JPMorgan Data Redaction Tech Could Stay Ahead of Privacy Regulation

Unstructured data tends to cause problems for conventional redaction techniques.

Sign up to get cutting-edge insights and deep dives into innovation and technology trends impacting CIOs and IT leaders.

Many Wall Street institutions are keenly interested in keeping up in the AI race, but its data-security pitfalls make it tricky for finance firms to adopt.

JPMorgan Chase may have a solution: The company is seeking to patent a system for “automated data redaction.” The patent application details a way to use machine learning to automatically recognize and obscure any information deemed sensitive or restricted in a dataset.

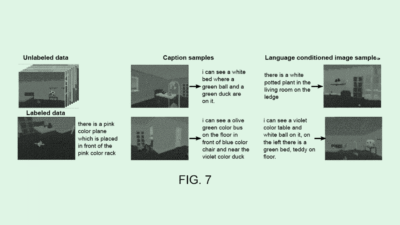

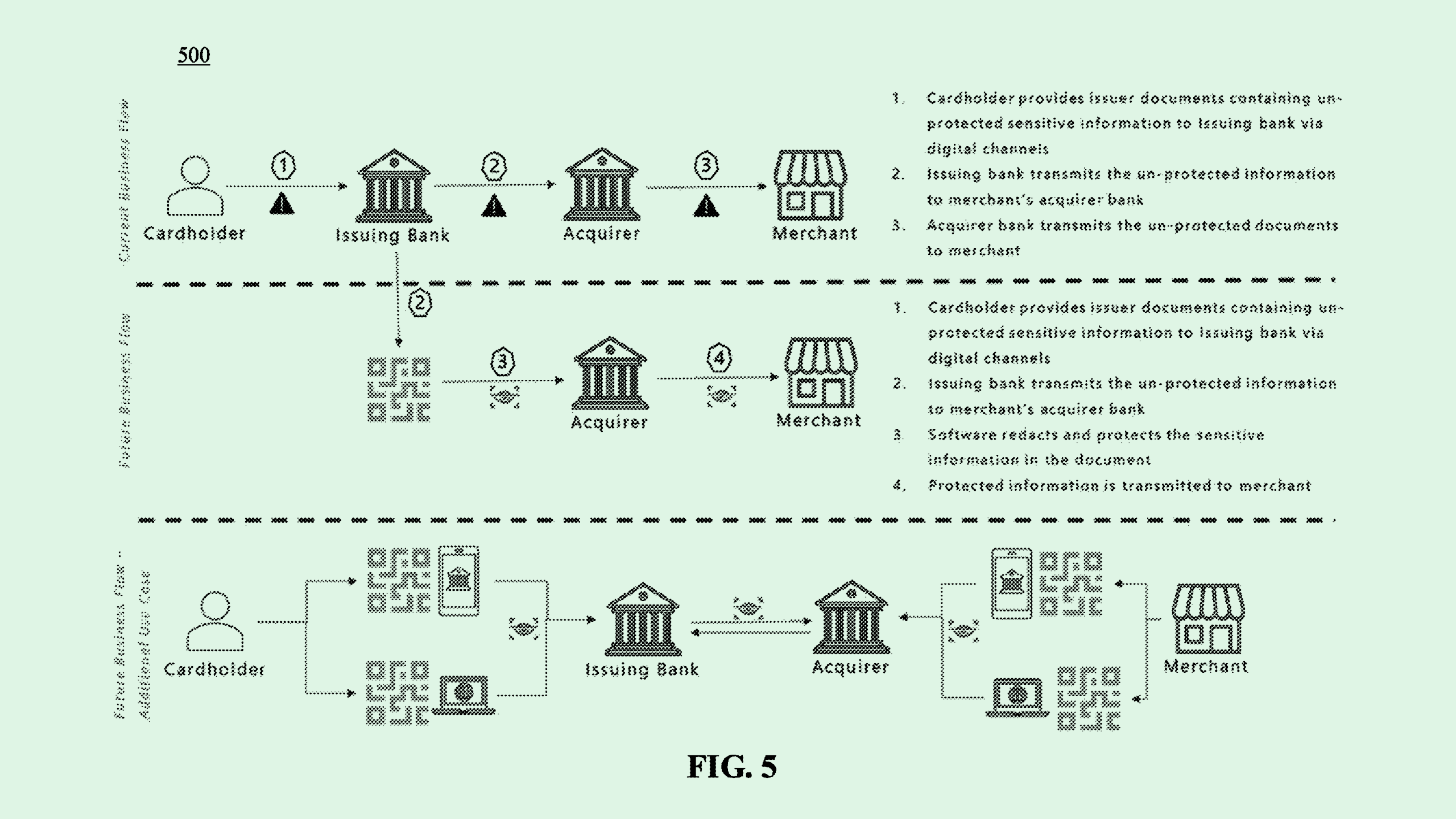

Using “optical character recognition,” this tech scans datasets for restricted information and creates new sets with that data redacted. The patent notes that the tech works with both structured data, such as databases or spreadsheets, and unstructured documents, such as PDFs and images.

Unstructured data tends to cause problems for conventional redaction techniques, so the system could allow JPMorgan to perform redaction in real-time “without compromising document integrity,” the company said in the filing.

JPMorgan has been loud about its commitment to AI. Along with its AI-focused patent activity in recent years, the company is largely leading the banking sector in AI adoption, including training every new hire on AI and rolling out AI assistants last year to 60,000 employees.

But given AI’s tendency to spill the beans, the patent is “likely an effort to ensure safeguarding of personal information and allow the business teams to be able to continue to invest in AI,” said Daniel Barber, co-founder and CEO of DataGrail.

Tech like this could also help JPMorgan and other firms get ahead of regulatory issues, Barber said. Though we’re “unlikely to see a federal privacy bill,” he explained, many states may follow models similar to the recently enacted New Jersey Data Protection Act and the California Privacy Rights Act, especially amid growing AI adoption. “Businesses like JPMorgan Chase would be very probably concerned about that from a compliance standpoint.”

“The market’s still evolving in this area, but it’s clear the regulatory requirements are being put forward, and I wouldn’t expect that to slow down,” Barber added.