Falling Housing Costs May Start Cooling Off Overall Inflation

While housing prices have skyrocketed in the past two years, the new year may bring a welcome relief to renters.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Does your landlord seem unusually nice suddenly? Or at least smirking less?

While housing prices have skyrocketed in the past two years, fueling a large piece of overall inflation, the new year may bring a welcome relief to renters, according to a Wall Street Journal analysis published last weekend. It’s the last major piece of the puzzle in the Fed’s fight to push inflation down to 2%.

Living Rent Free

While many essentials suddenly got more expensive over the past two years — oil, eggs, airfare, Taco Bell’s Cheesy Gordita Crunch — few categories powered inflation quite like housing. So-called shelter costs, which are based on rent (since houses are technically long-term investments), rose 6.5% in the year through November, according to Labor Department data. And because shelter costs comprise a 35% weight the Consumer Price Index formula, soaring rents were responsible for much of the inflation seen this year. In fact, without housing, inflation would’ve risen just 1.4% through November, below the Fed’s 2% target.

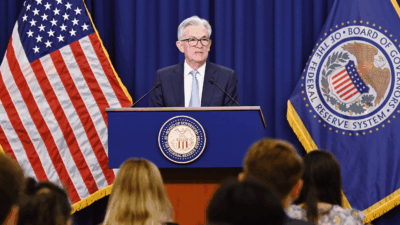

But the tides are starting to shift. While home prices increased 3.4% year-over-year in November, an all-time high for the month according to the National Association of Realtors, the pace of increases is far below the extreme 25% jump seen in May 2021’s post-pandemic bottleneck. That trend is expected to continue through next year, meaning Fed Chair Jerome Powell will personally celebrate with you once you finally find that two-bed, two-bath walkup for under $3,000 a month:

- UBS economist Alan Detmeister told the WSJ that the shelter component of CPI inflation can be expected to fall as much as 3.75% by the end of 2024. In some cities that have seen exorbitant rises in rents, like Seattle, prices are already starting to fall.

- Meanwhile, after the Fed indicated last week that it’s on track to cut rates next year, mortgage rates fell below 7% for the first time since July, according to data from RedFin. Monthly mortgage payments also fell to their lowest level in eight months, while mortgage-purchase applications are up nearly 20% from the 30-year low seen at the start of November.

Cooler Heads: Because most renters agree to new leases only once a year, the impact of cooling rents on overall inflation is typically slow to reveal itself. But once enough time has passed, the data is likely to show that the slowdown in housing costs marks a turning point in the battle to tamp inflation back down to 2%. “If you have [housing costs] finally coming down, it’s over,” Detmeister told the WSJ. Still, “the housing shortage will remain with us,” Moody’s Analytics chief economist Lu Chen told the WSJ. Sorry, prospective millennial homeowners: you may have to look a little deeper into the reaches of the suburbs than you had planned, but that beats having to reach deeper into your pockets to make rent.