bitcoin.

The decentralized cryptocurrency soared in value by a dizzying 305% last year (for most, this NYT article rings true).

And while the mainstream financial markets make their 2021 debut today, Bitcoin is already up 18% in the first few days of January.

Bitcoin Behavior

First introduced in 2008, Bitcoin has largely remained on the peripheries of finance. Attempts to incorporate Bitcoin as an accepted payment method by companies like Dell and Expedia have been frustrated by the currencies’ extreme volatility.

But lately, there are increasingly signs of traction.NFL Crypto: Carolina Panthers tackle Russel Okung recently agreed to receive half of his $13 million salary in Bitcoin.

- The Panthers will send Okung’s direct deposit to Zap, a startup that converts traditional paychecks in bitcoin.

- Okung exclaimed, “Getting paid in bitcoin is the first step of opting out of the corrupt, manipulated economy we all inhabit.”

- Zap founder Jack Mallers (reportedly a “friend” of Okung) has said that unnamed players on both the Yankees and Brooklyn Nets have joined the program.

Institutional: Two months ago, PayPal began to allow its 361 million worldwide users to buy and sell bitcoin. By 2021, users will be able to use Bitcoin to pay at any of the 28 million merchants that use PayPal.

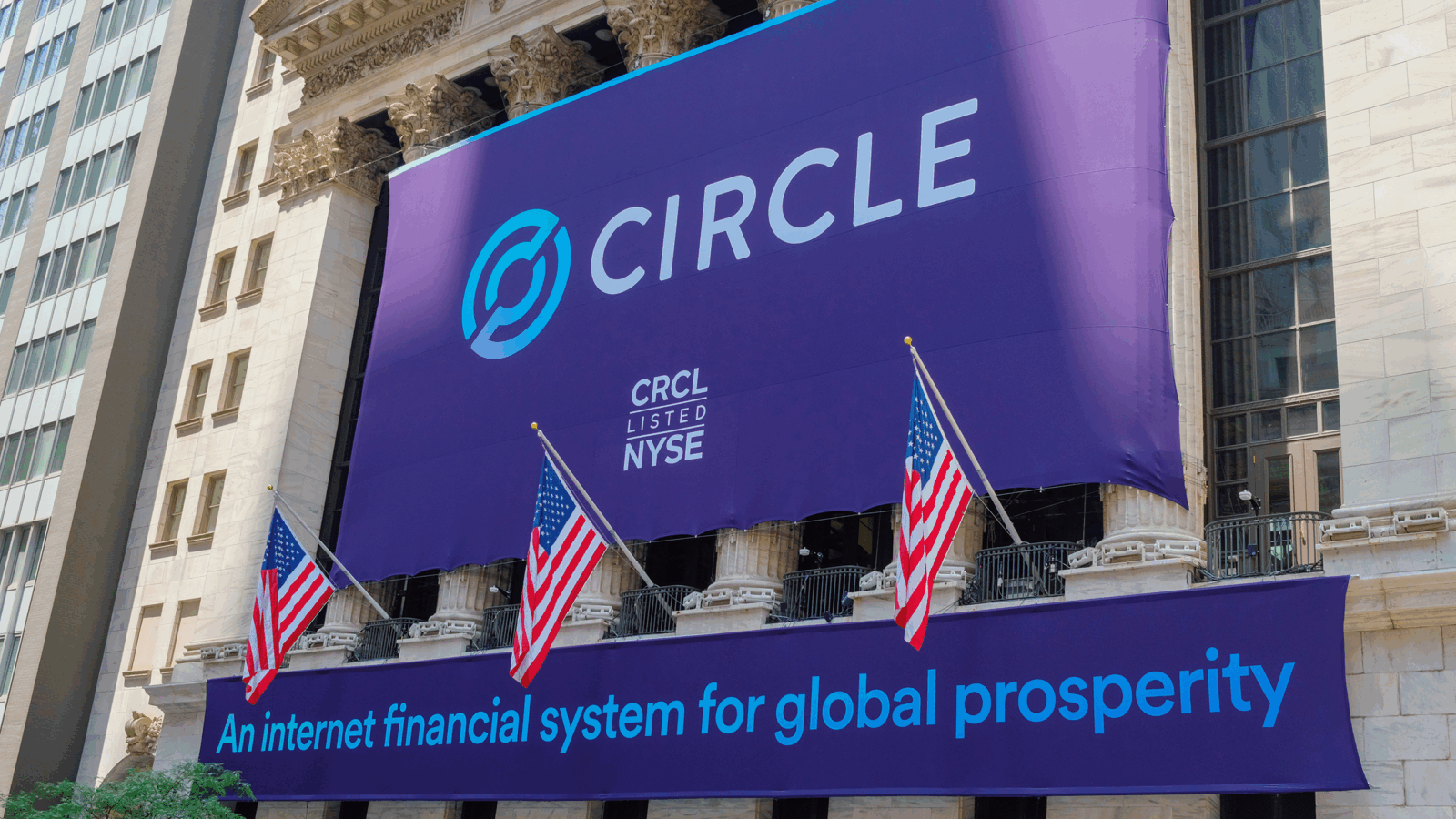

IPO Land: Coinbase, one of the largest cryptocurrency exchanges, has filed with the SEC for an initial public offering. Bitcoin bulls believe an IPO of the San Francisco-based company will help legitimize crypto in the eyes of regulators and the broader public.

Takes From The Peanut Gallery

Of course, Bitcoin has more than its fair share of both evangelists and doubters.

Well-known investors such as Paul Tudor Jones and Stanley Druckenmiller have both publicly backed Bitcoin. 169-year-old Massachusetts Mutual Life Insurance Co recently bought $100 million of Bitcoin.

Prominent economist Nouriel Roubini recently called it a “pure speculative asset and bubble with no fundamental value.”

The Takeaway

With stimulus checks hitting bank accounts, there will be no shortage of retail demand in the coming months.